Building global infrastructure and property into your core

Real asset ETFs can give investors access to assets that have historically had high barriers to entry. They also offer the added liquidity and transparency associated with publicly traded stocks.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares Core FTSE Global Infrastructure (AUD Hedged) ETF:

https://www.blackrock.com/au/products/331650/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth and/or income distribution

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

Find out more about iShares Core FTSE Global Property Ex Australia (AUD Hedged) ETF:

https://www.blackrock.com/au/products/331647/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth and/or income distribution

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

For many investors, infrastructure and real estate are no longer considered alternative investments but, in fact, have become a core component of the modern investment portfolio. According to BlackRock’s 2023 Private Markets Survey, approximately 69% of institutional investors planned to increase allocations to infrastructure and real estate and 74% plan to maintain their allocations within the next 12 months.1 This increasing interest has been demonstrated across iShares’ Australian ETF range, where infrastructure and real estate exposures have seen almost $700 million combined inflows in 2024 to date.2

Why now?

-

01

The new market regime is in action

We are in a new regime characterised by greater macroeconomic and market volatility. The four decades of steady growth and inflation known as the Great Moderation are over, and we expect central banks to keep monetary policy tight to lean against structurally higher inflation.

-

02

Getting granular

The old “set and forget” 60/40 portfolio construction approach is unlikely to deliver results as it did in the past. This stresses the need to construct more granular core portfolios, which will allow investors to be more nimble and quickly respond to market changes.

-

03

Now is the time

Against the current market backdrop now is the time for investors to reposition and build greater resilience in their core portfolios. With inflation and supply chain disruption top-of-mind for investors, global infrastructure and property can help investors navigate today’s turbulence, whilst capturing structural growth opportunities.

Infrastructure

Infrastructure refers to the physical and organisational structures that underpins the structure of any country’s economy and society. It covers sectors such as energy (power generation), transportation (toll roads and airports), communication networks, utilities (gas, water and waste), and social infrastructure (schools and hospitals) that are critical to everyday living.

It is important to distinguish between two broad types of infrastructure: core and value-added. Core infrastructure refers to the stable and consistent income-producing end of the spectrum, whereas value-added infrastructure performance is based on capital appreciation realised on the sale of the asset and is generally characterised as riskier in nature.

Core infrastructure, as defined by FTSE Russell, focuses on activities in transportation, energy and telecommunication, that act as the foundation of developed market economies.

Transportation

Roads, bridges, tunnels, ports, airports, railways, terminals, depots and inland waterways

Energy

Electricity generation, distribution and transmission, water supply projects and pipelines

Telecommunications

Fixed line, telephone, data networks, transmission lines, towers, wireless transmission, towers and transmission satellites

Source: FTSE Russell, August 2024.

