iBonds ETFs pass through the underlying bonds’ income each month and pay a final distribution of all the matured bonds, at which point the ETF will delist from the exchange. The income distributions can vary as bonds are added or removed at different yield levels; however, the final payment tends to offset any changes in income. As monthly income distributions increase, final NAV payouts tend to decrease and vice versa.

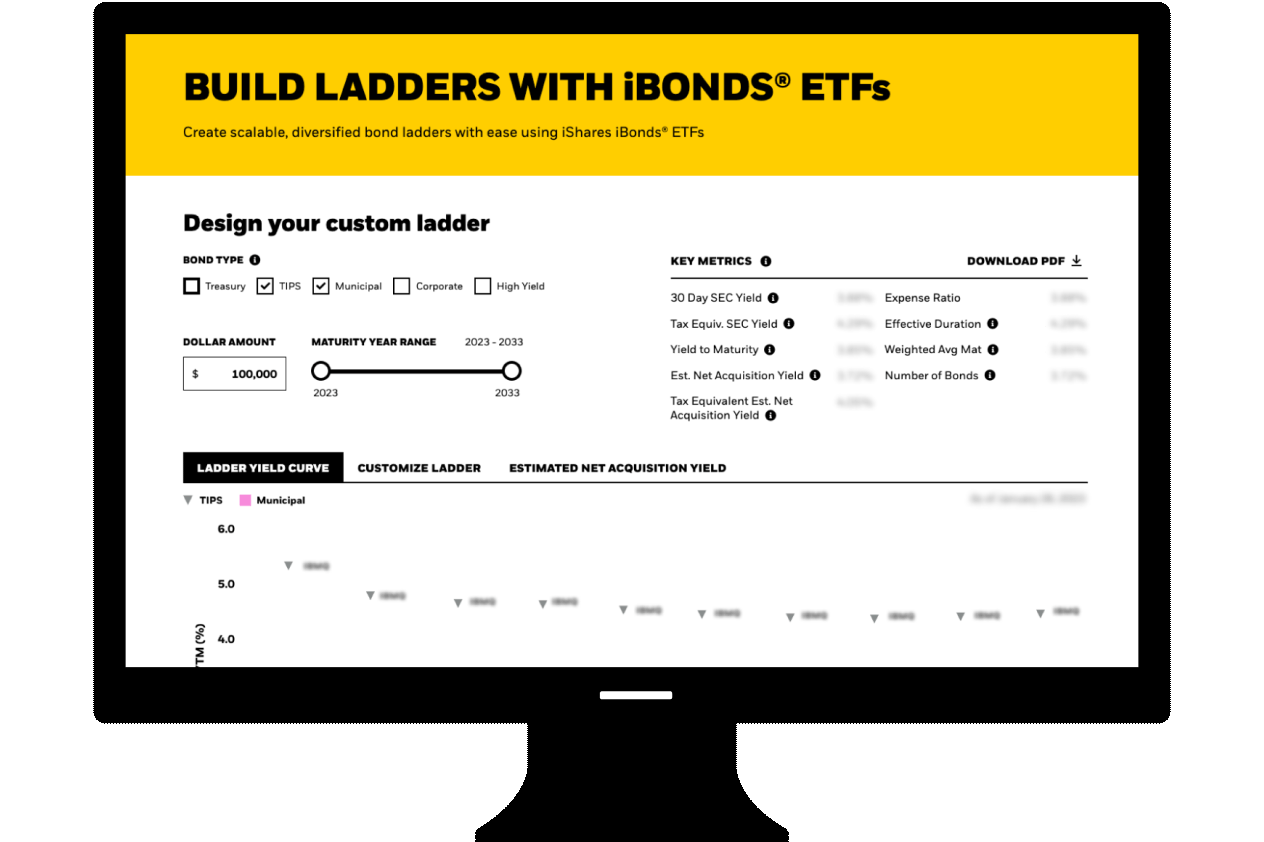

An iBonds ETF provides cash flows similar to a portfolio of bonds. Like a ladder there is some variability in cash flows, but investors can observe the approximate average YTM of the underlying bond portfolio at the time of purchase.