What is a separately managed account?

SMAs are portfolios of individual stocks and bonds that BlackRock manages and can customize to align with a client’s particular tax needs and personal values.

BlackRock’s direct indexing strategies seek to replicate the returns of an index pre-tax and outperform after-tax. Individual security ownership allows clients to transition their positions in-kind, harvest losses on an ongoing basis, and customize positions to reflect the individuality of the investor. Aperio, BlackRock’s direct indexing provider, has partnered with advisors for over 20 years with two main differentiators.

Schedule a meeting with an SMA specialist

If you are a financial advisor, you can sign in to schedule a meeting with one of our SMA specialists. They can review available SMA strategies, portfolio customization capabilities, and generate client-friendly sample portfolios.

Explore BlackRock’s SMA platform

BlackRock provides advisors the solutions to better tailor portfolios to the specific needs of their clients across equity, fixed income, and option overlay strategies.

Paragraph-1,Multi Column Teaser-2,Paragraph-2,Messaging Crosslink-1

Paragraph-3,Image-1,Messaging Crosslink-2

Paragraph-4,Multi Column Teaser-3,Paragraph-5,Messaging Crosslink-3

Analyze portfolios with SMAs in the 360° Evaluator Tool

Our 360° Evaluator Tool now allows BlackRock and third-party SMAs to be added to portfolios to provide comprehensive analysis across portfolio characteristics, performance, and risk.

How do SMAs compare to ETFs and mutual funds?

With SMAs, since each client directly owns the underlying stocks and bonds, you get visibility into the underlying securities, greater fee transparency and the ability to customize holdings to align with tax management and values preferences.

*The Cerulli Edge: U.S. Managed Accounts Edition, 3Q23

FAQ’s

-

SMAs create benefits for both end investor and advisors by offering institutional investment management in an account of directly held securities. As a result, advisors of high net worth clients are increasingly adding SMA allocations in portfolios.

Benefits for the End Investor:

- Personalization: direct security ownership allows investors to tailor the holdings in their account to their investment objectives, personal values, and liquidity needs.

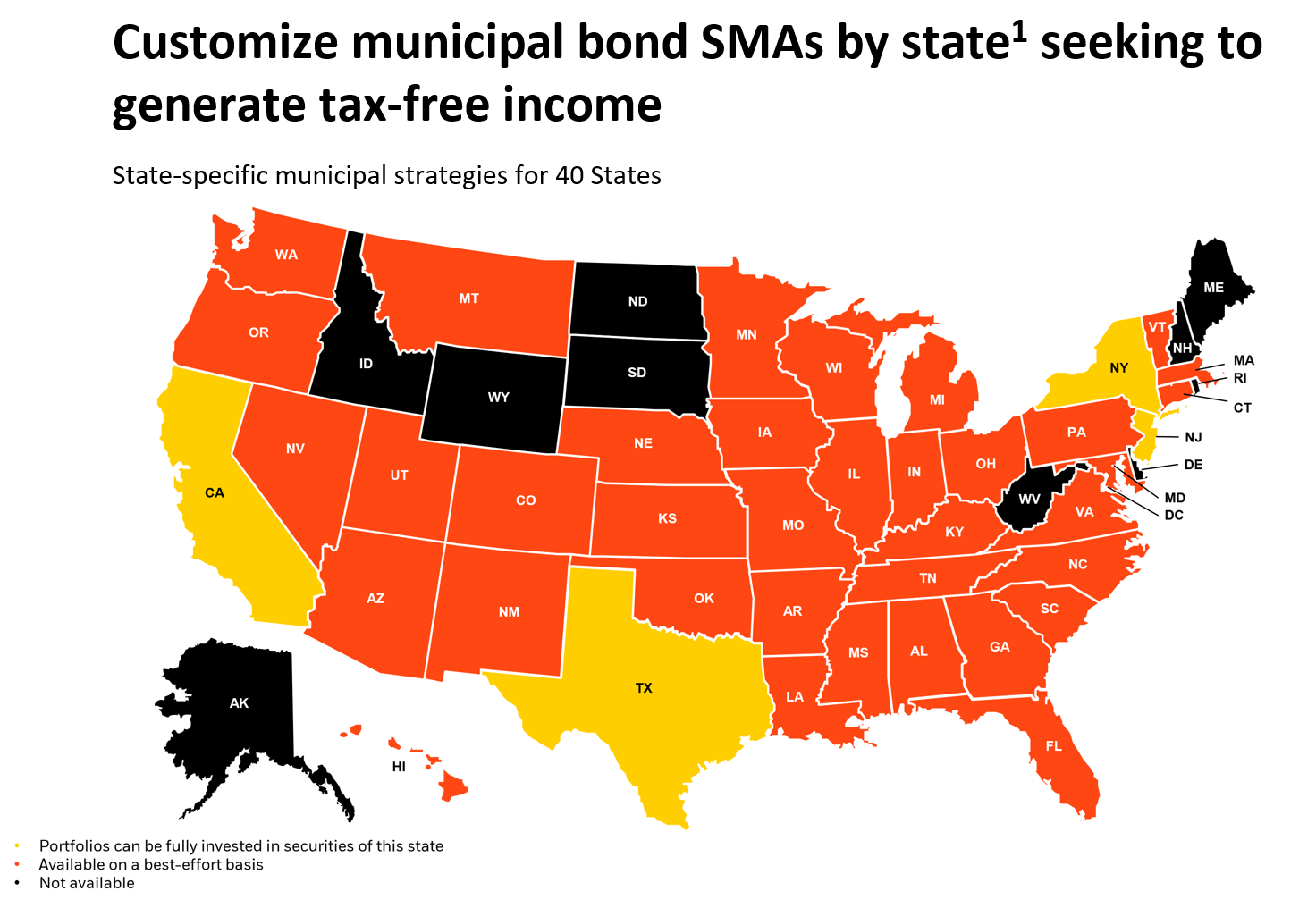

- Tax Efficiency: SMAs can be funded in kind with securities to reduce capital gains realization, customized with tax efficient features like state specificity in municipal bonds, and systematically tax loss harvested to offset gains elsewhere in client portfolios.

- Low Cost: SMA fees are often lower than those of mutual funds and can be negotiable for large client relationships.

Benefits for the Advisor:

- Capacity: advisors who adopt SMAs spend less time on research, portfolio management, and trading and more time with clients than peers who retain portfolio management responsibilities.

- Institutional Access: SMAs give advisors the opportunity to deliver institutional risk management, market access, and execution in each client account.

- Client Service: SMA PMs serve as an extension to an advisor’s team. BlackRock’s SMA PMs build client portfolios, conduct client reviews, and provide ongoing reports and analytics to both advisor and investor.

-

SMAs fees are billed monthly or quarterly as a percentage of the portfolio’s NAV. This billing process makes SMA fees more transparent than fund fees which are typically deducted directly from fund NAV throughout the year. SMAs like ETFs are generally lower cost than mutual funds, which may appeal to high net worth investors who qualify for their minimums.

-

SMAs are available through SMA or Unified Managed Account (UMA) platforms from broker dealers, custodians, and TAMPs across the wealth management industry. While each platform is unique, every SMA falls into one of two categories:

Dual Contract: the SMA manager signs a direct contract with both advisor and client. This structure enables high levels of account customization and pricing flexibility, but may be more operationally cumbersome.

Single Contract: the SMA manager signs a contract with the advisor, but not the client. While simpler to onboard, single contract SMAs offer less customization and pricing flexibility. SMAs on UMA platforms are single contract.BlackRock has SMA placement on all major industry platforms. For platform specific availability, please reach out to your BlackRock representative.