What is tax loss harvesting?

Tax loss harvesting is a strategy in which investors can s ell investments at a loss to offset capital gains elsewhere. To maintain a portfolio's asset allocation consider investing the proceeds from the loss sale to buy a fund in the same Morningstar Category.2

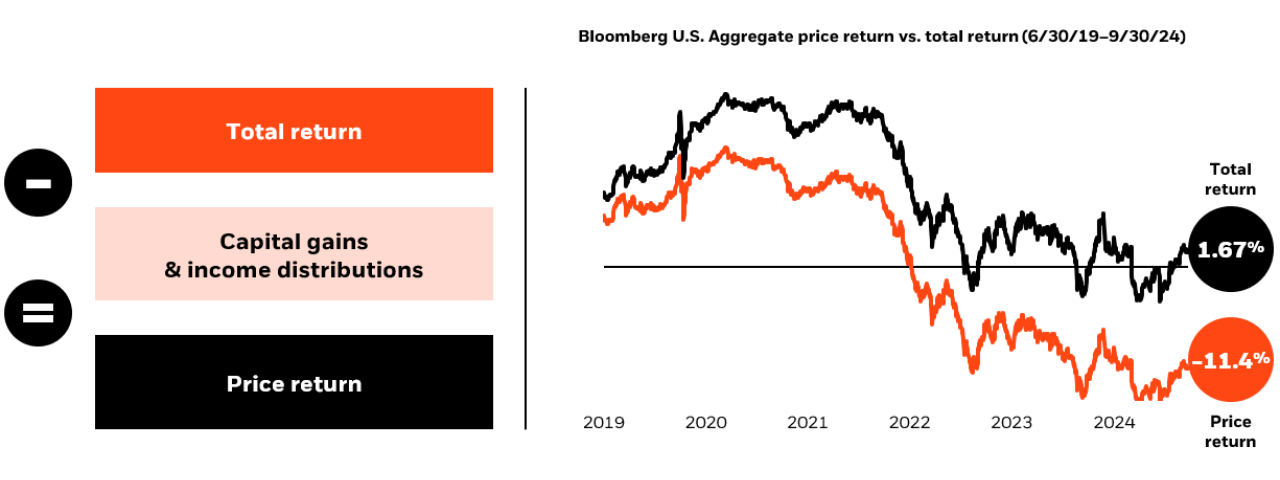

Why focus on price return

100% of Core and Core-Plus Bond funds have negative cumulative price returns over the 3- and 5-year periods.1 Advisors can use BlackRock's Tax Evaluator to identify bond funds with negative price returns that they may want to tax loss harvest.

Funds with a positive total return can have a negative price return

Since bond funds tend to distribute the bulk of their return in income distributions, their price return is usually well below their total return. This is the critical insight that can unlock tax loss harvesting opportunities.

Bloomberg, cumulative returns as of 9/30/24. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

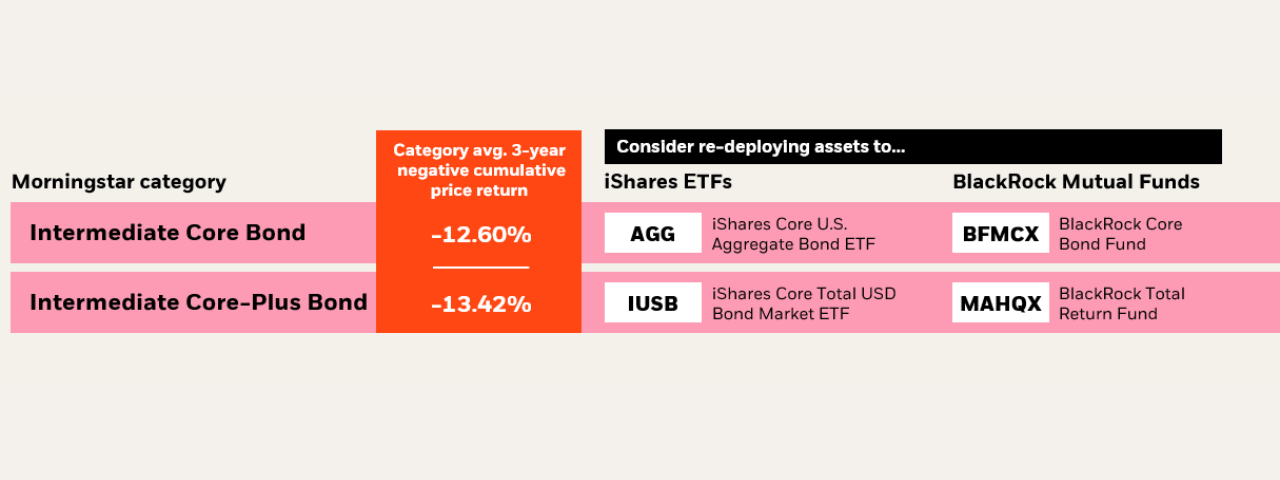

Tax loss harvest Core Bonds: a huge opportunity

Consider harvesting losses from Core Bond funds with negative price returns and re-deploy the proceeds to an investment in the same Morningstar Category.2

