Raffaele Savi

Global Head of BlackRock Systematic and Co-CIO and Co-Head of Systematic Active Equity]

After a decade of near zero interest rates, investors are rethinking the tradeoffs between generating income and investing for long-term growth. BlackRock Systematic has developed a combination of stock selection strategies and option-based strategies that optimize this very tradeoff.

[on screen: BlackRock Advantage Large Cap Income ETF]

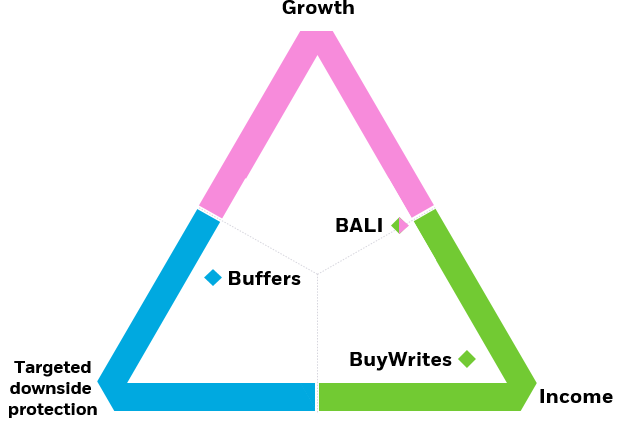

The BlackRock Advantage Large Cap Income ETF (aka BALI) provides investors with choices, aligning long-term goals with the dual aim of income generation and market participation. BALI seeks to enhance income through dividends, manages equity risk for downside resiliency and provides exposure to a defensive equity portfolio for continued potential market growth.

[on screen: Why BALI?]]

[split screen and show the list of benefits as the narrator speaks about them. Enhanced income]

BALI targets enhanced income by deploying a dividend rotation strategy in combination with an option writing premium strategy. The fund invests in U.S. large cap stocks, while writing call options on the S&P 500 Index in an attempt to deliver a consistent monthly dividend.

[on screen: Market participation]

The fund’s active stock selection seeks to capture large cap equity growth, while focusing on quality to help mitigate downside risk in the portfolio. BALI is managed by the BlackRock Systematic equity team, which seeks to uncover insights faster, at greater scale, and with more precision using data and machine learning.

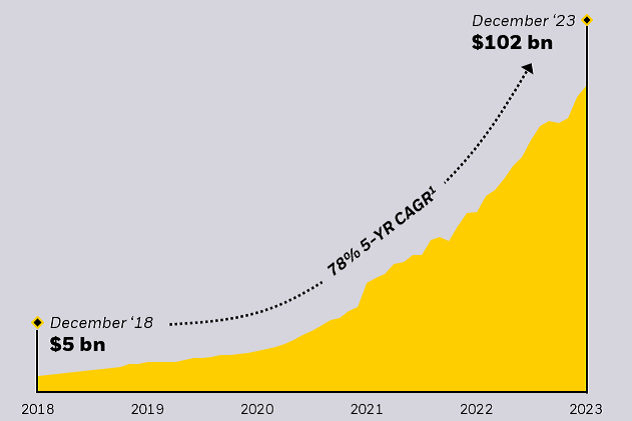

[on screen: Experienced team]

The team has managed systematic portfolios for over 35 years and has over a decade of experience managing global equity income strategies. BlackRock Systematic manages over $5B in dedicated equity income strategies and our broader systematic platform is comprised of over $223B of assets under management from clients around the entire world.

To learn more about how BALI can help investors like you navigate the current market environment, please visit BlackRock.com/BALI.

[Closing music]

Disclosures

Real yield historical data provided by Bloomberg, as of August 31, 2023.

The BlackRock Systematic team data is provided by BlackRock as of August 31, 2023.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses, or, if available the summary prospectus, which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

The Fund is actively managed and does not seek to replicate the performance of a specified index. The Fund may have a higher portfolio turnover than funds that seek to replicate the performance of an index. When the Fund sells call options on a large cap equity index, it receives a premium but it takes on the risk that these options may reduce any profit from increases in the market value of the long equity positions held by the Fund. Any such reduction in profits would be the difference between the payoff of the call option and the premium received. The Fund would also retain the risk of loss if the long equity positions decline in value. The premiums received from the options may not be sufficient to offset any losses sustained from the long equity positions. Factors that may influence the value of the options generally include the underlying asset’s price, interest rates, dividends, the actual and implied volatility levels of the underlying asset’s price, and the remaining time until the options expire, among others. The value of the options written by the Fund typically do not increase or decrease at the same rate as the underlying asset’s price on a day-today basis due to these factors.

A fund's use of derivatives may reduce a fund's returns and/or increase volatility and subject the fund to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. A fund could suffer losses related to its derivative positions because of a possible lack of liquidity in the secondary market and as a result of unanticipated market movements, which losses are potentially unlimited. There is no guarantee that any fund will pay dividends.

There can be no assurance that any fund’s hedging transactions will be effective. This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

©2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES is a trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.