iShares

It’s time to rethink your Fixed Income with Bond ETFs

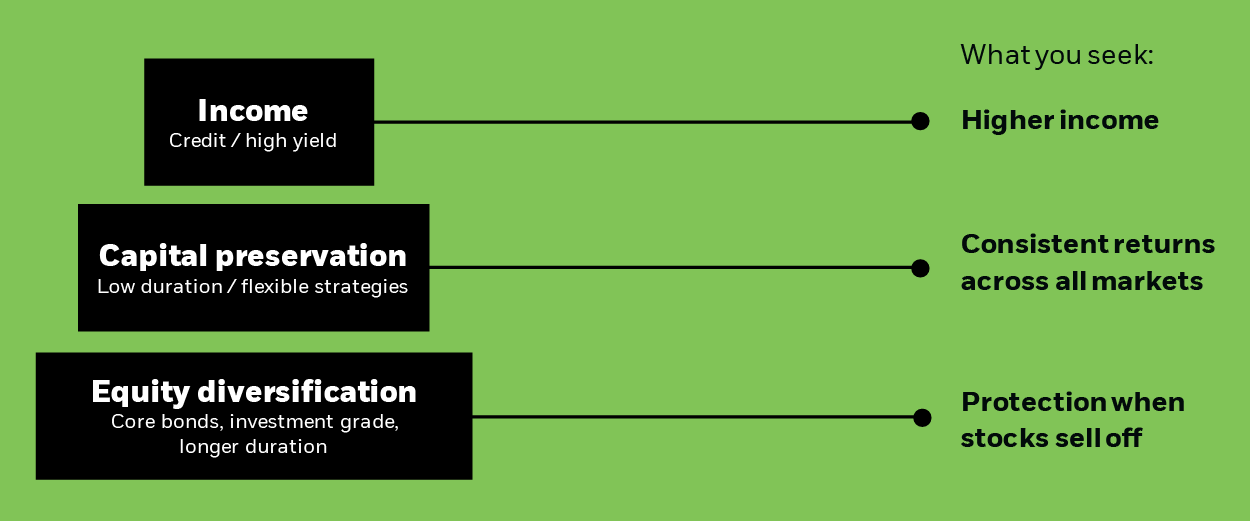

Investors are increasingly turning to bond ETFs for more precise fixed income exposures that allow investors to customise portfolios, hedge risks, and capture opportunities.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of these Funds for your investment objective, please visit our product webpage.

Find out more about iShares ETFs/BlackRock products:

What is a Bond ETF?

A bond, or fixed income, ETF is a collection of individual bonds that trades on exchange, making investing in fixed income simple and transparent, especially during periods of market volatility. Bond ETFs allow access to various segments of the domestic and international bond markets.

The growth of bond ETF investing highlights the three key benefits of ETFs—competitive performance, low-cost and liquidity — apply to bonds just as they do to equities.

Long duration bonds: The lowdown

Over the second half of 2024, inflows to long duration bond ETFs have soared as investors look to position against a rate cut in the US and de-risk their portfolio after increasing volatility in equities. This segment of the bond ETF market tends to see strong price growth as interest rates drop.

Falling rates typically push prices for bonds at the long end of the yield curve proportionately higher. For instance, if the Federal Reserve were to cut rates by 1%, you may theoretically see about 5% price growth in a Treasury bond fund with 5 years duration, and about 20% price growth in a Treasury bond fund with 20 years duration.

