Australians are known for their love of globetrotting and being adventurous travellers. But, at times, the same can't always be said when it comes to our investing behaviour.

Historically, Australian investors have had a strong preference to invest in Australian-listed securities because the ASX tends to be dominated by dividend-paying companies. They provide investors with a source of regular income and the potential for long-term growth.

A key behavioural explanation for this so-called ‘home bias’ is the familiarity with home-grown companies and brands and the perceived risk associated with investing abroad. Additionally, uncertainty around currency exposure and the tax benefits of fully franked dividend imputation credits play a role in the hesitation to invest beyond our own backyard.

Most investors also don’t have the time or resources to sift through global stock markets to pick specific companies to invest in that suit their risk and return objectives. Furthermore, managing currency exposures is another potential factor to consider when investing in international securities.

This Aussie home bias is reflected in the 2023 ASX Australian Investor Study, which found 58% of Australian investors owned domestic shares directly, down from 60% in 20201. Only 16% held international shares - up just one percentage point from three years earlier.

While this phenomenon is not unique to Australian investors, it is worth looking at global exposures to realise diversification benefits. According to S&P Dow Jones, the Australian market only represents around 2% of the global equity market2. With that context, the Australian portion of the global public market is a relatively small pond to be fishing in when it comes to return opportunities, and has sector concentrations towards banking and materials.

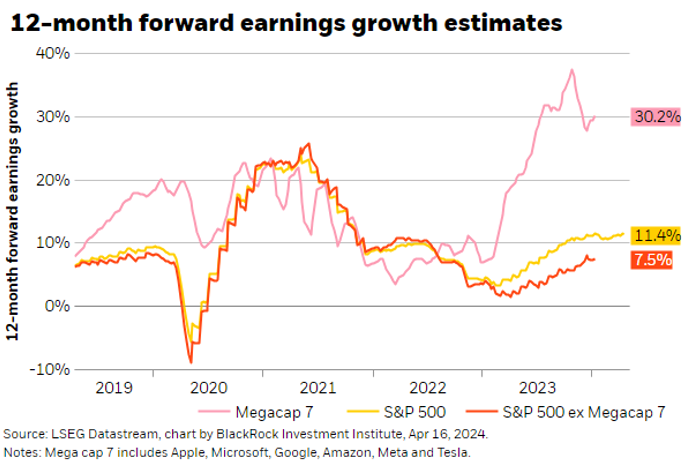

As a result, Australian portfolios are likely missing out on investing in the likes of Nvidia, Amazon, Microsoft, Apple and Meta. ‘Mega-cap’ tech stocks such as these have powered global returns in recent years (see chart below) and make up key constituents of the US S&P 500 index.

Following the release of its 2024 results in February when its stock price hit all-time highs, Nvidia’s market cap technically reached a level higher than the GDP of all but 11 countries in the world.3 This is just one example of the long-term earnings growth Australian investors may potentially be missing out on by choosing to invest in purely home-grown names.

Figure 1: How the ‘Mega-cap 7’ stocks are powering equity market returns

Global investing made easy

Global equity ETFs represent a simple, efficient way for investors to gain access to growth opportunities in overseas markets, as well as reducing concentration risk with broader exposure to assets across sectors and regions. This is increasingly being noted by investors - according to the ASX study, ETF adoption jumped from 15% to 20% among Australian investors last year, and diversification was one of the key investment priorities mentioned by ETF investors.4

