Investors flocked to emerging markets ex China exposures early in the year, but the stimulus-fuelled rebound in China’s equity market has seen tides begin to turn. With macro drivers still affecting China and other emerging markets in different ways, we outline why segmenting the two exposures may make sense long term.

Key takeaways

-

01

China’s surprise announcement of a new stimulus package drove a rebound in Chinese equities in late September, though the market has given back some gains in recent weeks.

-

02

While some investors are moving to close underweight positions in Chinese equities, long-term challenges remain for China’s economy, versus structural tailwinds for other emerging markets.

-

03

Investors can use a combination of EM ex China and Chinese equity exposures to implement tactical and strategic views on the two regions, with EM ex China potentially the more preferential play in the long term.

For most of this year, as China faced into a number of structural headwinds to economic growth, emerging markets (EM) ex China trades have been growing in popularity. In the US, iShares’ EM ex China exposure had taken in more than US$5 billion year to date by mid-August 2024, making it the most popular EM ETF by inflows in the world this year.1

However, the Chinese government’s surprise announcement of a comprehensive economic stimulus package in late September had a dramatic effect on market dynamics in the short term. Reversing a more than 6% year-to-date decline to 23 September, the CSI 300 Index has now shot up over 14% since the government first flagged the stimulus.2

At the same time, China A Shares ETFs saw almost US$16 billion average global ETF weekly inflows in the three weeks following the announcement – almost 8 times the average weekly inflow amount prior to 23 September – before returning to outflow territory in mid-October as a lack of further detail on the stimulus package dampened investor sentiment.3

While the policy signal from China has no doubt been effective in providing a short term boost to Chinese equity market sentiment, a question mark still hangs over whether the scale of government stimulus will be sufficient to address the nation’s long-term economic challenges. The short-term tactical opportunity offered by China’s equity market, versus the longer-term structural tailwinds driving other EMs, are in our view a strong illustration of why segmenting the two exposures makes sense.

China: Short-term surprise

Looking at investor flows to Chinese equities since the government stimulus announcement in late September, we can see these have chiefly come from domestic investors. According to China’s National Bureau of Statistics, turnover of Chinese equities more than doubled in the last week of September, while the outstanding balance of margin trades among Chinese investors surged around 7% on the day of the announcement.4

