Systematic investing

-

BlackRock cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpages.

BlackRock cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpages.

Find out more about BlackRock Advantage Australian Equity Fund

https://www.blackrock.com/au/products/254830/blackrock-advantage-australian-equity-fund

This product is likely to be appropriate for a consumer:

• seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a medium to high risk/return profile, and

• who is unlikely to need access to their capital for up to one week from a request

Find out more about BlackRock Advantage International Equity Fund

https://www.blackrock.com/au/products/254692/blackrock-advantage-international-equity-fund

This product is likely to be appropriate for a consumer:

• seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a medium to high risk/return profile, and

• who is unlikely to need access to their capital for up to one week from a request

This product is for advised consumers only.

Find out more about BlackRock Advantage Hedged International Equity Fund

https://www.blackrock.com/au/products/254833/blackrock-advantage-hedged-international-equity-fund

This product is likely to be appropriate for a consumer:

• seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a high to very high risk/return profile, and

• who is unlikely to need access to their capital for up to one week from a request

This product is for advised consumers only.

What Is Systematic Investing?

In today’s uncertain markets, we all need more targeted investment outcomes.

By combining the power of data-driven insights, investment science, and disciplined portfolio construction to modernize the way we invest, systematic investing is unlocking new ways to seek specific outcomes amidst a world of unpredictability.

Systematic investing begins with data-driven insights.

In the digital age, we have access to vast amounts of data, from traditional sources like company financial statements and economic reports to more complex unstructured sources like company news stories, web traffic, social media sentiment, consumer geo-location data and even satellite imagery.

By harnessing highly sophisticated analytics techniques like machine learning and artificial intelligence, we transform this sea of raw data into useful investment information—providing insights faster, at greater scale, and with more granularity than traditional methods.

Next, we deploy rigorous scientific testing to learn if these investment insights actually have the potential to help forecast future returns.

This process includes a comprehensive examination of empirical evidence by seasoned investment experts—testing different combinations of variables and comparing the results to known outcomes. This ability to validate insights means portfolio decisions are firmly evidence-based on not dependent on human conviction alone.

Finally, when an insight is shown to be valuable, we employ a disciplined portfolio construction process to implement it. Our investment experts use computers to model the many complex trade-offs involved—finding a balance between expected return, risk, correlation, and cost—to guide any allocation decisions.

At every step, the systematic process is designed to help deliver more targeted investment outcomes.

Whether it’s seeking risk-managed growth through equities… generating income and maintaining ballast with bonds… or accessing new sources of diversification and return with alternative strategies…

Systematic investing is unlocking new ways to navigate a world of uncertainty.

What is systematic investing?

Systematic investing, often called quantitative investing, is an investment approach that emphasizes data-driven insights, scientific testing of investment ideas, and advanced computer modelling techniques to construct portfolios.

Investing, evolved

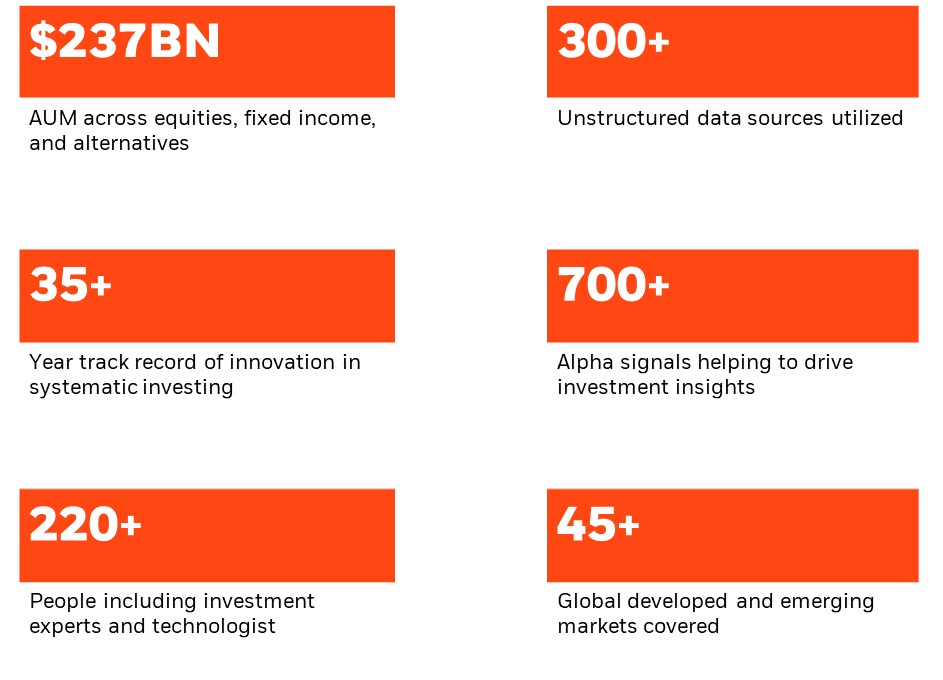

BlackRock Systematic, as of June 30, 2024. For illustrative purposes only.

AUM refers to USD figures.

Innovative investment insights are validated through rigorous quantitative testing—amplifying the decision-making of our investment experts.

Technology-driven process helps scale investment insights across vast sets of securities, enabling high-breadth portfolios for equities, fixed income, and alternatives.

Systematic tools help our investors balance complex risk and return trade-offs with precision—targeting the investment outcomes that you expect.

The future of investing requires modern technology and portfolio construction to deliver consistent returns at a reasonable cost.

Seek risk-managed growth at a low cost

Managed through a technologically-driven investment process, the BlackRock Advantage Series of funds can help to seek risk-managed growth at a low cost.