Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

MAXJ

iShares Large Cap Max Buffer Jun ETF ACTIVE

-

Fees as stated in the prospectus

Expense Ratio: 0.53%

Net Expense Ratio: 0.50%

Overview

Performance

Performance

Growth of Hypothetical $10,000

Performance chart data not available for display.

Distributions

Premium/Discount

-

Returns

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | - | - | - | - | - |

| Market Price (%) | - | - | - | - | - |

| Benchmark (%) | - | - | - | - | - |

| After Tax Pre-Liq. (%) | - | - | - | - | - |

| After Tax Post-Liq. (%) | - | - | - | - | - |

Performance data is not currently available

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | -1.13 | -2.44 | -1.13 | 0.27 | - | - | - | - | 4.07 |

| Market Price (%) | -1.34 | -2.24 | -1.34 | 0.03 | - | - | - | - | 3.99 |

| Benchmark (%) | -4.27 | -5.63 | -4.27 | -1.97 | - | - | - | - | 3.80 |

| After Tax Pre-Liq. (%) | -1.13 | -2.44 | -1.13 | -0.04 | - | - | - | - | 3.75 |

| After Tax Post-Liq. (%) | -0.67 | -1.45 | -0.67 | 0.18 | - | - | - | - | 2.43 |

Performance data is not currently available

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | - | - | - | - | - |

| Market Price (%) | - | - | - | - | - |

| Benchmark (%) | - | - | - | - | - |

Performance data is not currently available

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted.

Performance shown reflects fee waivers and/or expense reimbursements by the investment advisor to the fund for some or all of the periods shown. Performance would have been lower without such waivers.

Key Facts

Key Facts

Net Assets of Fund

as of Jun 06, 2025

$109,863,940

Exchange

Cboe BZX

Benchmark Index

S&P 500 Index (USD)

