Exchange traded funds (ETFs) have grown quickly in both size and scope over the past decade. Globally, assets under management accelerated from $1 trillion in 2008 to $21.2 trillion in 2024. 1 Today, almost 700 issuers offer more than 12,000 ETFs.2

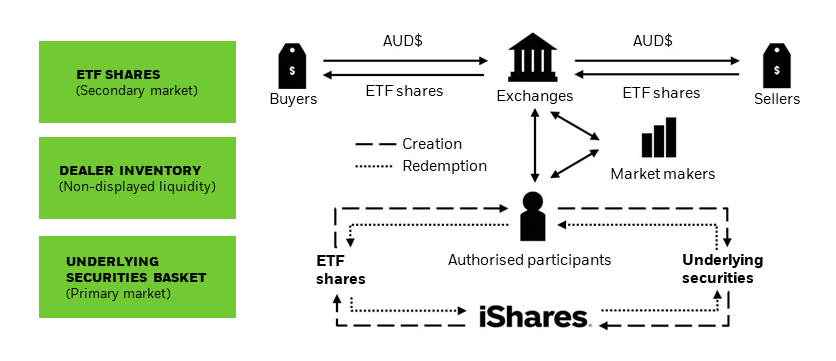

Many players help support the mechanism that enables ETFs to operate efficiently. We examine two institutions — authorised participants (APs) and market makers—that play central roles in ensuring that ETF prices are accurate, and that trading is smooth, in all market conditions.

ETFs: A unique fund structure

ETFs combine features of managed funds and stocks. Like managed funds, ETFs are pooled investment vehicles that offer access to a broad mix of stocks, bonds or other assets. Unlike managed funds, ETF investors don’t interact directly with the fund provider when buying or selling fund shares. Instead, they generally trade existing ETF shares with each other during market hours, on an exchange, just like trading stocks.3

Uniquely, ETFs operate in two markets that involve different types of market participants. Most trading usually occurs in the ‘secondary’ market, or on-exchange, where investors buy and sell existing ETF shares. The price of the shares is determined in real-time and, as with stocks, transaction costs are affected by the ETF’s bid/ask spread (the difference between the buyer and seller prices). Larger, more frequently traded ETFs generally have tighter spreads, and thus lower transaction costs.4

A separate, “primary” market involves large institutions (authorised participants) transacting with ETF issuers to create or redeem ETF shares based on market demand. Individual investors do not participate in the primary market. In terms of volume, ETF trading in the primary market is generally less than ETF trading in the secondary market.

APs: Key players in ETF creations and redemptions

An AP is a financial institution, often a bank, that dynamically manages the creation and redemption of ETF shares in the primary market. This process adjusts the number of ETF shares outstanding and helps keep an ETF’s price aligned with the value of its underlying securities.

Each AP has an agreement with an ETF issuer that gives it the right (but not the obligation) to create and redeem ETF shares. APs may act on their own behalf or on behalf of market participants and are not compensated by ETF issuers.

Examples of APs include Merrill Lynch, J.P. Morgan and Citigroup.

Market makers: Matching buyers and sellers

A market maker regularly provides two-sided (buy and sell) quotes to clients on the exchange. Market makers are key liquidity providers in the ETF ecosystem that ensure continuous and efficient ETF trading in the secondary market.

The role of a market maker is distinct from the role of an AP, though both are necessary for robust ETF trading activity. A market maker does not need to be an AP, nor does an AP need to be a market maker. Still, some firms play both roles in certain ETFs.

In Australia, each listed ETF is required to have a designated market maker, this market maker has set obligations to provide a minimum quantity at a spread up to a defined maximum schedule for at least 80% of the time during market hours. These obligations are set out in a contract with the ETF issuers.

iShares have multiple market makers on all ETFs including but not limited to the designated market maker.

Examples of market makers include JP Morgan, BNP Paribas, Susquehanna, Jane Street and Nine Mile Financial.

ETF trading in action

APs and market makers have an economic incentive to take advantage of arbitrage opportunities in the market. This involves trading the ETF shares or underlying securities when there are small price differences between the two.

A market maker may engage an AP to initiate a creation if the price of an ETF share is greater than the value of the underlying holdings (at a premium) or a redemption if the price of an ETF share falls below the value of the underlying holdings (at a discount).

For example, assume that when the market opens, the price of an ETF and the value of its underlying securities are both $100. If the value of the underlying securities falls to $99 while the price of the ETF remains $100 (i.e., the fund is trading at a premium), an AP could profit by creating new ETF shares. Specifically, the AP could buy the underlying securities for $99, deliver them to the ETF issuer to create shares of the ETF and sell the ETF shares at the market price of $100. This results in a profit of $1 per share for the AP.

