Factors are not new

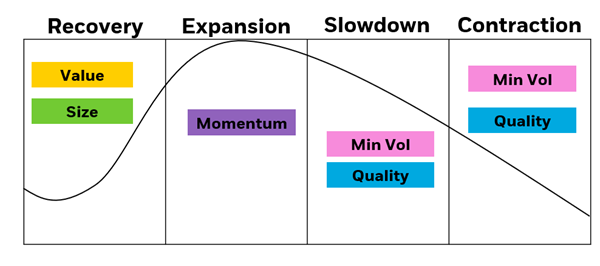

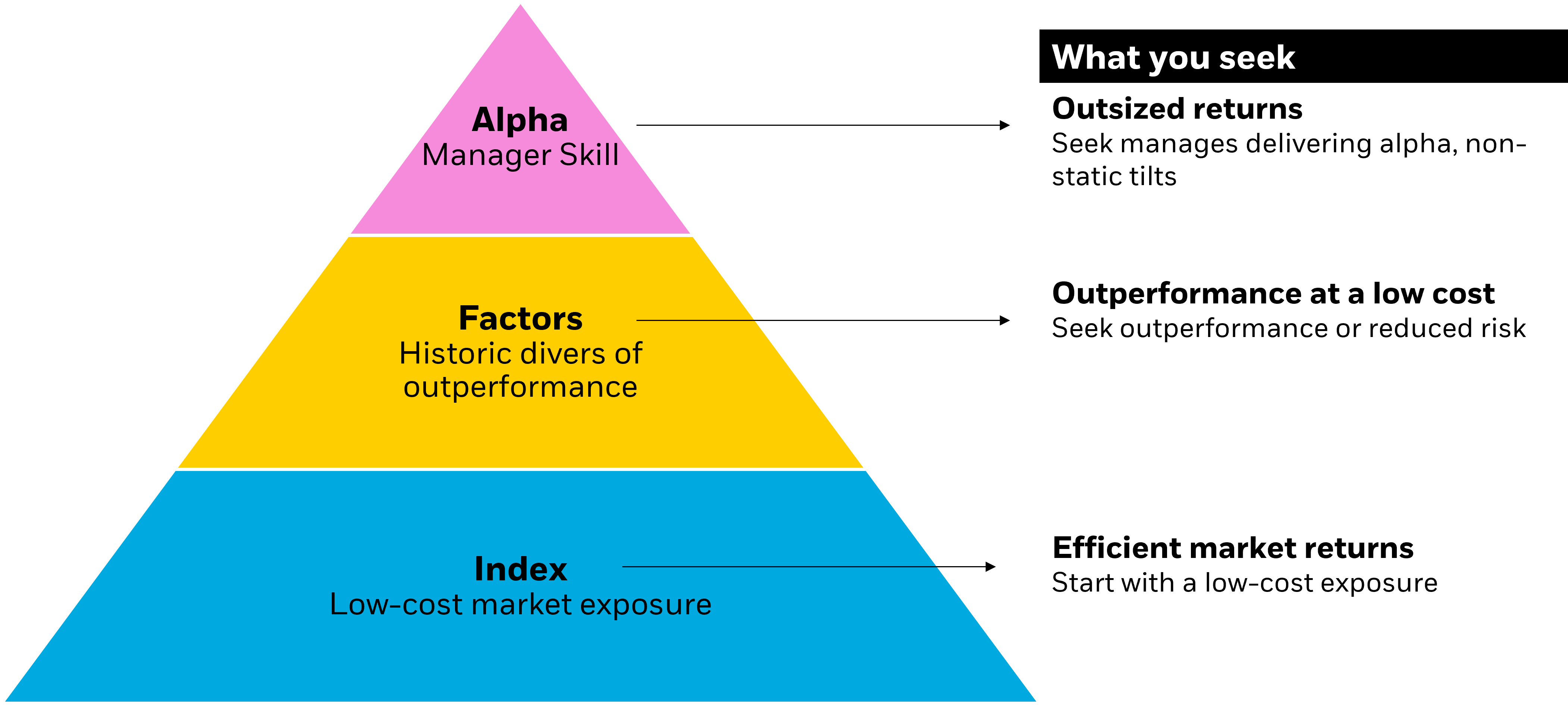

Factor style investing, has become prominent in recent years as investors seek to enhance portfolio returns and diversification while keeping volatility low. Factor investing is the strategy of targeting securities with specific characteristics such as value, quality, momentum, size, and minimum volatility.

These characteristics are persistent and well-documented and have generated returns due to the following three reasons: an investor’s willingness to take on risk, structural impediments, and the fact that not all investors are perfectly rational all the time.1

Factors are not new — they have been present in portfolios for decades. But exchange traded funds (ETFs) have helped to revolutionise how investors access these historically rewarded strategies2 by capturing the power of factors in a transparent and cost-effective way.