The principles of unconstrained global equity investing

Building a future

The investment management landscape has come a long way in the four decades since BlackRock was established. Over that time, we’ve seen the introduction of benchmark-based performance measures that track sector weightings and assess risk versus the broad market, as well as the rise of passive index-based investing that encourages a top-down approach based on which markets or themes are poised to perform well.

The evolution of big data has also driven an increasingly quantitative approach to investment research led by short-term data points such as credit card spending, website visits and other data scrapes, as managers race for an edge based on live changes in these trends.

While each of these changes have brought welcome improvements to the industry, we also believe there’s still a place in an investor’s toolkit for a strategy that goes “back to basics”, focusing purely on companies that can generate long-term alpha over and above economic cycles and the short-term macro picture.

This is our approach in global unconstrained equity investing, and the idea behind it is to think about how an investor might run their own personal money to achieve a long-term goal, such as helping their children financially when they move out of home. Typically, someone investing in this way would think about which stocks are going to achieve the highest capital growth over time, without paying attention to short-term events such as quarterly results or sudden drops in the market.

Unconstrained investing 101

Unconstrained investing is a broad concept and different fund managers may have their own approaches, so how do we define our unconstrained investing strategy at BlackRock? Firstly, we don’t assess positioning based on a benchmark. If we think again about our long-term investor building a nest egg that they’re not planning to touch for 10-15 years, they typically won’t construct their portfolio based on what the index is doing.

While benchmarks such as the MSCI World Index can be a useful barometer of broad market sentiment and performance, they are ultimately an indication of what has happened in the past, and do not provide the best opportunity set for what is going to happen in the future.

