iShares

Switch on the core four

Build a diversified, multi-asset portfolio with just four core building blocks.

iShares ETFs cover a broad range of asset classes, risk profiles and investment outcomes. To understand the appropriateness of this fund for your investment objective, please visit our product webpage.

Find out more about iShares Core S&P/ASX 200 ETF

https://www.blackrock.com/au/products/251852/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth and/or income distribution

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years

- with a medium to high risk/return profile

Find out more about iShares Core Composite Bond ETF

https://www.blackrock.com/au/products/251977/

This product is likely to be appropriate for a consumer:

- who is seeking capital preservation and/or income distribution

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 3 years, and

- with a medium risk/return profile

Find out more about iShares Core Cash ETF

https://www.blackrock.com/au/products/287045/

This product is likely to be appropriate for a consumer:

- who is seeking capital preservation and/or income distribution

- using the product for a whole portfolio solution or less

- with no minimum investment timeframe, and

- with a very low risk/return profile

Find out more about iShares Core MSCI World ex Australia ESG ETF

https://www.blackrock.com/au/products/283117/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a major allocation of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

Build a strong foundation with four Core ETFs

iShares’ four core ETFs offer broad stock and bond exposures by seeking to track high-quality, established indexes. Over the last five years, the funds have outperformed the majority of their index and active fund peers.1 A resilient, diversified portfolio is much like a balanced diet. You need a good mix of different food groups for optimal health. And for a well diversified, global multi-asset portfolio, what you need to consider are four basic ingredients.Starting with the iShares’ core four - gain access to Australian equities, Australian fixed income, cash and international equities. Your recipe for a resilient and well-diversified core portfolio

Source: Morningstar, 31/08/2023. Performance is compared to peer universe of the respective ETFs over a 5 year annualised period.

Chart description: Peer universe for IOZ is the Morningstar Australian Equity Category, for IWLD is the Morningstar World Equity Category, for IAF is the Morningstar Australian Bond Category, for BILL is the Morningstar Australian Cash Category. Past performance does not guarantee future results. Funds included in Morningstar’s category universe include indexed and active funds. Material differences may exist between products being compared, such as, investment objectives, fees and expenses, types of investments made, countries or markets covered.

Explore our Core Four ETFs

Why Core ETFs

Simplicity

Aim to achieve return resilience and easily build a broadly diversified portfolio across major asset classes, accessing thousands of securities across the globe.

Quality

Invest in low-cost ETFs, so you can keep more of what you earn.

Affordability

Each ETF is carefully curated, aimed to simplify your investing and designed to give you instant access to a diversified basket of equities.

A choice of four ETFs that you can readily access and invest in

Aim to achieve return resilience and easily build a broadly diversified portfolio across major asset classes, accessing thousands of securities across the globe.

BlackRock, 29 September 2023.

Build a quality portfolio

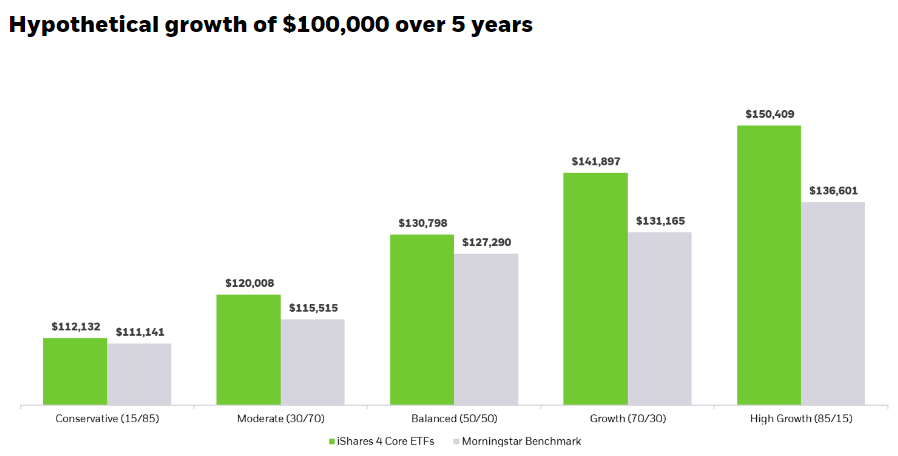

Use just four simple building blocks that can be tailored for different risk profiles and achieve competitive performance.2

Morningstar, 31/08/2023. Performance is compared to peer universe of the respective ETFs over a 5 year annualised period.

Chart description: Peer universe for IOZ is the Morningstar Australian Equity Category, for IWLD is the Morningstar World Equity Category, for IAF is the Morningstar Australian Bond Category, for BILL is the Morningstar Australian Cash Category. Past performance does not guarantee future results. Funds included in Morningstar’s category universe include indexed and active funds. Material differences may exist between products being compared, such as, investment objectives, fees and expenses, types of investments made, countries or markets covered.

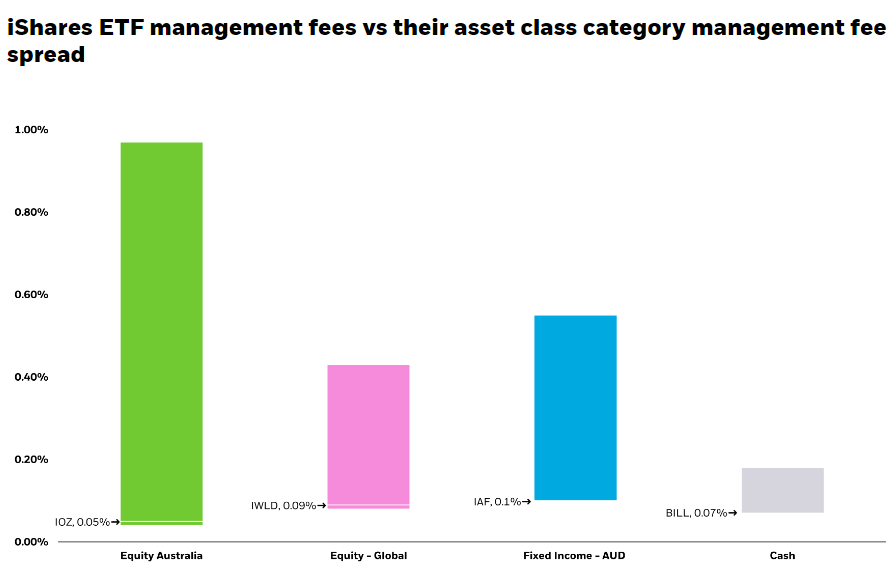

Low portfolio costs

Keeping overall portfolio costs low can help you reach your investment goals sooner. These iShares four core ETFs are much more cost competitive compared to their ETF peers.

Morningstar, 31/08/2023. Performance is compared to peer universe of the respective ETFs over a 5 year annualised period.

Chart description: Peer universe for IOZ is the Morningstar Australian Equity Category, for IWLD is the Morningstar World Equity Category, for IAF is the Morningstar Australian Bond Category, for BILL is the Morningstar Australian Cash Category. Past performance does not guarantee future results. Funds included in Morningstar’s category universe include indexed and active funds. Material differences may exist between product, service or performance being compared, such as, investment objectives, fees and expenses, types of investments made, countries or markets covered.