Likewise, if the market price of the ETF falls to $99 while the value of underlying securities remains $100 (i.e., the fund is trading at a discount), an AP could buy shares of the ETF and redeem them with the issuer in exchange for the fund’s underlying securities, resulting in a profit of $1 per share for the AP.5

The ability to exchange the ETFs for either cash or the underlying assets provides economic incentives for market makers to trade when the price deviates from the value of the underlying assets. This self-policing mechanism ensures the exchange price does not materially deviate from the values of the funds’ assets. Any drifting in the price of an ETF away from the current value of the ETFs portfolio of securities will economically incentivise market makers due to the fact that profit (as described above) can be made by selling the higher-priced asset while simultaneously buying the lower-priced asset. We term this the “ETF arbitrage mechanism”.

APs transact in the primary market

APs dynamically adjust the number of ETF shares outstanding, and in doing so, increase efficiency and reduce costs for ETF investors.

When demand for ETF shares exceeds the supply of shares available in the market, APs work with ETF providers to create additional shares.

An AP can initiate a creation in three ways:

- Deliver a “creation basket,” or a pre-specified bundle of securities representing the underlying index, to the ETF issuer.

- Provide cash equal to the full or partial value of the creation basket (including actual trading costs of purchasing the creation basket) to the ETF issuer.

- Provide cash equal to the value of the ETF shares plus a trading spread (a buy/sell spread) to the issuer.6

In return, the ETF issuer will deliver new shares of the ETF to the AP. The AP can then hold these shares in their inventory or sell them to investors in the secondary market.

Conversely, when there are too many ETF shares outstanding due to more investors selling shares than buying shares in the secondary market (i.e., supply is exceeding demand), an AP will buy ETF shares on the exchange and return them to the ETF issuer.

To initiate a redemption, the AP must deliver ETF shares—either obtained from inventory or purchased on the secondary market—to the ETF issuer. Once ETF shares are delivered, the ETF issuer gives the AP a “redemption basket”, or cash, in return.7

If you’re familiar with exchanged traded funds, or ETFs, you may have heard the phrase Creation and Redemption. But let’s dig deeper into what it means and why it’s important?

ETFs are low-cost ways to access both broad and precise market exposures. They trade like stocks, can provide deep liquidity, and their prices are closely tied to the value of their underlying securities. But how is this possible? It’s all thanks to the processes of creation and redemption.

To better understand how it works, think of an individual stock or bond as a flower. Just like companies come in different sectors and sizes, flowers come in all kinds of varieties and shapes. Now take a variety of flowers and bundle them into a bouquet, and you’ve got yourself an ETF. The price of an ETF is based on the price of the stocks or bonds that make up the ETF. So when the prices of individual flowers increase, so does the price of the bouquet.

Now let’s say an investor wants to buy a bouquet, what does she do? She goes to a flower shop, which we can imagine as a brokerage firm. Here, the investor browses bouquets and finds the emerging markets bouquet, the clean energy bouquet, and the S&P 500 bouquet. She decides to buy one S&P 500 bouquet. Like a florist, the broker dealer takes this order and sends the market maker out to the market to fill it. The market maker finds the S&P 500 bouquet and brings it back to the shop. The investor pays the broker and gets the ETF she wants. Easy!

But what happens if the investor wants one hundred bouquets? Just as before, the broker dealer sends the market maker to get one hundred bouquets. But there are only five bouquets available. So what’s the poor market maker to do? Thanks to the unique process of ETF creation, more bouquets can be made to fill the large order. The creation process kicks in as soon as the investor places the order. It begins with the authorised participant, or AP for short.

The AP watches the market in order to manage the supply of flowers and bouquets. When the market maker can’t fill an order, he asks the AP to make extra bouquets. The AP checks the S&P 500 Index to find out exactly which individual flowers make up the S&P 500 bouquet. Once the AP has everything he needs, he gives the flowers to iShares.

Similar to a bouquet designer, iShares assembles brand-new S&P 500 bouquets. Once they bundle the individual flowers, iShares gives the new bouquets back to the AP; the AP gives the bouquets to the market maker; and the market maker brings them back to the broker dealer, who in turn sells them to the investor at market price. Despite the size of the order, the price of the bouquets stays approximately the same due to the increased supply.

Now let’s flip things around for redemption.

The investor wants to return one hundred bouquets, so the florist buys them back. He then gets the market maker to take the bouquets to the market to see who wants them. But there’s already an adequate supply of bouquets. So what does the market maker do now?

Well, he turns to the AP again. The market maker gives the AP the bouquets, who then brings them to the iShares workshop where they are disassembled into individual flowers. And just like that, the number of bouquets decreases to meet market needs and keep bouquet prices stable. Creation and redemption occur to keep ETF supply in line with demand. This generally keeps ETF values closely tied to their underlying assets. And it allows you to easily trade ETFs throughout the day due to their deep liquidity. Visit iShares to learn more about ETFs today.

The ETF creation and redemption process

Understand ETF liquidity and the creation and redemption process that lets ETFs trade even when volume is low.