Source: Morningstar, BlackRock as of 9/30/2024. 1%, 100%, and 100% of Intermediate Core bond funds have a negative price return over the 1-, 3-, and 5-year tracking periods, respectively. 0%, 99%, and 98% of Intermediate Core-Plus bond funds have a negative price return over the 1-,3-,and 5-year periods, respectively. 0%, 79%, and 18% of EM funds have a negative price return over the 1-,3-,and 5-year periods, respectively. Past Performance does not guarantee future results. For illustrative purposes only. This material is provided for educational purposes only and does not constitute investment advice. The information contained herein is based on current tax laws, which may change in the future. BlackRock cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. The information provided in this material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice. Consider the wash-sale rule when tax loss harvesting. Wash sale restrictions prevent investors from realizing a loss on a sale and then buying a "substantially identical" security 30 days before and after the sale of the security. Please note that iShares ideas do not take wash sale rule considerations into account and BlackRock does not provide tax advice. We urge you to consult a tax.

2 To ensure that investors don’t get a tax break and then instantly buy back their original investment, the government has what’s known as the “wash sale” rule. The rule mandates that an investor cannot claim a loss on the sale of an investment and then buy a “substantially identical” security for the period beginning 30 days before and ending 30 days after the sale.

Investors want to build wealth over time, but if you aren’t careful, taxes can eat away at that wealth.

One way to reduce your tax burden may be to use a tax-loss harvesting strategy.

With this strategy, you look to sell investments at a loss and use the proceeds to buy investments with similar exposures.

Let’s take a look at a hypothetical example to see how it works.

Generally, if you sell a taxable investment for more than you paid for it, you have a realized gain.

Similarly, when you sell an investment for less than you paid for it, you have a realized loss.

With tax-loss harvesting, you realize losses, and reinvest the proceeds into your portfolio.

When realized losses offset realized gains, this means less taxes paid and more money to invest and potentially grow.

Any losses that were not used this year can be carried forward into future years.

Some things to consider with tax-loss harvesting:

First, if you harvested losses but don’t have enough gains to fully offset, you can still lower your year-end tax bill with a reduction of up to $3,000 of ordinary income per year.

Second, the Internal Revenue Services, or IRS, has stipulations around netting gains and losses.

Finally, the IRS 30-day wash-sale rule generally prevents you from recognizing a tax loss if you repurchase the same or a substantially identical security during the 30-day wash sale window.

And as always, tax-loss harvesting may not be for everyone.

Help your clients stay invested while potentially saving money on taxes.

Use BlackRock's Tax Evaluator to help identify tax loss harvesting opportunities.

INVESTING INVOLVES RISK, INCLUDING POSSIBLE LOSS OF PRINCIPAL.

The Internal Revenue Service has not released a definitive opinion regarding the definition of “substantially identical” securities and its application to the wash sale rule and ETFs. The information and examples provided are not intended to be a complete analysis of every material fact respecting tax strategy and are presented for educational and illustrative purposes only. Tax consequences will vary by individual taxpayer and individuals must carefully evaluate their tax position before engaging in any tax strategy.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. The information contained herein is based on current tax laws, which may change in the future. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

Due to the complexity of tax law, not every single taxpayer will face the situations described herein exactly as calculated or stated; i.e., the examples and calculations are intended to be representative of some but not all taxpayers. Since each investor’s situation may be different in terms of income tax, estate tax, and asset allocation, there may be situations in which the recommendations would not apply. Please discuss any individual situation with tax and investment advisors first before proceeding. Taxpayers paying lower tax rates than those assumed or without taxable income would earn smaller tax benefits from tax-advantaged indexing or even none at all compared to those described.

No proprietary technology or asset allocation model is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful.

Prepared by BlackRock Investments, LLC, member FINRA. BlackRock Fund Advisors, an affiliate of BlackRock Investments, LLC, is a registered investment adviser.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners

Earn CE with our Tax Foundations course

Pre-tax returns may not be as important to a taxable investor. See why managing taxes matters and learn how to incorporate tax-smart strategies into your investment process.