A globally diversified strategy in search of opportunity

-

BlackRock cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

BlackRock cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about BlackRock Global Allocation Fund (Aust)

https://www.blackrock.com/au/products/254711/

This product is likely to be appropriate for a consumer:

• seeking capital growth

• using the product for a major allocation of their portfolio or less

• with a minimum investment timeframe of 5 years

• with a medium to high risk/return profile, and

• who is unlikely to need access to their capital for up to one week from a requestThis product is for advised clients only.

BlackRock Global Allocation Fund (Aust)

The BlackRock Global Allocation Fund (Aust) is designed to be a core, “one-stop shop” for investors seeking long-term growth. The fund’s flexible mandate and broad investment universe enables its management team to scour the world for the best opportunities and adapt as markets change. Well-diversified with typically over 1000 issuers across 80 countries and 40 currencies, the fund is constantly seeking to strike an appropriate balance of risk and return.

Broad diversification

A globally diversified investment approach to help mitigate risk1

An established track record

Delivered returns competitive with global equities with one-third less volatility

Experienced team

A seasoned teamed team of 50+ professionals, navigating markets for over 31 years

Today’s markets warrant a nimble approach

Increased uncertainty in today’s markets underscores the importance for an unconstrained approach to capture investment opportunities. In the past few years, markets have experienced a global pandemic, elevated inflation, increased geopolitical tensions and a dramatic interest-rate hiking cycle.

Global Allocation seeks to help clients by considering the following questions and by adjusting the portfolio to manage the near-term and invest for the long-term:

- What is the macro environment and do we want to be risk-on or risk off?

- What is the optimal allocation across stocks, bonds, and cash in the current environment?

- What are the individual securities we want to invest in?

- How have the markets and investment opportunities evolved?

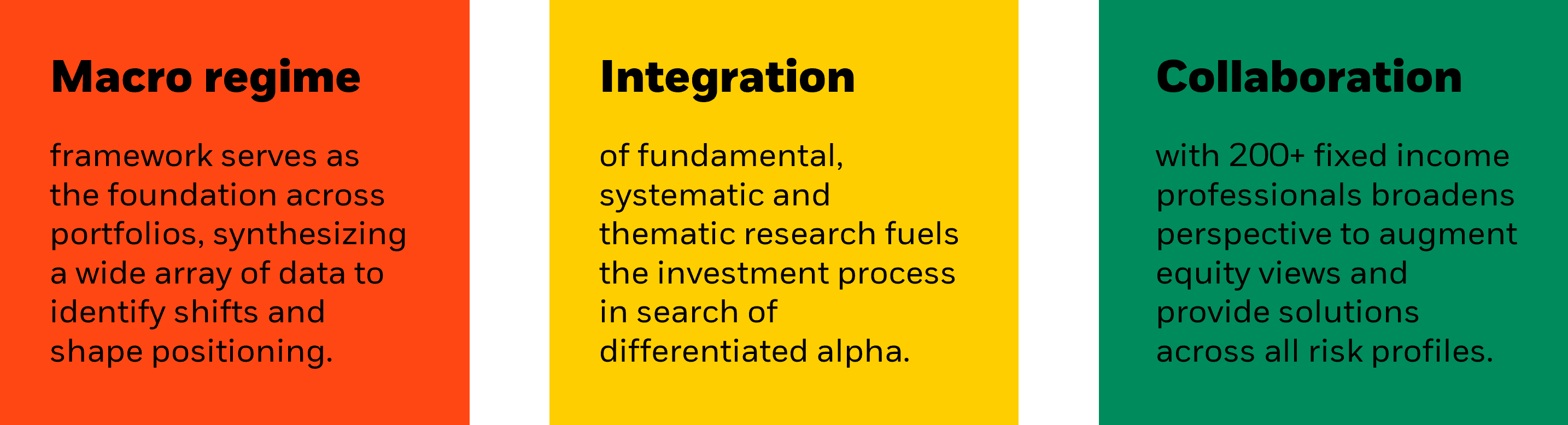

Under Rick’s leadership, the Global Allocation investment process was enhanced through a more robust framework to harness macro, regional, and thematic views to complement the bottom-up fundamental research. In addition, we implemented a deeper integration of systematic strategies to monitor investment trends and augment positioning. Finally, we increased research collaboration with Fundamental Fixed Income (FFI) credit analysts worldwide.

Asset allocation, risk management, and security selection decisions are synchronized. As a result, strategies across the platform can create unique expressions with the ability to manage exposures swiftly, efficiently, and precisely – all critical in finding differentiated alpha.