9.45%

Distribution rate3

$8.44

NAV per share

$667

AUM (mm)

Source: BlackRock as of 02/28/2025 unless otherwise noted. Effective March 3, 2025, the CREDX Board approved a decrease to the fixed daily distribution rate per share on Institutional Shares to an 8.50% annualized yield based on a $8.59 NAV, the average daily NAV over the 3-month period ended December 31, 2024 (with an adjustment for other share classes based on share class expenses).

Navigating greater uncertainty

We believe more dispersion is ahead and that credit selection will grow in importance and drive

more differentiated outcomes. Taking advantage of opportunities across the credit spectrum, in our

view, creates more significant investment opportunities.

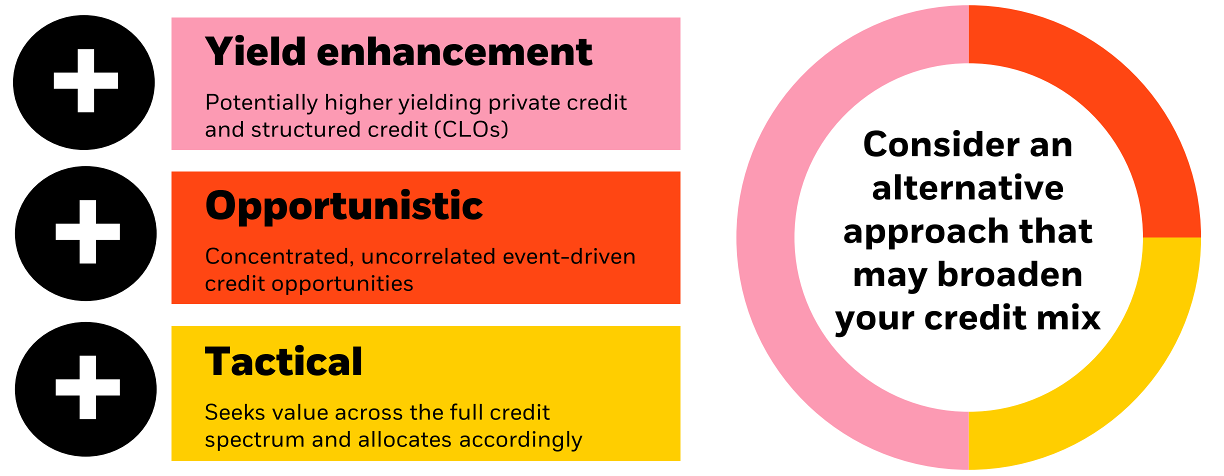

Credit portfolios are evolving

An alternative approach invested across the credit spectrum may help manage the effects of asset class volatility, while potentially enhancing overall yield and returns versus traditional fixed income funds. CREDX investments generally fall into three strategies that work together to potentially optimize income and return.

Explore our alternative fund suite

Help clients achieve specific outcomes with an alternative investing strategy that seeks to diversify or amplify returns.