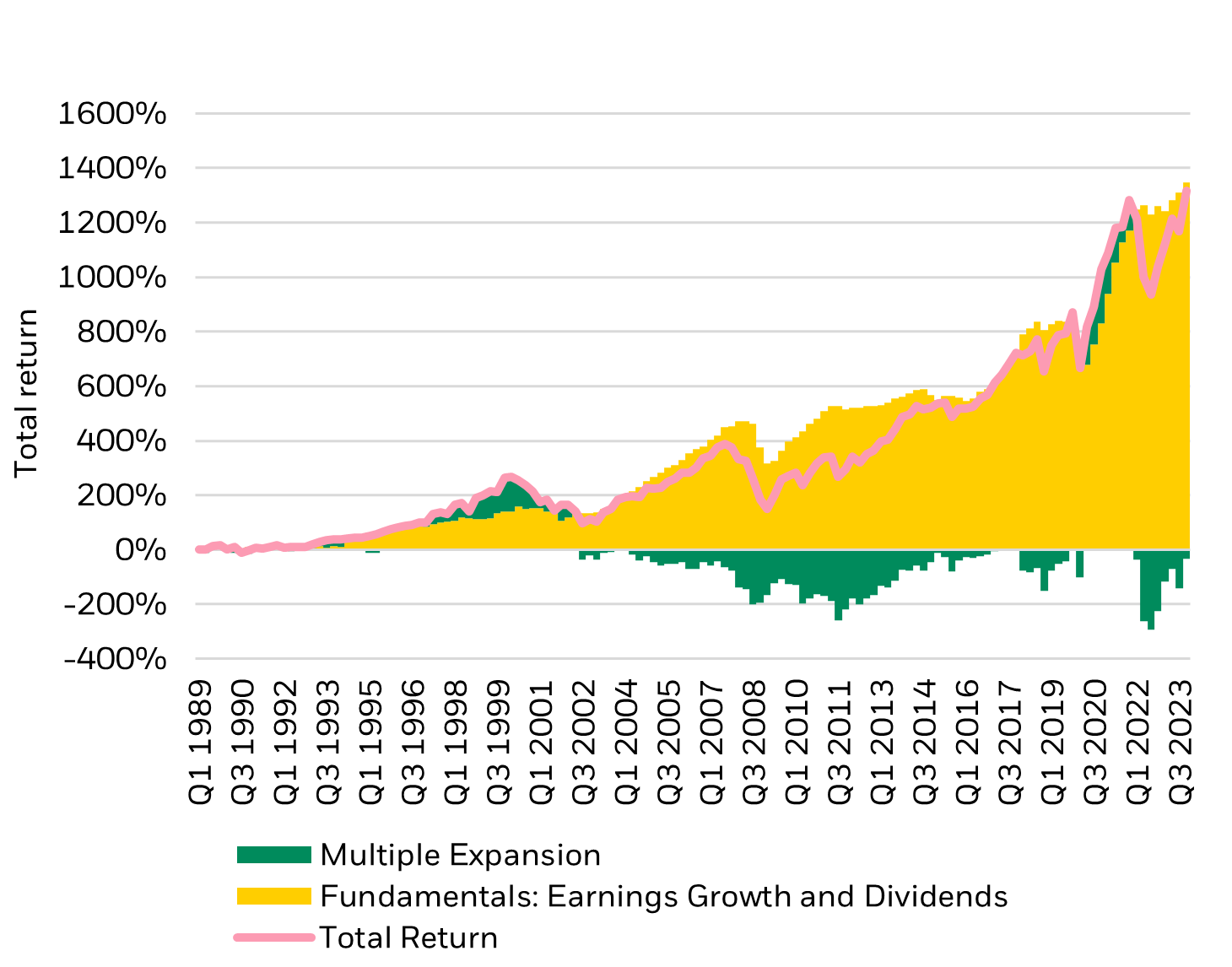

Secondly, we focus on fundamentals and not short-term volatility. The chart below shows the Total Return of the MSCI World since 1989, decomposed into fundamental drivers (yellow), and valuation changes (green). It is clear that what really drives the market over the long-term are the fundamentals of constituent companies, and not valuation changes, which are driven by macro and sentiment, and in their nature, ephemeral and mean-reverting.

MSCI World Index (Gross) Sources of Total Return

Source: BlackRock Investment Institute and Refinitiv Datastream, 31 December 2023.

Finally, we take a long-term view – here we focus on a small number of companies that we call long-term compounders. These companies are proven winners with strong, existing cash flows and the ability to reinvest those cash flows over time. Because the market is short-term by nature, these long-term compounders are often undervalued and provide a significant opportunity to generate alpha – we believe this is the largest arbitrage in the market available to long-only equity investors.

Taking a long-term approach in a public equity context, where everything is marked to market on a daily basis can be challenging. Over 2024 so far, for example, we’ve seen fluctuating expectations around economic growth, interest rates and whether central banks would be able to tame inflation without bringing about a global recession.

