Women, Wealth and Wellbeing

Women in Australia are gaining power

Women in Australia are building their wealth and power. Research reveals ongoing progress in enhancing the social standing of women when compared with male counterparts.

Souces: JBWere Women and Wealth Report March 2024, Australian Institute of Company Directors March 2024, Australian Financial Review January 2024

Women are acquiring more wealth than ever before

As women wield more financial power, more knowledge is needed to make educated financial choices. However, women have historically been underrepresented in the wealth industry – now there is a greater demand and focus on helping women feel confident with their financial decisions.

Women still face ongoing challenges

So clearly, women have come a very long way. But it is no secret that they still face a lot of challenges.

They earn 88 cents per dollar a man earns3

Women are still paid less. This accumulates over the course of a woman’s life. And although men make more than women, oddly enough more than two thirds of women are their household’s primary financial decisionmakers.4

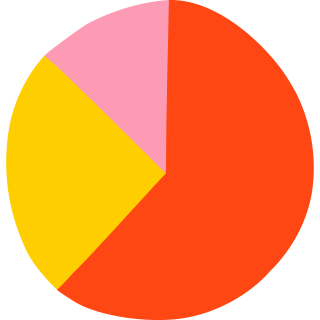

Women are typically conservative investors

More than 40% of high net worth women describe their investment style as conservative, and say they struggle most with current investment market knowledge – although they are more confident with the basics of finance, such as risk and return trade-offs.5

Only 1 in four Australian CEOs are women6

In Australia, there remains a lack of women in leadership and senior positions. Women are also more likely to make tradeoffs for family, such as career breaks.

Wealth means something different to everyone

“Wealth" means a lot of different things to different people; for some it means being in a state to have choices, for others, wealth brings to mind images of travel, security, independence, or health. What does it mean to you? Your clients?

Our mission is to help them think about a few considerations when putting a plan in place, while honouring the fact that each one of us has a unique life journey, unique relationship with money and investing.

We want to make sure that we’re setting up the plan to help them reach their future goals.

How can you help your clients?

Define goals and investment profile

Ask what's important

Everyone’s goals are different. Work together with your client to better understand her goals and establish trust.

Align to a portfolio

Once you know her goals, work together to create an investment roadmap to stay aligned in the long run.

Ensure she's invested

Start with asset allocation

Many women are un- or underinvested. Discuss the roles of the different investments in her portfolio and how the portfolio aligns to why she is investing.

Consider investing with purpose

Sustainable investing is about investing in better ways of doing business. It recognizes that companies solving the world’s challenges may be best positioned for growth.

Supporting a better retirement should start with well-being