Expected Return Analyzer

Help bridge the gap in client portfolios

With uncertainty about rates, high stock market volatility and inflation, you may need to think beyond traditional 60/40 allocations. BlackRock’s Expected Return Analyzer lets you test your current portfolio against forward-looking projections and may help you identify ways to narrow the gap between your goals and your current allocation.

3 ways financial professionals use alternatives

Image Cta-2

Image-1

Image-2

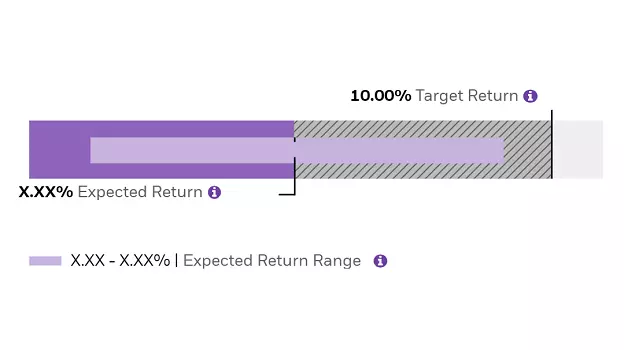

Is your portfolio meeting expectations?

Delivering on your clients’ goals is critical to your success. The Expected Return Analyzer identifies how your portfolio stacks up against your targeted return and highlights potential gaps. Learn more about how exposures to alternatives can help narrow the gap to achieve better outcomes or analyze your existing alternative allocations.

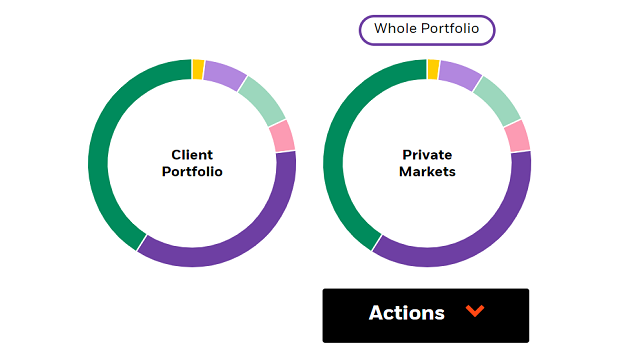

What type of alternatives can help?

For illustrative purposes only.

There’s more than one way to address a potential gap between expected and target returns. This tool offers insights that can help you:

- Explore illustrative portfolios, including exposures to alternatives, that can help achieve your goals.

- Easily review different allocations to evaluate the impact of alternatives on your portfolios.

- Explore a simple framework for selecting alternatives, including private markets.

Highlight your value to clients by using alternatives

For illustrative purposes only.

Have more meaningful conversations with your clients by showing the potential impact of alternatives in their portfolios. You can easily generate client-friendly reports of your analysis in 360° Evaluator that will differentiate your practice from other financial professionals and help educate clients on the benefits of private markets.