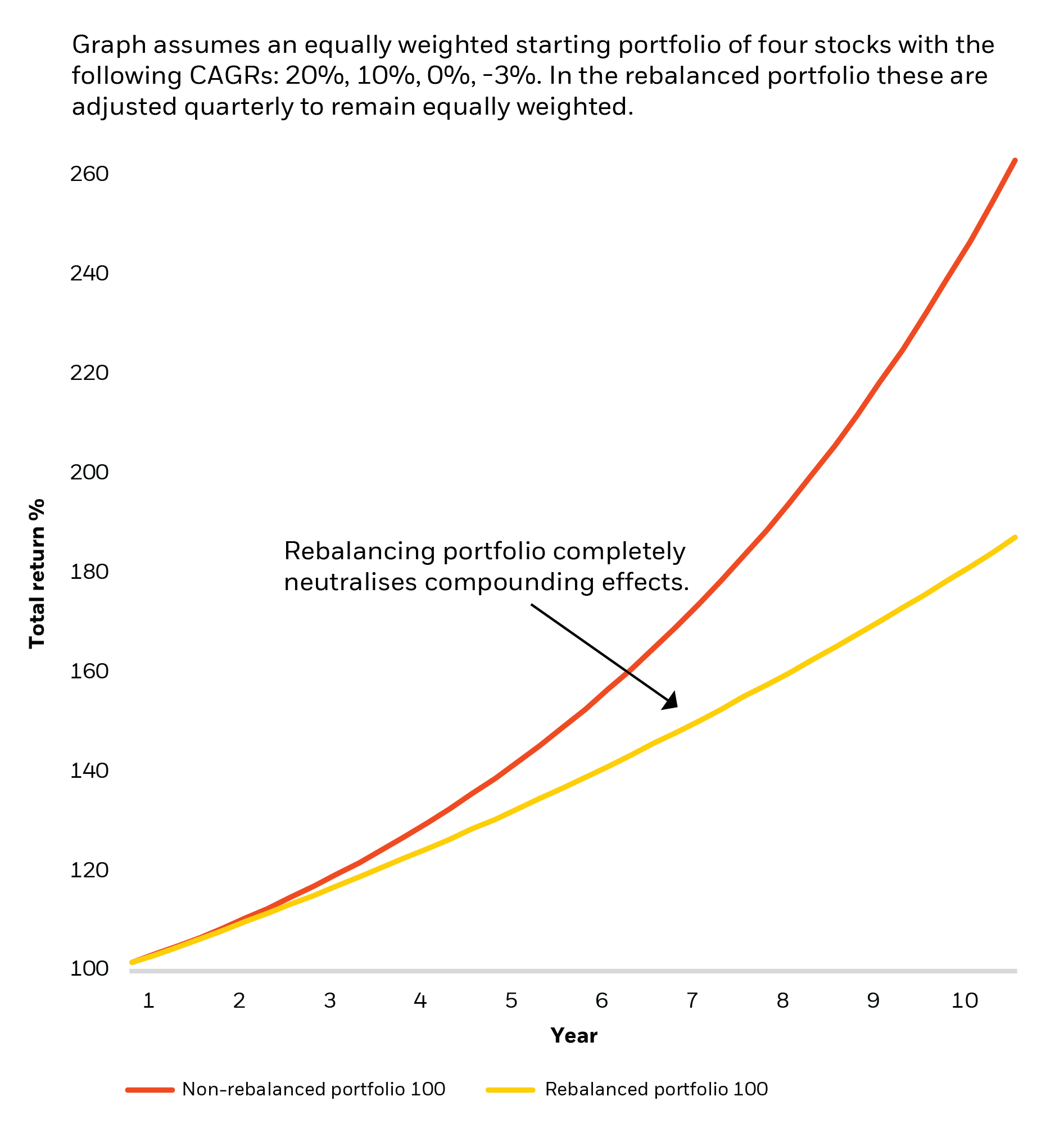

This has led to increasing volatility. As long-term investors, however, we try look through cycles of volatility and keep portfolio turnover as low as possible, only divesting based on long-term structural trends – trading in times like these can lead to whipsaw risk, and disrupts the compounding effect of our approach (see chart below).

Systematic rebalancing can hinder portfolio performance

Source: BlackRock 30 June 2024. For illustrative purposes only and subject to change.

How does this work in practice?

Let’s look at one of the top three holdings in the fund, ASML. BlackRock’s unconstrained equity strategy has a 10% weighting to this stock, versus 0.5% in the MSCI World Index and 3.1% in Europe’s Stoxx 600 Index.

We believe ASML is a strong example of a ‘proven winner’ in its field, as the largest supplier of photolithography systems for the semiconductor industry and the only company producing extreme ultraviolet lithography (EUV) machines that allow the printing of microscopic chips. Structurally, as devices increasingly require smaller chips to store more memory, the company’s monopoly status in the technology sector is expected to grow.*

ASML’s net cash balance sheet, and history of reinvestment in research and acquisitions, also gives us confidence of the compounding effect in this stock. According to company data, ASML has spent around US$1 billion a year on average in R&D over the last 10 years.1

Looking at ASML’s historic ability to compound its earnings over time also provides a compelling picture. Back in 1999, the stock was trading at 44.6 times earnings, which many investors at the time would have considered overvalued. However, the actual P/E ratio ASML would need to have been trading at in 1999 to generate a market-level return for investors by the present day was 921.9 times earnings.2

The semiconductor cycle is certainly volatile based on order patterns and waves of investment from the major technology companies – for instance, we expect 2025 to be a positive year for ASML while 2026 may be negative as companies digest the previous year’s investment. However if we look past these short-term macro trends, we’re confident in the 10-20 year outlook for the stock, which occupies the leading position in arguably the world’s most important industry.

Core vs satellite

We’ve seen investors use an unconstrained equity strategy in their portfolio in a number of ways. For those who do have a longer time horizon, with more discretion in what they can allocate to, it may make sense to make this strategy part of their core developed market equity holdings. Others who may be more risk averse can add it as a satellite strategy to generate additional alpha on top of a core, index-based equity allocation.

Of course, as a highly concentrated style of investing, there are no doubt risks for investors to be aware of, as well as the strategy’s overall suitability for investors with long time horizons and high levels of risk tolerance. For those interested in a different approach to the norm, and exposure to businesses with the ability to generate excess returns over the long term, we believe unconstrained investing may be worth considering as part of a resilient portfolio.