IHVV

iShares S&P 500 (AUD Hedged) ETF

Overview

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

Performance

Performance

Growth of Hypothetical $10,000

Distributions

Tax Summary

-

Returns

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 2.69 | 2.69 | 6.00 | 9.31 | 24.51 | 30.30 | 77.07 | 211.94 | 216.54 |

| Benchmark (%) | 2.74 | 2.74 | 5.97 | 9.26 | 24.44 | 29.72 | 77.78 | 209.97 | 214.99 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | 12.55 | 27.64 | -20.75 | 22.95 | 23.10 |

| Benchmark (%) | 13.54 | 27.41 | -20.91 | 22.77 | 23.03 |

Incept.: The date on which the first iShares ETF unit/share creation was processed.

The performance quoted represents past performance and does not guarantee future results.

Switch on the core four

Switch on the core four

Key Facts

Key Facts

Portfolio Characteristics

Portfolio Characteristics

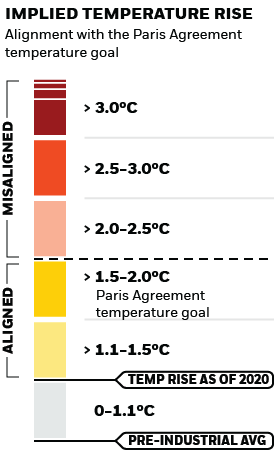

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Holdings

Holdings

Notional Value: The market value of the securities held by the ETF at the given date. The notional value of a futures contract is the face value of the futures contract as at the given date.

All security prices are shown in the fund base currency.

Underlying Holdings: Underlying Holding data shows the direct investments of the iShares Core S&P 500 ETF (IVV), the underlying fund into which the fund substantially invests. The base currency of the underlying fund is U.S. dollars, however, holding information has been converted to Australian dollars for illustrative purposes only, using the previous day’s London 4 p.m. exchange rate, as provided by Reuters. For further information please call iShares on 1300 474 273.

Total allocation percentages may not equal 100% due to rounding or omissions of holdings of less than 1%. Information on certain fund holdings or less than 1% may not be widely available and may not be included in the table of holdings shown.

Holdings are subject to change.

Although BlackRock shall obtain data from sources that BlackRock considers reliable, all data contained herein is provided “as is” and BlackRock makes no representation or warranty of any kind, either express or implied, with respect to such data, the timeliness thereof, the results to be obtained by the use thereof or any other matter. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

Exposure Breakdowns

Exposure Breakdowns

Total allocation percentages may not equal 100% due to rounding or omission of holdings of less than 1%.

Literature

Literature

-

iShares S&P 500 (AUD Hedged) ETF Australian Dollar Factsheet

-

Indicative Distribution Calendar - Australian Domiciled iShares ETFs

-

iShares International Equity ETFs: Product Disclosure Statement

-

iShares International Funds - Semi Annual Report

-

iShares S&P 500 (AUD Hedged) ETF (IHVV): Target Market Determination

-

ishares-international-funds-annual-report-en-au.pdf

-

Zenith Fund Review: iShares S&P 500 AUD Hedged ETF

-

Lonsec Fund Review:iShares S&P 500 AUD Hedged ETF

-

Morningstar Fund Review: iShares S&P 500 AUD Hedged ETF

-

Indicative Distribution Calendar - Australian Domiciled iShares ETFs

-

iShares ETF Distribution Reinvestment Plan - Australian Funds

Trading iShares

Trading iShares

iShares ETFs can be bought and sold via an exchange just like individual shares.