Learn more about factor investing

iShares

Momentum is an investment strategy which focuses on buying stocks that are outperforming and selling those that are underperforming.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares MSCI World ex Australia Momentum ETF (IMTM)

https://www.blackrock.com/au/products/335486/

This product is likely to be appropriate for a consumer who is seeking capital growth, using the product for a major allocation of their portfolio or less, with a minimum investment timeframe of 5 years with high to very high risk/return profile.

Momentum strategies seek to buy stocks with rising prices and can complement other factor styles.

Momentum investing has been around for decades and is backed by economic theory and real-world data.1

Momentum strategies aim to capture stocks with strong recent performance by identifying companies with high price gains over the past 6-12 months.

For decades, professional investors have followed the ups and downs of equity markets, seeking to increase exposure to companies where stock prices are trending up and reduce exposure to stocks that are trending down.

Now there's an easy way for investors to access stocks that have recently outperformed.

The iShares MSCI World ex Australia Momentum ETF or IMTM.

IMTM tracks an index which aims to target developed market stocks outside Australia with the strongest risk adjusted performance over the past 6-month and 12-month periods.

The fund’s portfolio rebalances every six months to take account of these changing trends.

To reduce stock specific risk, we also apply a maximum cap to the weights of individual stocks.

The iShares MSCI World ex Australia Momentum ETF provides access to stocks with positive momentum, which can offer the potential to generate higher risk adjusted returns over time.

It can also act as a complement to other equity strategies in an investor's portfolio.

Find out more blackrock.com.au/ishares.

Momentum, like all our factor investing options has consistently rewarded investors over time. Each of the factors that we believe in at BlackRock are supported by historic and real-world data, are diversifying to other well-known factor investing styles, and can be efficiently captured in live portfolios.

The success of momentum is probably best explained by behavioural finance theories – that is, investors will tend to buy stocks whose price is going up, leading to further upward pressure on the stock’s price.

Momentum premiums might also be a reward for bearing risk—the risk of short-term losses that other investors avoid. Momentum occasionally undergoes short term crashes—like 2001, 2009, and 2023— but investors are often compensated in the long run for bearing potential short-term losses.

In our opinion, both explanations have merit, and we believe both will continue going forward, which helps give us conviction that momentum strategies may continue to outperform.2

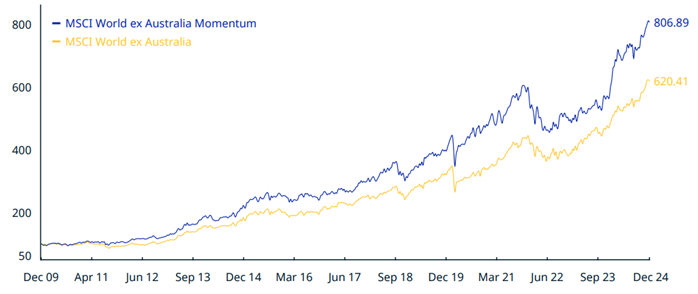

Long term outperformance of global momentum

(Dec 2009 – Dec 2024)

Source: MSCI as of 31 December 2024. Past performance is not a reliable indicator of future performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Material differences may exist between indexes being compared, such as investment strategies, and countries or markets covered.

The momentum index takes into consideration the relative risk-adjusted performance of each stock over the past 6 months and 12 months. Once identified, the top 30% of the parent universe with the strongest momentum exposure is selected (subject to some constraints – see below).

| Metric | Objective |

| undefined6-month risk adjusted price momentum | undefinedMeasures the price momentum of each stock in the parent index over the past 6 months adjusted for risk |

| undefined12-month risk-adjusted price momentum | undefinedMeasures the price momentum of each stock in the parent index over the past 12 months adjusted for risk |

Source: BlackRock, MSCI as of November 2023

Unlike our other factor funds, momentum is the only factor where sector constraints are not applied.

Academic research3 has found momentum at the security level, industry/sector level, and at the asset class level; so, it is important not to limit sectors when capturing momentum in a portfolio.

But it is important to consider diversification within a momentum strategy to avoid an overconcentration in single stocks. To reduce this risk, the index puts a limit on the weighting of each single stock.

Rebalance frequency

The MSCI Momentum Indexes are rebalanced twice a year, usually as of the close of the last business day of May and November4.

The index's rebalance frequency balances the cost of trading with the need to update momentum exposure frequently.

The index can also rebalance at times other than the scheduled 6-month periods if market volatility is high. This flexibility was used during the COVID-19 pandemic in 2020, allowing our US-based momentum ETFs to adjust to changing trends.

