We are your trusted investment manager

BlackRock’s purpose is to help more and more people experience financial well-being. The money we manage as a fiduciary is not our own. It belongs to the individuals and organizations representing more than 120 million people around the world who rely on BlackRock to help them reach their long-term investment goals.1

Recognized by Fortune Magazine: World's Most Admired Companies

We’re honored to be on Fortune Magazine’s list of the World’s Most Admired Companies for the 12th consecutive year, ranking 1st in the securities and asset management industry.4

What does BlackRock do?

We offer investment choices to help meet our clients' financial goals

We believe more and more people put their trust in BlackRock to manage their investments in large part because we offer choice. Our global platform is designed to help our clients become better positioned to meet the financial goals that matter most to them.

We make investing easier and more affordable for more Americans

Through iShares Exchange Traded Funds (ETFs), we’re making it easier, more convenient, and more cost efficient for anyone to access market opportunities. Since 2015, iShares fee reductions have helped investors save nearly $600 million.5

Our story

BlackRock is leading the way to a better financial future

Over the past 30 years, BlackRock has shown our commitment to our platform, our people and our technology so that we can continue to deliver long term value for our clients and our shareholders.

Paragraph-1

Paragraph-2

Paragraph-3

Image Cta-4

Paragraph-4

Data Value Pair-1

BlackRock founded in 1988 with a mission to create a better financial future for investors

BlackRock began in 1988 with eight people in a single room who shared a determination to put clients’ needs and interests first. Our founders believed they could manage assets in a way that was better for their clients by utilizing their passion for understanding and managing risk. This is the way the firm continues to be managed today.

Pictured above Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson

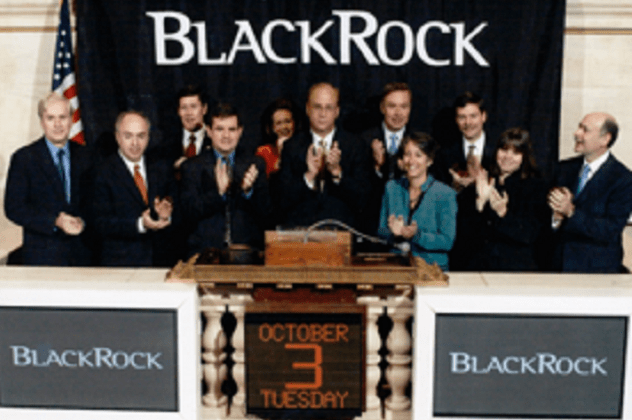

BlackRock IPOs in 1999

We make our IPO on the New York Stock Exchange on October 1st, for $14 a share. By the end of the year, we had $165B in assets under management.

Launched Financial Markets Advisory and acquired Barclays Global Investors (BGI)

Launches Financial Markets Advisory business to help solve the complex financial challenges of governments, central banks, and financial institutions.

BlackRock acquires Barclays Global Investors (BGI), becoming the world's largest asset manager, with employees in 24 countries. With this acquisition, BlackRock makes the unprecedented move of bringing alpha and index strategies under one roof to provide a wider breadth of solutions for its clients.

iShares Core ETFs

We launch iShares Core ETFs to provide investors with a low-cost, tax-efficient foundation for their portfolios.

BlackRock acquires Aperio and is listed as a top company to work at.

BlackRock acquires Aperio. This combination expands the breadth of our personalization capabilities via tax managed strategies.

Fortune Magazine ranked BlackRock among the World’s Most Admired Companies and #1 in its industry.6

Today

BlackRock is entrusted with more assets than any other investment firm in the world.

$11.6

BlackRock has $11.6 trillion assets under management7

Increase18,400

Employees

Increase35

Countries