Distribution Frequency

Annual

CUSIP

46438G612

30 Day Avg. Volume

as of Jun 06, 2025

20,862.00

Daily Volume

as of Jun 06, 2025

5,591.00

Fund Launch Date

Jun 28, 2024

Asset Class

Equity

Shares Outstanding

as of Jun 06, 2025

4,080,000

Premium/Discount

as of Jun 06, 2025

-0.02%

Closing Price

as of Jun 06, 2025

26.92

30 Day Median Bid/Ask Spread

as of Jun 06, 2025

0.11%

Strategy Characteristics

Strategy Characteristics

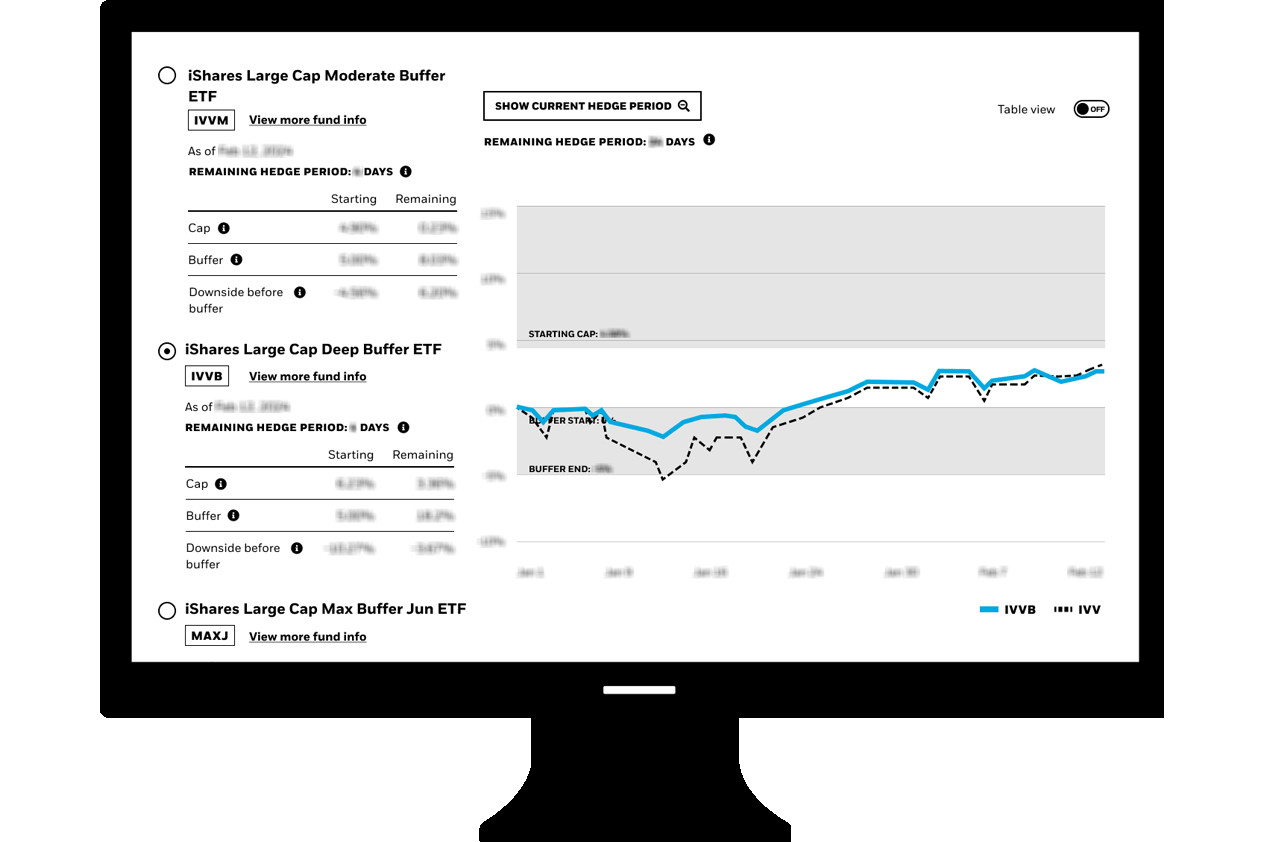

The Fund employs an options strategy that seeks to track the price return of the iShares Core S&P 500 ETF (“the Underlying ETF” or the “Reference Asset”) while providing an approximate downside buffer (the “Buffer”) in exchange for an approximate cap (the “Cap”) on upside potential. The Buffer may help reduce volatility and mitigate the effects of a decline in the value of the Fund to a set range of potential losses for investors who hold Fund shares over the entire Hedge Period. The table below provides an indication of the Buffer and Cap levels as of the previous day’s market close.

| Starting Payoff Values | |

|---|---|

|

Starting Cap

|

10.64% |

|

Starting Buffer

|

99.50% |

|

Starting Downside Before Buffer

|

-0.50% |

|

Hedge Period Start Date

|

Jul 01, 2024 |

|

Hedge Period End Date

|

Jun 30, 2025 |

| Current Payoff Values | |

|---|---|

|

Remaining Hedge Period

as of Jun 05, 2025

|

25 Days |

|

Remaining Cap

as of Jun 05, 2025

|

2.61% |

|

Return in Reference Asset to Realize Remaining Cap

as of Jun 05, 2025

|

2.05% |

|

Remaining Buffer

as of Jun 05, 2025

|

92.27% |

|

Remaining Downside Before Buffer

as of Jun 05, 2025

|

-7.73% |

| Reference Asset Values | |

|---|---|

|

Reference Asset

|

IVV |

|

Reference Asset Value

as of Jun 05, 2025

|

$595.98 |

|

Cap Reference Asset Value

as of Jun 05, 2025

|

$608.19 |

|

Buffer Start Reference Asset Value

as of Jun 05, 2025

|

$547.23 |

|

Buffer End Reference Asset Value

as of Jun 05, 2025

|

$0.00 |

Strategy Characteristics are meant to provide investors with additional metrics on the options strategy used by the Fund. They are provided for transparency and illustrative purposes only, are not representative of a specific investment outcome and may not represent current value. The Cap and Buffer may vary from what is shown in the table above. All payoff figures, including the Buffer and Cap, are in reference to holding the Fund shares through the end of the Hedge Period and are not guaranteed. All figures shown are net of fees (as applicable).

Strategy Characteristics

Portfolio Characteristics

Portfolio Characteristics

Equity Beta (3y)

as of -

-

12m Trailing Yield

as of -

-

Unsubsidized 30-Day SEC Yield

as of Apr 30, 2025

0.92%

30 Day SEC Yield

as of Apr 30, 2025

0.92%

Standard Deviation (3y)

as of -

-

This information must be preceded or accompanied by a current prospectus. For standardized performance, please see the Performance section above.

Fees

Fees

as of current prospectus

| Management Fee | 0.50% |

| Acquired Fund Fees and Expenses | 0.03% |

| Other Expenses | 0.00% |

| Expense Ratio | 0.53% |

| Fee Waivers | 0.03% |

| Net Expense Ratio | 0.50% |

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0.00".

Ratings

Holdings

Holdings

Holdings are subject to change.

For options contracts held within the fund, the maturity date represents the expiration date of the contract.

For options contracts held within the fund, the maturity date represents the expiration date of the contract.

The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”). The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. London. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above.

Please see the “Determination of Net Asset Value” section of each Fund’s prospectus for additional information on the Fund’s valuation policies and procedures.

“Quantity” represents the number of shares, units or contracts of the corresponding security, as applicable per security type.

BUFFER COMPARISON CHART

Buffer ETFs target different levels of downside protection to help you balance risk and return potential.

Portfolio Managers

Portfolio Managers

Orlando Montalvo

Literature

Literature

Sign In / Register to access this functionality