Interest rates are at a stalemate, but there’s no time to yield

Last month’s shock jump in inflation figures forced the RBA to walk back its dovish stance from earlier in 2024. With interest rates stuck in an extended “pause”, BlackRock’s Head of Australia Fixed Income, Craig Vardy, explains why you should consider moving to fixed interest and how you can use bond ETFs to position your portfolio ahead of the next stage of the economic cycle.

Key takeaways

-

01

While the risk of additional interest rate hikes is rising, we see the RBA maintaining an extended “neutral” stance on monetary policy, with a soft landing for the Australian economy being the base case

-

02

With strong returns expected from fixed interest in the lead-up to and immediately after rate cuts, this pause period represents an opportunity for investors to move back into fixed interest

-

03

Given the breadth of ETF options now available that capture specific segments of the bond market, you can use fixed income exposures to position your portfolio for each possible RBA interest rate scenario

Inflation backs the RBA into a corner

Markets were thrown off course in late June when monthly CPI figures came in ahead of market expectations, rising to 4% for the 12 months to May. The second consecutive hotter than expected CPI print signalled that the cash rate was more at risk of rising than falling. Unlike the Bank of Canada and the European Central Bank, which have recently cut rates as inflation falls within their respective target bands, Australia’s underlying inflation has accelerated since the end of 2023.

Given the shortcomings of monthly CPI data in providing a full picture around inflation, we believe a further trigger from the next quarterly CPI figures is needed to convince the RBA to raise rates at its August meeting. The labour market shows mixed signals with employment growth and signs of weakening. Consumer sentiment remains low, and modest GDP growth is supported by government relief measures.

We believe a ‘high for longer’ scenario is more likely, with the RBA maintaining the current cash rate for an extended period. When the easing cycle commences, it will be gradual and shallow.

You can read more of our thoughts on where the economy is headed in the full Q3 Economic, Credit and Currency Outlook.

What this could mean for portfolios?

Despite the RBA’s current struggles with ‘sticky’ inflation, inflation is on a normalising path in the long-term. Policy loosening is not a question of “if” but “when”. While the rising rate environment of the last two years may have rewarded investors for holding cash, we believe now may be the time to consider moving out of cash as elevated cash rates may ultimately be coming to an end.

With strong returns expected from fixed interest in the lead-up to and immediately after rate cuts, this pause period represents an opportunity for investors to consider to move back into fixed interest to position for the next phase of the economic cycle.

