Now available in defined contribution plans

Workers are looking for help answering the question, how much of my nest egg can I spend in retirement… and not run out?

We’ve launched a solution. LifePath Paycheck™ combines the simplicity of a target date strategy with the increased certainty of an annuity from insurers selected by BlackRock to offer participants a paycheck for life.

Why retirement income?

#1

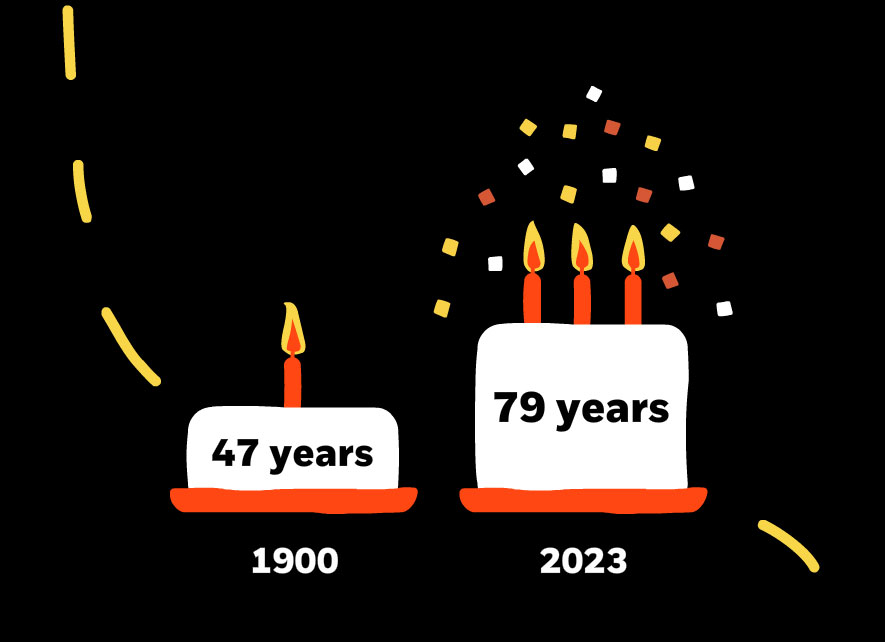

Because we’re living longer – and that should be a good thing. In the 20th century, the average American lifespan grew by about 30 years.¹

Life expectancy has grown from 47 in 1900 to 79 in 2023.

#2

Because outliving savings is a top financial concern - and employers want to help.

60% of workplace savers worry they will outlive their retirement savings;2 and 99% of plan sponsors feel responsible to help fix that.3

#3

Because having guaranteed retirement income can help retirees’ wallets – and minds.

People can get a 22% average increase in potential retirement spending from a target date strategy with an embedded income solution;4 and 93% of workplace savers say having more certainty around retirement income would help their mental health.5

For illustrative purposes only.

OUR PUBLICATIONS

Insights for better outcomes

LASTEST RESEARCH

When nest eggs need a safety net

Who benefits from guaranteed lifetime income – and how?

22%. That is the average increase in potential retirement spending that individual savers in defined contribution plan can achieve when they embed guaranteed retirement income solutions into a target date fund. For lower-income workers, it’s a 25% increase.

Women live longer. Can they afford it?

A look at gender, life expectancy, and the need for retirement income.

Living longer should be a good thing. And it can be with the right tools – for both getting to and through retirement. Women may face different challenges to retirement saving, but there are levers employers can pull to ensure women feel secure in knowing that when work stops, financial security doesn’t have to.

Six reasons to consider retirement income

What the research reveals for workplace retirement savers

People are living longer. But for the most part, we’re not choosing to put off retirement. From financial security to mental fitness, here are 6 ways guaranteed lifetime income can benefit workers as they enter that next chapter.

Our principles of decumulation

A framework for spending down assets in retirement

Financial advice often focuses on boosting personal savings rates and maximizing return on investment during a worker’s accumulation years. Equally important, however, is the decumulation process, when people spend those savings in the form of income.

How to optimize retirement income

Joint research with the Bipartisan Policy Center

Leveraging BlackRock’s proprietary lifecycle model, our analysis demonstrates how taking a holistic approach to retirement income benefits savers. In particular, a few steps can potentially generate more retirement income and decrease risk.

Lights, camera, income…

Check out our latest videos on retirement income – and the impact it can have.

Simply better prepared. For life.™

Introducing LifePath Paycheck™: the next generation of target date solutions that include an option to purchase a lifetime income stream from insurers selected by BlackRock. In other words, participants can get a paycheck for life.

Here’s how it works:

LifePath Paycheck is focused on growth when participants are young and is primarily invested in equity and equity-like assets.

This breaks down as 99% Equity and 1% Fixed Income.

Starting at age 55, LifePath Paycheck begins allocating to a new asset class called “lifetime income,” which grows over time.6

This breaks down as 52% Equity, 9% Inflation, 24% Fixed Income and 15% Lifetime Income.6

Beginning at age 59 ½, participants can:

Get a paycheck for life by opting to purchase a lifetime income stream for retirement – payable by insurers selected by BlackRock.

The remaining retirement plan savings can either be invested in a target date solution designed to complement the lifetime income stream,7 in another retirement plan investment option, or redeemed for cash.

This breaks down as 37% Equity, 9% Inflation, 24% Fixed Income and 30% Lifetime Income.

For illustrative purposes only and subject to change.

Life doesn’t retire™

The MyLifePath™ platform is a digital experience that is accessible through an eligible retirement plan’s recordkeeper. MyLifePath provides information about LifePath Paycheck and provides a means of facilitating an eligible participant’s annuity purchase option with the selected insurers.

Contact us to learn more about retirement income

Please try again