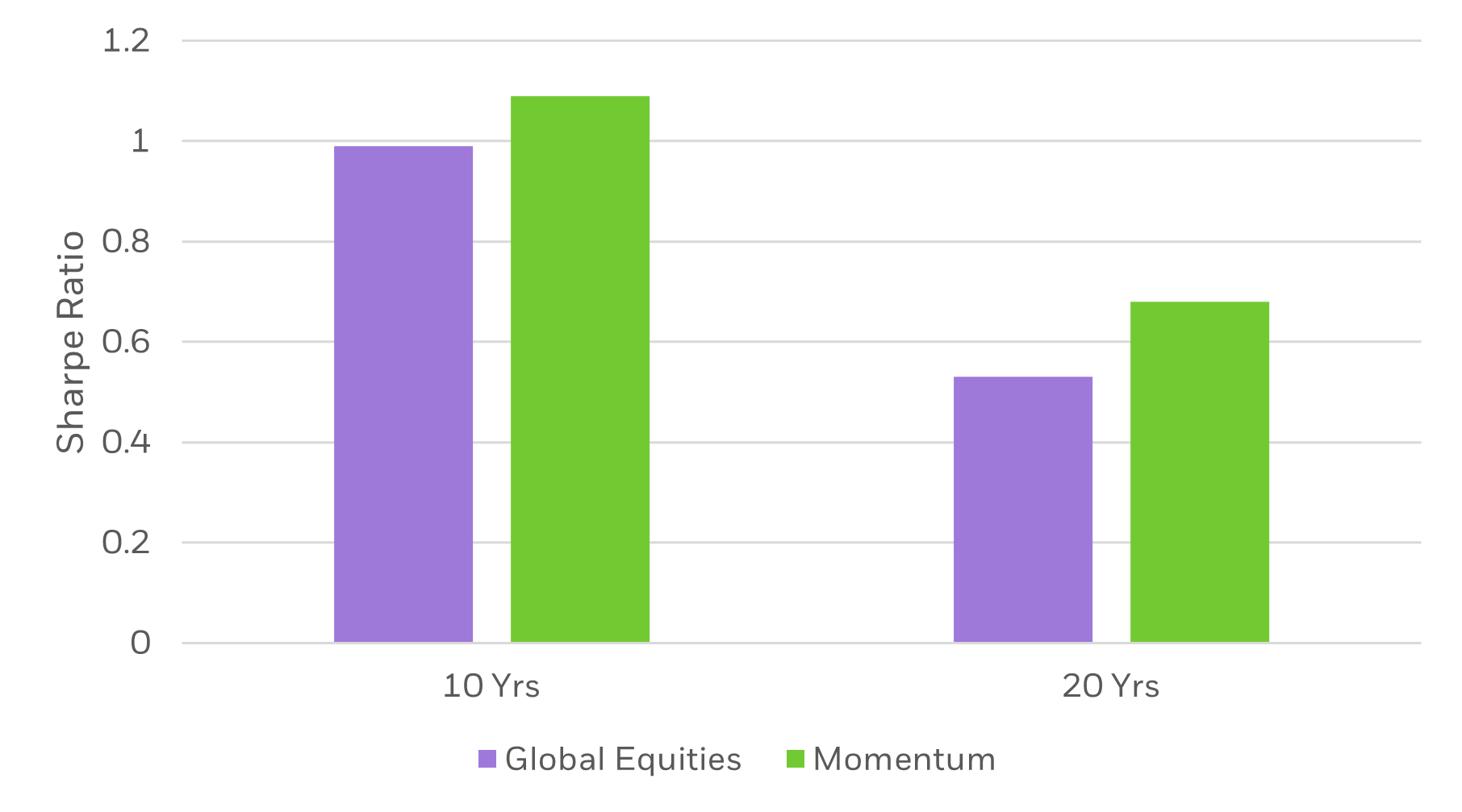

The momentum factor has shown a higher reward/risk ratio than the broader global equity market, as well as delivering more consistent outperformance than its factor counterparts, quality and value, over the last two decades.4

It's no wonder then that many have become momentum investors, given the supporting economic theory and evidence.

As shown below, the momentum factor has provided “more bang for your buck” than the broad equity market on a long-term basis. Historically, momentum has had higher volatility than size, value, and quality, but it has also provided the highest risk-adjusted returns – approximately 10% higher on a 10-year basis, and 28% higher on a 20-year basis5.

Reward to risk ratio

Source: BlackRock data as of 2 December 2024. Global equities represented by MSCI World ex Australia Index. Momentum represented by MSCI World Momentum Index. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

The table below shows persistence in momentum when examining rolling returns over various periods. Historically, the momentum factor has delivered more consistent outperformance than other popular factor investing styles over 1-year, 3-year, and 5-year rolling periods. Over 10-year rolling periods, momentum is modestly less persistent than quality.

| Size | Value | Quality | Momentum | |||||

|---|---|---|---|---|---|---|---|---|

| 1-yr | Size55% | Value60% | Quality68% | Momentum74% | ||||

| 3-yr | Size54% | Value68% | Quality78% | Momentum86% | ||||

| 5-yr | Size55% | Value72% | Quality83% | Momentum86% | ||||

| 10-yr | Size57% | Value78% | Quality87% | Momentum81% | ||||

Source: Ken French data library as of 30 June 2024. | ||||||||

In the past, active managers used teams of analysts to find stocks with price momentum to outperform others. Now, technology offers new ways for investors to systematically find stocks that are doing better than the market.

Accessing momentum through low-cost ETFs such as the iShares MSCI World ex Australia Momentum ETF (IMTM) allows investors to capture the historically proven momentum strategy in a simple, easily tradeable format.