Tap into the emerging market growth story

Traditionally more difficult and expensive to access, low-cost ETFs now offer the opportunity to tap into these high-growth economies with favourable demographics.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares MSCI Emerging Markets ex-China ETF (EMXC)

https://www.blackrock.com/au/products/337684/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile.

Find out more about iShares MSCI Emerging Markets ETF (IEM)

https://www.blackrock.com/au/products/273417/

- This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a high to very high risk/return profile

Find out more about iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF (IHEB)

https://www.blackrock.com/au/products/275254/

This product is likely to be appropriate for a consumer:

- who is seeking capital preservation and/or income distribution

- using the product for a major allocation of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium risk/return profile

Find out more about iShares China Large-Cap ETF (IZZ)

https://www.blackrock.com/au/products/273424/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a high to very high risk/return profile

Access new frontiers with emerging market ETFs

Emerging markets can be more complex to access as an individual investor, with a range of local legal and administrative requirements to contend with. ETFs have helped investors to access diversified baskets of shares from these markets in a direct, efficient, and easily tradeable way, with the ETF provider doing the legwork of meeting administrative obligations.

However, this complexity means that costs to access EM have remained relatively high, with an average management fee of 0.75% across ASX-listed exchange traded products that focus on EM *. As one of the world’s largest asset managers, BlackRock is able to take advantage of scale and efficiencies in other markets to offer investors access to EM for as low as 0.25%.1

Just launched: iShares MSCI emerging markets ex-China ETF (EMXC)

Historically, investors have treated the umbrella of EM as one asset class. But as China’s weight in the major EM indices has grown, we have seen an increased interest from investors in making distinct allocations between EM ex-China and China, to more flexibly tailor their investment views across the different regions.

For instance, while China accounts for almost one-third of the MSCI EM Index, it represents less than 3% in global benchmarks.2 As companies from the world’s second largest economy expand, investors can elect to overweight or underweight allocations to China relative to its significance in global markets.

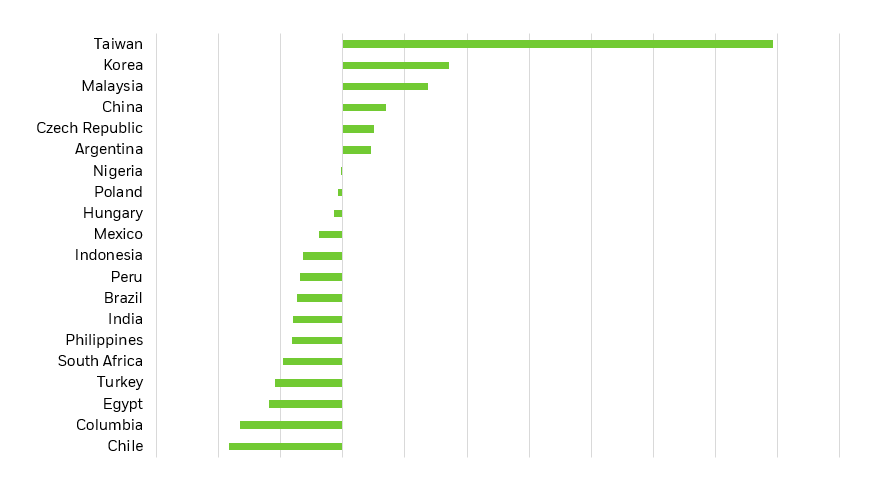

Opportunities in EM: Mapping mega forces

Emerging market economies are positioned to benefit from some of the key ‘mega forces’ driving the lion’s share of growth opportunities in today’s investment landscape. The most dominant of these forces recently has been artificial intelligence, particularly at the base of the AI tech ‘stack’ among semiconductor chip manufacturers and datacenters.

It’s not just developed market tech stocks that stand to profit from the AI theme. Taking a look at EM current account data, we can see that both Taiwan and Korea have a significant share of their GDP leveraged to AI and tech demand. In fact Taiwan Semiconductor Manufacturing Company, the largest single stock weighting in the MSCI EM Index, is also the largest semiconductor chipmaker in the world.3

Emerging current account balances

Share of GDP (%)

Source: LSEG Datastream and BlackRock Investment Institute, April 2024

A second important theme we have seen play out at the macro level is geopolitical fragmentation, as the global economy increasingly splits into competing blocs and supply chains are rewired closer to home. Economies such as commodity-rich Brazil, with its valuable resources and supply inputs, as well as a diverse export base across Asia, Europe and the Americas, are well-positioned to benefit from this trend.

Finally, demographic change will also play a role in long-term economic growth as markets with younger, working-age populations claim an advantage. With India set to overtake China by 2030 in terms of the percentage of its total population that’s working age, we expect demographics to act as a tailwind for India's economy – which we’ve certainly seen play out so far in strong business activity post-COVID and positive performance in Indian equities year to date.4

A building block approach for EM

Being able to more flexibly manage allocations between China and other EM economies can potentially help to reduce portfolio volatility. According to March 2023 BlackRock data, more than 50% of the MSCI EM Index’s volatility was attributable to China, up from 40% five years before.

As this segmented approach starts to make more sense, we’ve seen increased investor interest in separate China and EM ex-China exposures. In the US, iShares’ EM ex China exposure has seen more than US$12 billion cumulative flows since 2020. In fact, flows to broad EM exposures are only slightly ahead of EM ex China exposures for the year to date in the US market.5

With a range of ETFs available across broad EM, EM ex China and Chinese equities, as well as EM fixed income exposures, you can adjust and blend your allocations to EM economies based on market events and your own investment views.