Filter list by keyword

Show More

Show Less

to

of

Total

Sorry, no data available.

IJT

iShares S&P Small-Cap 600 Growth ETF

-

Fees as stated in the prospectus

Expense Ratio: 0.18%

Overview

Performance

Performance

Growth of Hypothetical $10,000

Performance chart data not available for display.

Distributions

Premium/Discount

-

Returns

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

|

Total Return (%)

as of Dec 31, 2024 |

9.42 | 0.27 | 8.02 | 9.33 | 8.79 |

|

Market Price (%)

as of Dec 31, 2024 |

9.34 | 0.25 | 8.02 | 9.33 | 8.78 |

|

Benchmark (%)

as of Dec 31, 2024 |

9.63 | 0.44 | 8.24 | 9.55 | 8.98 |

|

After Tax Pre-Liq. (%)

as of Dec 31, 2024 |

9.14 | 0.01 | 7.76 | 9.06 | 8.58 |

|

After Tax Post-Liq. (%)

as of Dec 31, 2024 |

5.77 | 0.17 | 6.28 | 7.60 | 7.64 |

Performance data is not currently available

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

|

Total Return (%)

as of Dec 31, 2024 |

9.42 | -9.17 | -2.66 | 6.02 | 9.42 | 0.81 | 47.05 | 144.01 | 683.07 |

|

Market Price (%)

as of Dec 31, 2024 |

9.34 | -9.25 | -2.71 | 6.07 | 9.34 | 0.75 | 47.05 | 143.91 | 682.61 |

|

Benchmark (%)

as of Dec 31, 2024 |

9.63 | -9.16 | -2.62 | 6.12 | 9.63 | 1.32 | 48.59 | 148.88 | 717.00 |

|

After Tax Pre-Liq. (%)

as of Dec 31, 2024 |

9.14 | -9.23 | -2.71 | 5.86 | 9.14 | 0.02 | 45.33 | 137.95 | 647.00 |

|

After Tax Post-Liq. (%)

as of Dec 31, 2024 |

5.77 | -5.39 | -1.53 | 3.68 | 5.77 | 0.52 | 35.59 | 107.95 | 504.63 |

Performance data is not currently available

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | 19.17 | 22.40 | -21.24 | 16.97 | 9.42 |

| Market Price (%) | 19.27 | 22.37 | -21.32 | 17.12 | 9.34 |

| Benchmark (%) | 19.60 | 22.62 | -21.08 | 17.10 | 9.63 |

Performance data is not currently available

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted.

Key Facts

Key Facts

Net Assets of Fund

as of Jan 21, 2025

$6,760,178,111

Exchange

NASDAQ

Benchmark Index

S&P SmallCap 600(R) Growth Index

Shares Outstanding

as of Jan 21, 2025

47,600,000

Premium/Discount

as of Jan 21, 2025

0.03%

Closing Price

as of Jan 21, 2025

142.07

30 Day Median Bid/Ask Spread

as of Jan 17, 2025

0.12%

Fund Launch Date

Jul 24, 2000

Asset Class

Equity

Bloomberg Index Ticker

SPTRSG

Distribution Frequency

Quarterly

CUSIP

464287887

30 Day Avg. Volume

as of Jan 17, 2025

161,943.00

Daily Volume

as of Jan 21, 2025

95,919.00

Portfolio Characteristics

Portfolio Characteristics

Number of Holdings

as of Jan 17, 2025

361

30 Day SEC Yield

as of Dec 31, 2024

0.92%

Standard Deviation (3y)

as of Dec 31, 2024

22.82%

P/B Ratio

as of Jan 17, 2025

3.10

Equity Beta (3y)

as of Dec 31, 2024

1.11

12m Trailing Yield

as of Dec 31, 2024

1.06%

P/E Ratio

as of Jan 17, 2025

21.86

This information must be preceded or accompanied by a current prospectus. For standardized performance, please see the Performance section above.

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more

This fund does not seek to follow a sustainable, impact or ESG investment strategy. The metrics do not change the fund’s investment objective or constrain the fund’s investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. For more information regarding the fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

MSCI ESG Fund Rating (AAA-CCC)

as of Dec 21, 2024

BBB

MSCI ESG Quality Score (0-10)

as of Dec 21, 2024

5.7

Fund Lipper Global Classification

as of Dec 21, 2024

Equity US Sm&Mid Cap

MSCI Weighted Average Carbon Intensity (Tons CO2E/$M SALES)

as of Dec 21, 2024

141.26

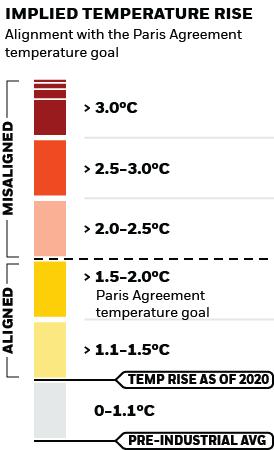

MSCI Implied Temperature Rise (0-3.0+ °C)

as of Dec 21, 2024

> 3.0° C

MSCI ESG % Coverage

as of Dec 21, 2024

93.70%

MSCI ESG Quality Score - Peer Percentile

as of Dec 21, 2024

24.36%

Funds in Peer Group

as of Dec 21, 2024

1,445

MSCI Weighted Average Carbon Intensity % Coverage

as of Dec 21, 2024

93.26%

MSCI Implied Temperature Rise % Coverage

as of Dec 21, 2024

92.70%

All data is from MSCI ESG Fund Ratings as of Dec 21, 2024, based on holdings as of Oct 31, 2024. As such, the fund’s sustainable characteristics may differ from MSCI ESG Fund Ratings from time to time.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

MSCI - Controversial Weapons

as of Jan 20, 2025

0.00%

MSCI - Nuclear Weapons

as of Jan 20, 2025

0.00%

MSCI - Civilian Firearms

as of Jan 20, 2025

0.00%

MSCI - Tobacco

as of Jan 20, 2025

0.00%

MSCI - UN Global Compact Violators

as of Jan 20, 2025

0.67%

MSCI - Thermal Coal

as of Jan 20, 2025

0.87%

MSCI - Oil Sands

as of Jan 20, 2025

0.00%

Business Involvement Coverage

as of Jan 20, 2025

98.49%

Percentage of Fund not covered

as of Jan 20, 2025

1.51%

BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.87% and for Oil Sands 0.00%.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Fees

Fees

as of current prospectus

| Management Fee | 0.18% |

| Acquired Fund Fees and Expenses | 0.00% |

| Other Expenses | 0.00% |

| Expense Ratio | 0.18% |

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0.00".

Ratings

Ratings

Holdings

Holdings

Exchange-traded index futures may be used to offset cash and receivables for the purpose of tracking the benchmark index.

Holdings are subject to change.

The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”). The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. London. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above.

Please see the “Determination of Net Asset Value” section of each Fund’s prospectus for additional information on the Fund’s valuation policies and procedures.

Notional weight (%) is based on the position’s notional value and represents the economic exposure of the position. The notional value displayed for the money market fund is indicative of the economic exposure attributed to the position (i.e., excludes the money market fund balance associated with the notional value of swaps and unsettled transactions).

Literature

Literature

Sign In / Register to access this functionality