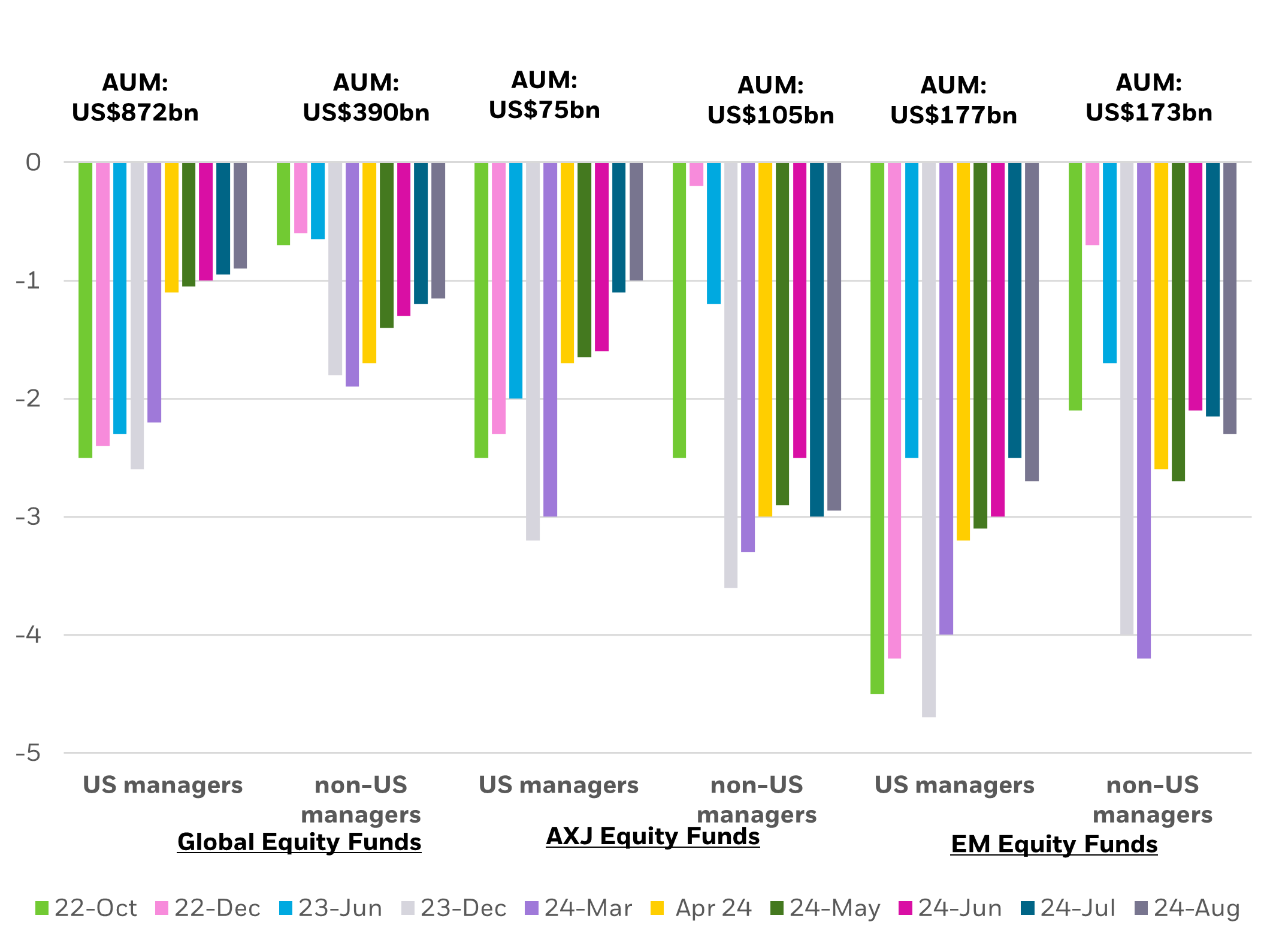

Those flows we have seen from foreign investors since the stimulus news appear to have been focused on balancing existing emerging market allocations rather than new money into Chinese equities. As China ETF flows surged on the back of the announcement, Indian exposures saw outflows of around US$6 billion. This makes sense given the persistent underweights to China we’ve seen from professional investors in recent years as the Chinese economy faced challenges post-COVID (see chart below).

China underweight positions

Top 30 global mutual funds by category

Source: Morningstar, Factset, EPFR. Notes: Data as of end-August 24. Fund universe of each category is formed by the largest 30 active mutual funds under Morningstar regional category. All the covered funds are benchmarking to either MSCI or FTSE standard regional indices of All Country World, Asia ex-Japan or Emerging Markets.

Outside of this short-term surge, the long-term headwinds for China still remain – namely persistent deflation in the domestic economy, declining home prices due to a national oversupply of residential properties, an ageing population and the long-term geopolitical and economic competition with the West.

India: Asia’s growth engine

On the other hand, India’s long-term macro outlook appears much stronger, with the nation set to overtake China by 2030 in terms of the percentage of population that’s working age. Following the re-election of the pro-reformist Modi government in mid-2024, albeit with a minority of seats, investor sentiment towards India has remained positive – Indian equities funds pulled in a record US$18.3 billion net global inflows in the first half of this year.5

