KEY TAKEAWAYS

- Buffer ETFs can help investors and advisors mitigate risk by targeting a level of downside protection, in exchange for capping upside potential.

- Advisors can choose a level of downside protection on the iShares Core S&P 500 ETF suitable for their clients – ranging from:

- Up to 100% downside protection over a one-year period

- First 5% downside protection every quarter

- Next 5-20% downside protection every quarter

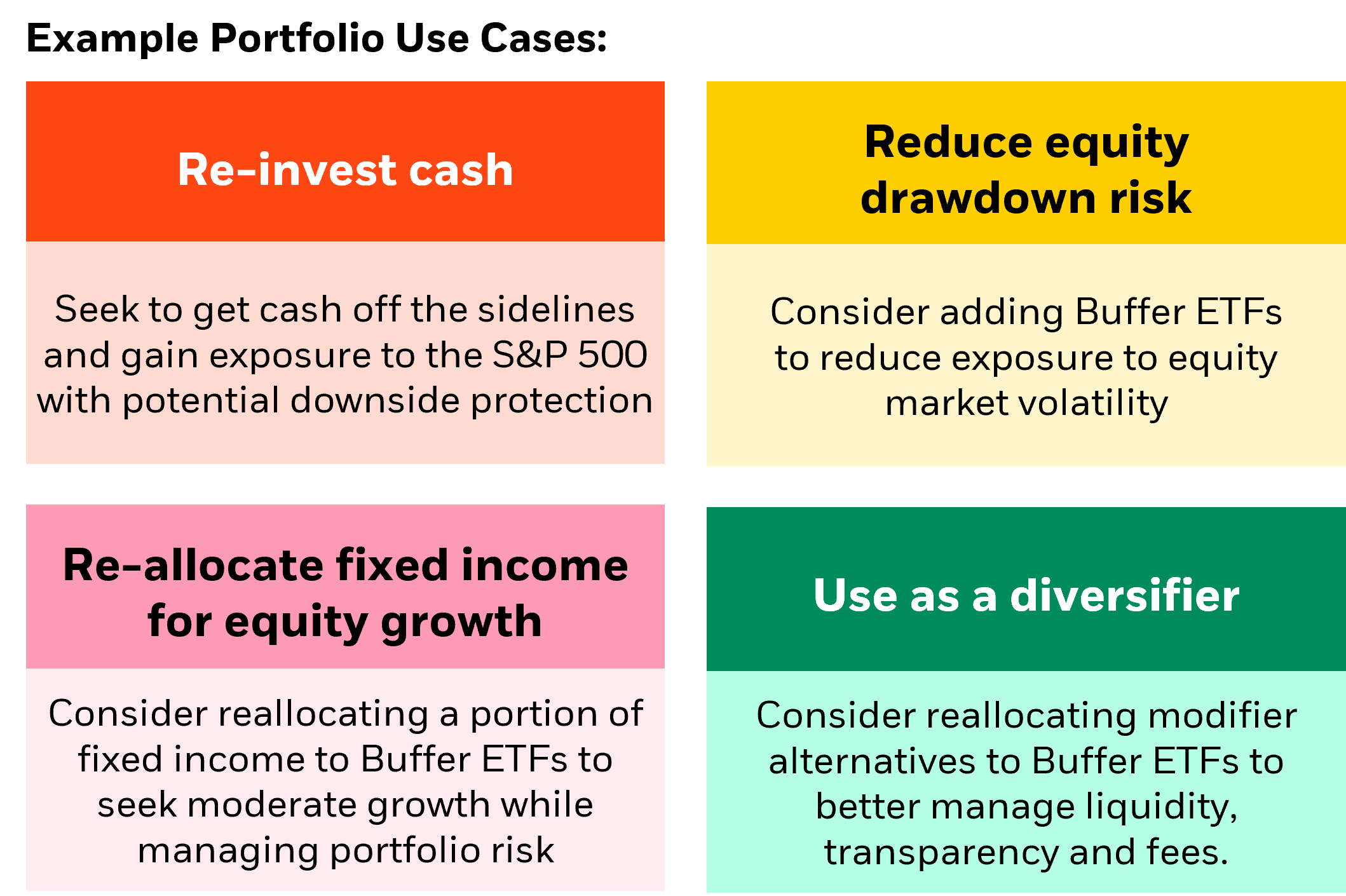

- iShares Buffer ETFs can be used strategically in portfolios to gain exposure to equities, and as a complement to their fixed income or alternatives. They can also be used as a tactical trade allowing advisors to pursue higher returns.