- 7 days left

HIGH-NET-WORTH HUB

Serving the unique needs of high-net-worth clients

High-net-worth investors are a growing segment of the wealth market and present a significant opportunity for advisors. However, effectively serving the needs of these clients can be complex and time-consuming.

Explore how BlackRock can help advisors attract and retain high-net-worth clients.

POLL

/blk-one01-c-assets/documents/charts/high-net-worth-2023-chart-1.csv

bar-chart

%

column-simple

true

Wealth is concentrating up market

The clients you built your business on are not the ones who will double it moving forward, especially if you want to do so with fewer families. Clients with over $5 million now account for over 50% of investable assets in the U.S.1

Investable assets by investor net worth segments

High-net-worth portfolio management

Complex challenges require differentiated solutions. Work with BlackRock to re-think how you construct portfolios and the vehicles used inside to better meet the needs of your largest clients.

Image Cta-2,Related Content-1

Image Cta-3,Related Content-2

Image Cta-4,Related Content-3

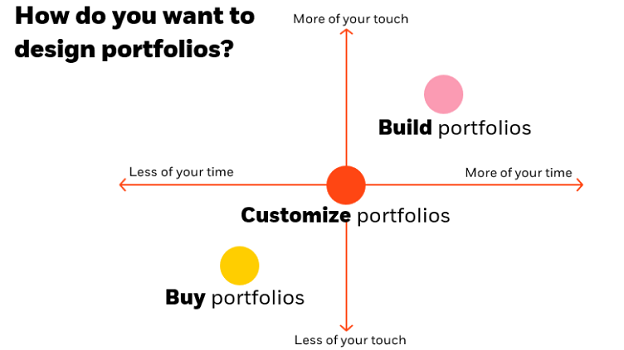

Unlock time to deliver high-net-worth portfolios your way

Whether you want to build portfolios yourself, customize portfolios with us, or buy our model portfolios off-the-shelf, BlackRock can help you design and deliver high-net-worth solutions.

Evolve your practice for high-net-worth clients

The BlackRock Business Consulting team has helped thousands of advisors, teams and firms evolve their business. Explore our advisor best practices to help scale client portfolios to open up time, expand your service offering and differentiate yourself to high-net-worth investors.

Free up time to focus on high-net-worth investors

Streamline your investment approach

38% of advisors’ time is spent on investments and administrative tasks2. Explore options, like model portfolios, to scale your investment approach for your existing clients to reclaim the time needed to provide services to and prospect for high-net-worth investors.

Offer impactful high-net-worth services

Upscale your service offering

To attract and retain high-net-worth clients, you will need to offer a robust menu of personalized services and build a team of experts who can deliver them effectively.

Segment your clients to boost growth

Align your services to client segments to use time more efficiently

Being intentional about which services you offer each client segment allows you to allocate more of your time to serving high net worth clients and improve the profitability of your business.

Showcase your offerings to clients

Ensure high-net-worth investors know what services you provide

Top advisors we work with often list all of the products, services and offerings that they or their team are capable of providing. Shared with a client, this list can help reiterate your value proposition, open up share of wallet opportunities and highlights the services you already provide.

Analyze high-net-worth portfolios with 360° Evaluator

Create more “aha” moments

Use BlackRock’s 360° Evaluator to analyze and build client portfolios, as well as generate customized reports to simplify pre-meeting prep and enhance the client experience.