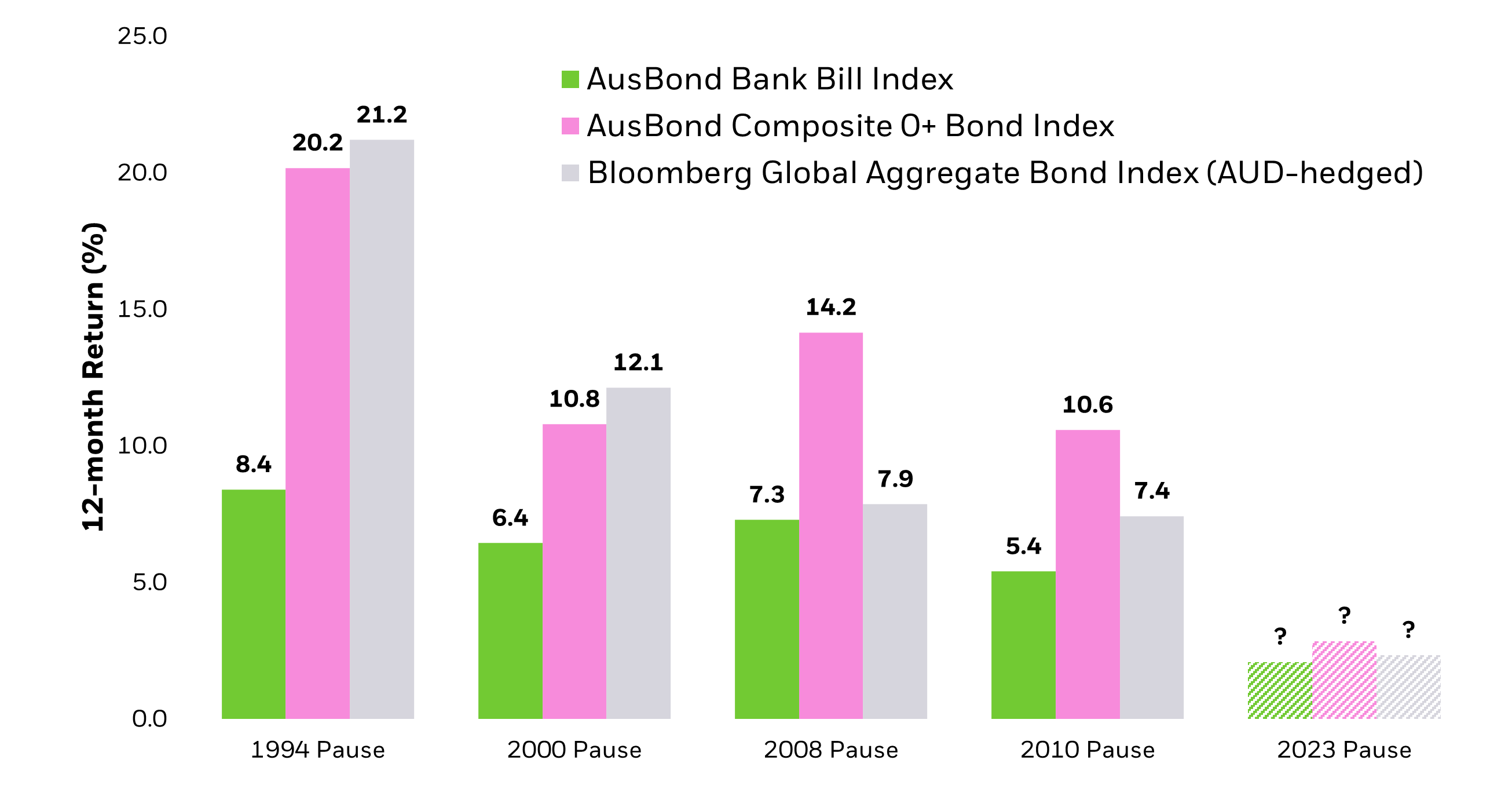

Historically, longer term bond yields have moved ahead of monetary policy shifts, as shown in our latest paper No Time to Yield, so investors who are not forward looking could miss this opportunity. Bonds have tended to perform well in similar interest rate “pause” periods to the one we are facing now, as you can see in the chart below.

Figure 1: Bonds have historically delivered strong performance during the ‟hold” period. Bonds vs. cash 12-month returns (%) after last rate hike of each RBA hiking cycle.