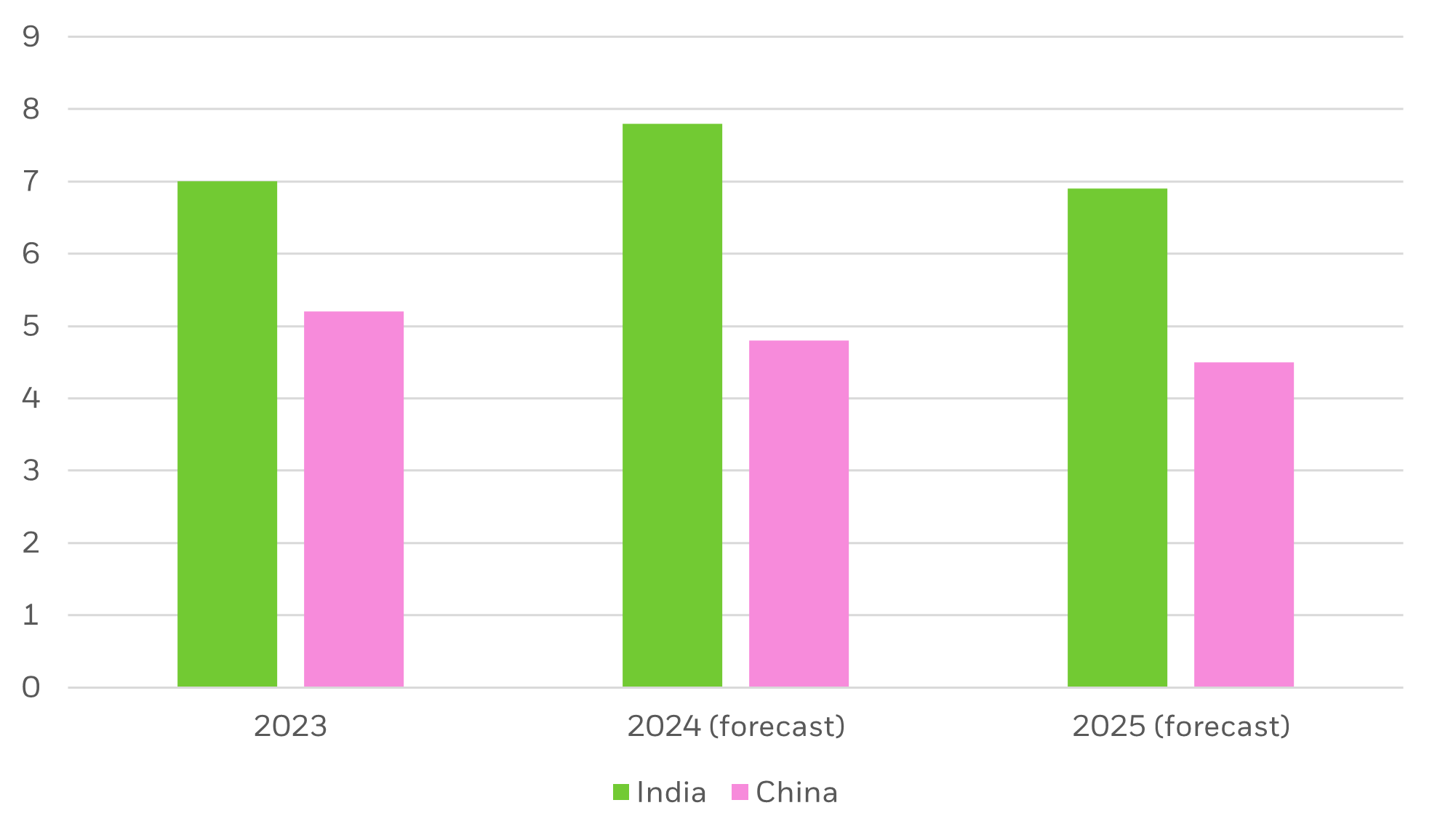

Real annual GDP (%) - India vs China

Source: Bloomberg, 29 October 2024. Forecasts may not come to pass.

While the economy has battled some inflationary pressures this year, India remains one of the world’s fastest growing large economies, with expected GDP growth of 7-7.2% in FY25.6 It’s also projected to be a net beneficiary of supply chain diversification and rewiring, with India’s exports hitting a record high in Q2 20247 and tech giants such as Apple ramping up production in the region to decrease reliance on China.8

Taiwan and South Korea: Tech transformation

The AI theme that has driven much of positive market sentiment this year shows few signs of slowing down, and we expect investment to continue flowing into sectors and regions that are a beneficiary of this trend in the years ahead, particularly those that play crucial roles in the technology supply chain. Broadly, the EMXC index has around a 21% weighting to the semiconductor industry9, which has seen the largest total returns across the technology sector in the past two years.10

Looking at the economic make-up of two key geographic weightings in the MSCI Emerging Markets ex China Index – Taiwan and South Korea – we can see they derive around 13.8% and 3.4% respectively of national GDP from technology, compared to around 1.4% for China.11 The two nations are also home to the index’s two largest individual stock holdings, TSMC – the world’s largest semiconductor chipmaker12 – and Samsung, which is responsible for almost 1 in every 3 smart TV sales globally.13

Bringing it all together: EM for the long-term

By adopting a segmented approach to EM and China allocations, investors are better able to factor in all of these different macro forces by under or overweighting each exposure based on their views. For example, based on what we’ve observed around investor flows this year, many may have chosen to ‘underweight’ China versus EM ex China prior to the stimulus announcement.

As the stimulus news provides a catalyst for investors to jump back into Chinese equity markets, some may choose to move back to a more neutral, or tactically overweight position on China, while keeping their EM ex China position as a longer-term strategic allocation. With further details on China’s stimulus package expected in the coming weeks, and the US election results also coming into play, keeping the two exposures separate allows investors the flexibility and selectivity to best position their portfolios as markets evolve.