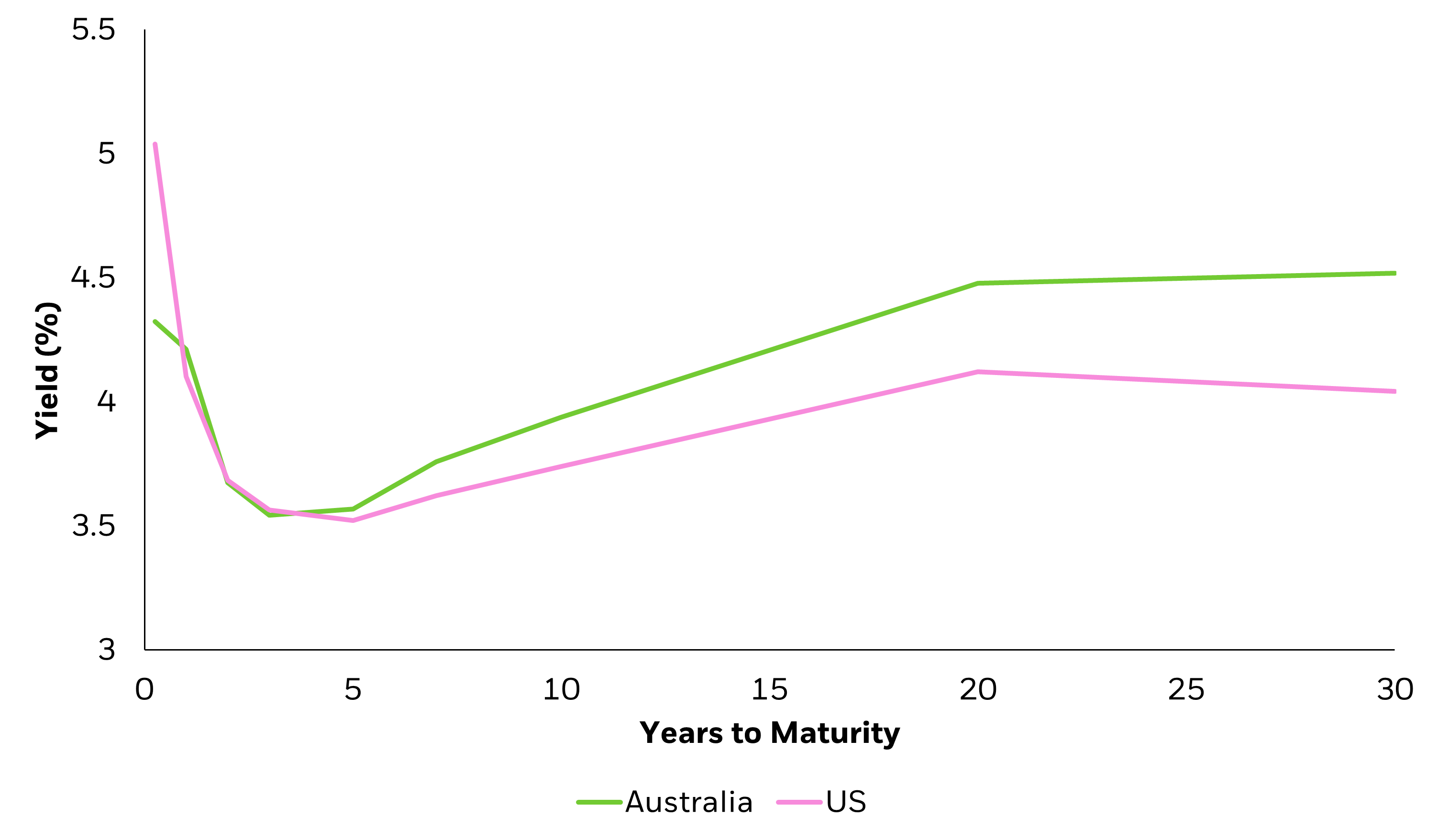

If we look at the yields offered by cash and short duration bonds versus long duration bonds, it’s not surprising that investors have tended to stay at the short end of the curve up until recently. Long duration bonds typically attract more volatility as bond markets can swing up and down over the time period that the bond is held, and if short-term yields are higher than long-term yields – as is the case currently in the US – investors may decide the risk of holding longer term bonds is not worth it.

Yields on US versus Australian government bonds, September 2024

Source: Bloomberg, as of 9 September 2024.

While the Fed’s September 2024 rate cut ended the central bank’s prolonged ‘pause’ period, investors may want to consider bar-belling – short duration exposures where short-end rates remain attractive, with long duration bond ETFs to maximise duration contribution in their portfolio for the least amount of capital. With more precise options now available for investors to build and adjust their fixed income holdings, bond ETFs may help you to manage and respond to market volatility and build a more resilient portfolio over time.