Feeling FOMO? Bond ETFs can help

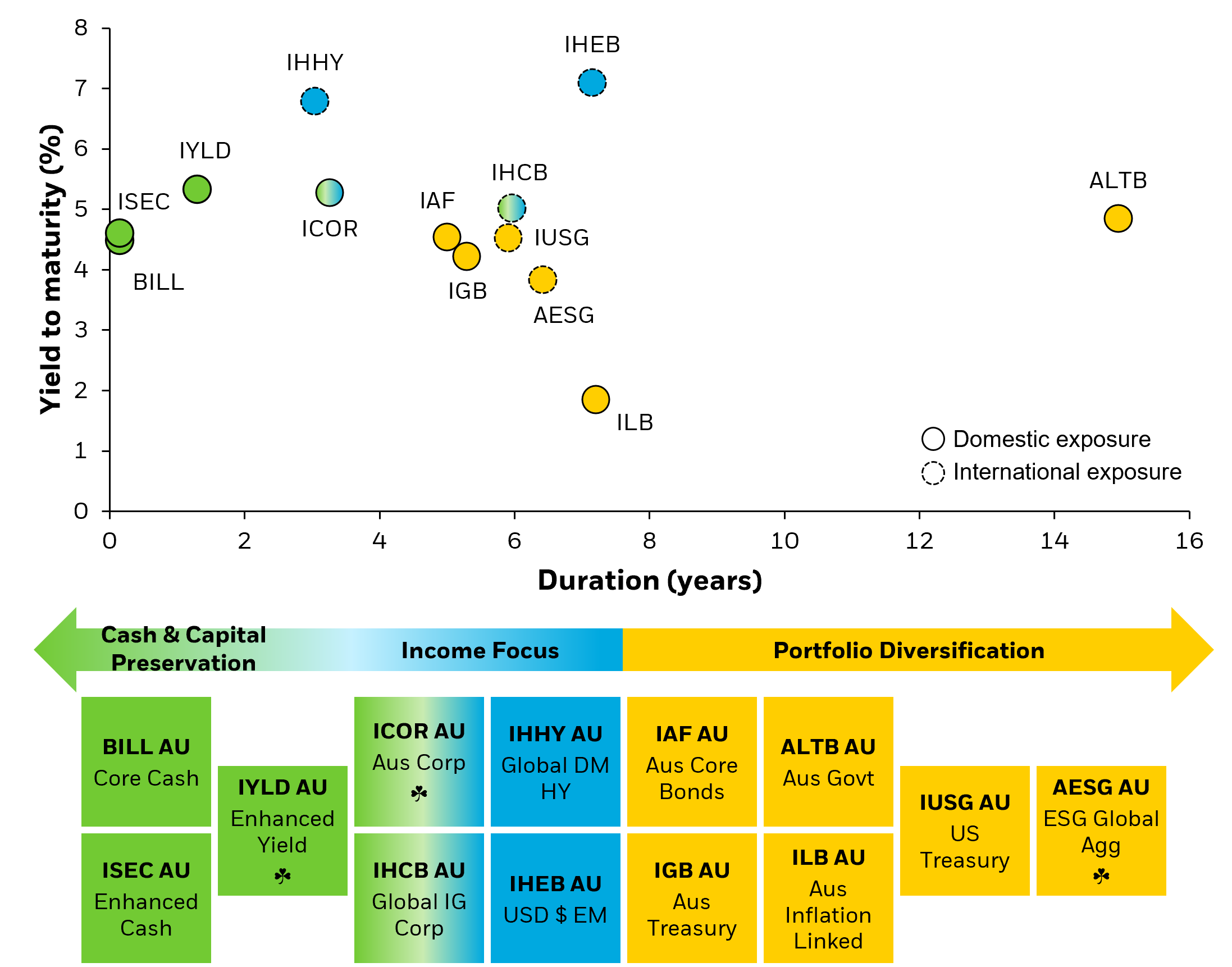

While cost and access have been a problem in years past for investors looking to increase their fixed income allocations, bond ETFs have revolutionised the way investors access fixed interest exposure. Investors may now buy and sell portfolios of thousands of bonds through ETFs with a single click, with exposures running the gamut of liquid sovereigns to emerging markets across duration, sector, and credit quality. The breadth of iShares bond ETF toolkit provides flexibility to suit a range of income/return risk profile (Figure 2).

Figure 2: Bond ETFs offer increasingly greater flexibility for investors.

Bond ETFs in action: Positioning for interest rate uncertainty

So how can we use bond ETFs to step out of cash? Depending on your views of where interest rates are heading, a number of strategies could be worth considering. To read more on why we believe now is the time to step out of cash with these ETFs, access the full No Time to Yield paper here.

Implementing ETFs in your portfolio

Scenario 1: More rate hikes

In this scenario where inflation persists at a high level, the RBA may have to hike the cash rate.

Funds to consider: iShares Core Cash ETF, iShares Enhanced Cash ETF

Scenario 2: Extended pause

The status quo continues in this scenario, and the RBA keeps the cash rate unchanged for longer.

Funds to consider: iShares Yield Plus ETF

Scenario 3: Soft landing

In this ‘goldilocks’ scenario, inflation continues to fall and the RBA starts to gradually cut the cash rate.

Funds to consider: iShares Core Corporate Bond ETF, iShares Global High Yield Bond (AUD Hedged) ETF

Scenario 4: Recession fears grow

In this hard landing scenario, both growth and inflation falls, leading to a sudden decrease in the cash rate.

Funds to consider: iShares Treasury ETF, iShares US Treasury Bond (AUD Hedged) ETF, or long duration exposures such as the iShares 15+ Year Australian Government Bond ETF that can increase duration contribution in portfolios for the least amount of capital.