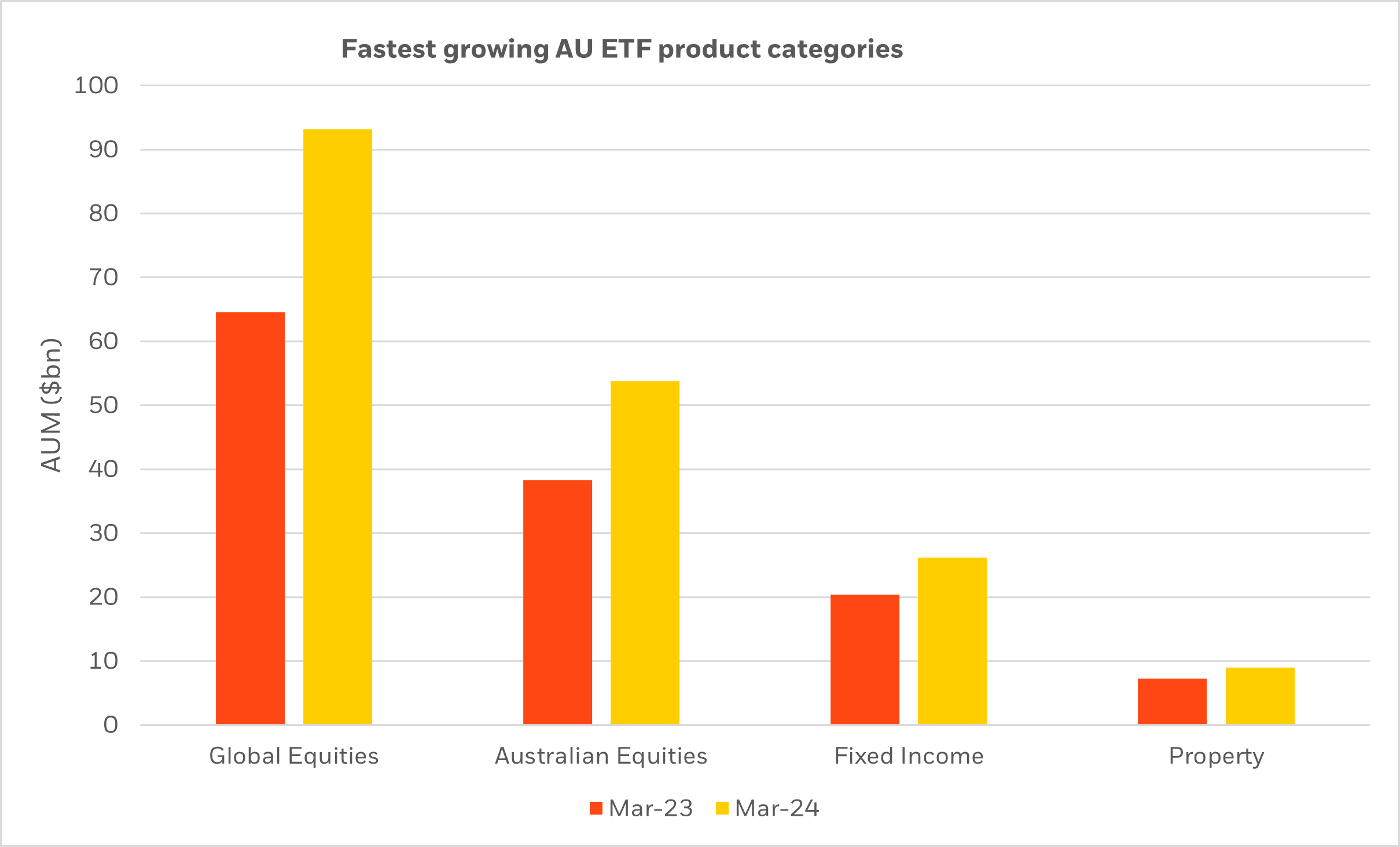

At the same time, global equity exchange traded products were the fastest growing product category on the ASX in the year to March 2024, recording a 44% year-on-year growth rate in assets under management to more than $90 billion5 (see figure 2). Investment Trends data also reveals that of the 1.7 million Australians planning to invest or reinvest in ETFs this year, almost half cited access to overseas markets as a key motivator.6

It’s clear that local investors are increasingly realising the benefits that ETFs provide when it comes to accessing global markets. ETFs can play an important role in broadening out the choice available to investors, by enabling easy access to potentially hundreds of international stocks through a single trade on the local exchange.

In some cases, global exposures also have a currency hedged version, providing Australian investors with a valuable tool for their global investing journey – one that may come in handy given the Aussie dollar is currently trading below its long-run US dollar exchange rate.

Figure 2: Global exposures are a popular choice with Aussie ETF investors

Source: ASX data as at 18 April 2024

When we reflect on the growth of markets over the years including increasingly higher ETF adoption rates, the cost-efficiency of ETFs as an investment vehicle has also played a role in their fast adoption. With over 300 exchange traded products now available on the ASX7, increasing competition means Australians have been able to access these global exposures at a fraction of the cost of yesteryears.

The future of the ETF market

While there is a lot to celebrate in terms of the exponential growth we’ve seen in the Australian ETF market, we believe there is more room to grow to close the gap to other developed markets. In March 2024, Australia crossed $190 billion in ETF AUM, but this still represents just a fraction of the more than US$12 trillion invested in ETFs globally.8 To put this into perspective, Australian listed ETFs make up only 7% of the Australian share market. In comparison, in the United States, ETFs make up approximately 14% of the market; in Europe, ETFs account for approximately 9%.9

As the first ETF provider to offer global equity ETFs on the ASX, BlackRock’s iShares product suite includes over 20 global exposures spanning developed markets, emerging markets, sectors such as real estate, tech, healthcare, as well as style factor ETFs such as quality, value and momentum. The range also includes seven currency hedged global equities exposures.

We believe that this accessible, transparent and comprehensive range of ETFs is a compelling proposition for Australian investors who wish to broaden their sights and diversify and indeed complement their Australian portfolio.