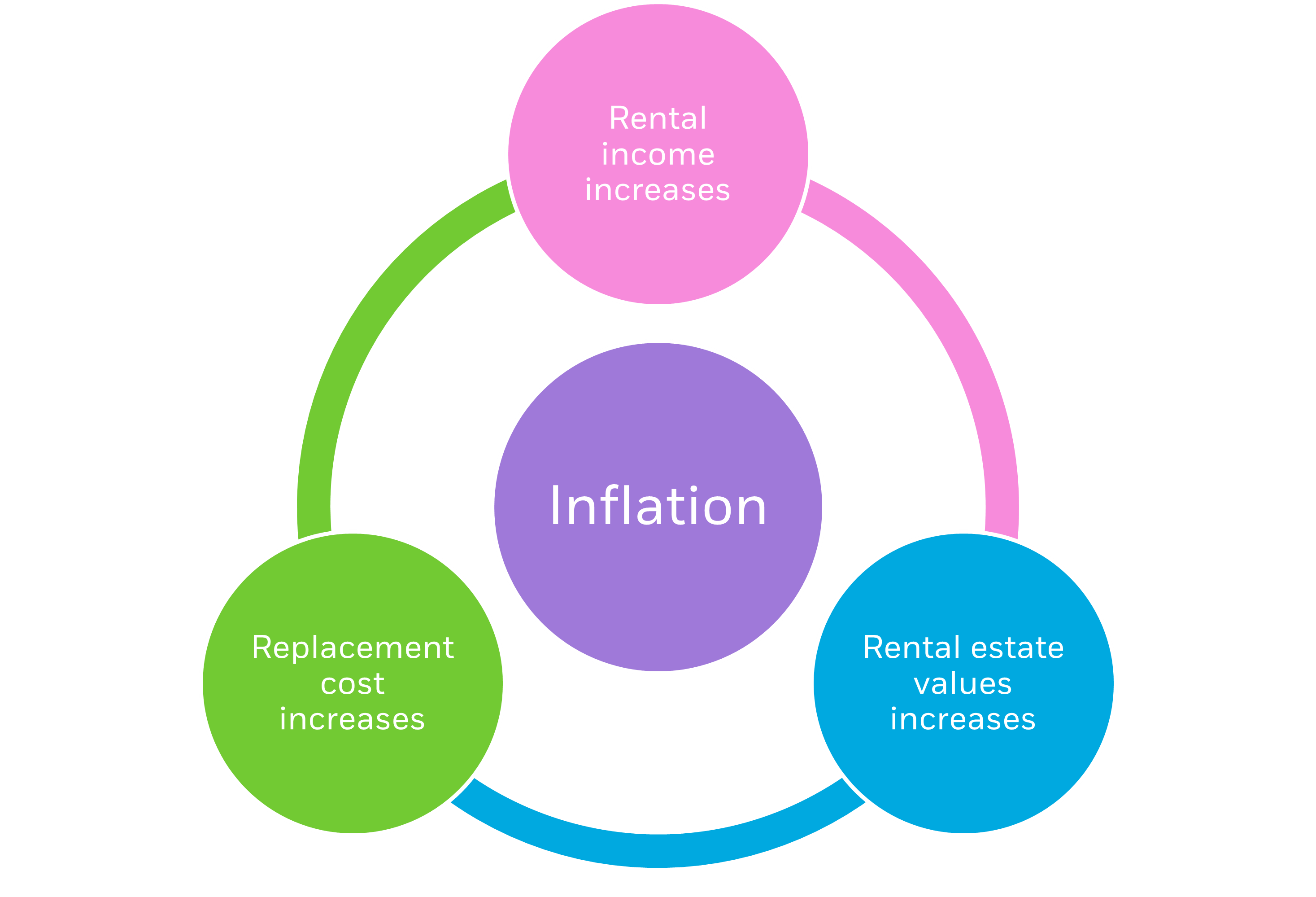

Property

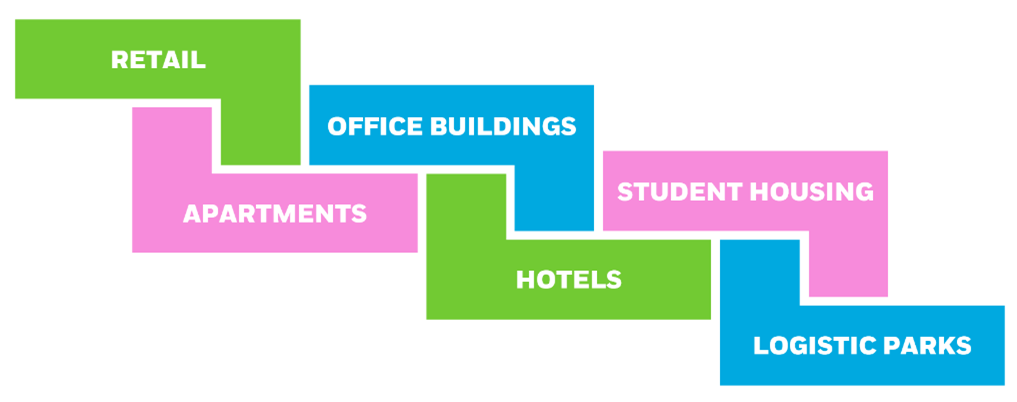

Listed real estate represents companies engaged in real estate investment, development, and other real estate related services. Real Estate Investments Trusts (REITs) are a company that owns, operates or finances income-producing real estate such as apartments, shopping centres, offices, hotels and warehouses, allowing investors to invest in the property sector without the risk of purchasing properties directly.

The most common real estate sectors include office, residential, industrial & logistics and retail. There are numerous other secondary sectors including hospitality, self-storage, student accommodation, retirement, and other special purpose buildings.