Hi – I’m Eve Cout with BlackRock and I am going to walk you through the importance of managing concentrated stock risk and the business opportunity it presents to advisors. Diversifying away from concentrated stock is a multi-dimensional challenge. That is why BlackRock offers access to a platform of solutions to address concentrated stock risk. Our market leaders work with you to analyze client’s objectives and discuss our broad range of solutions.

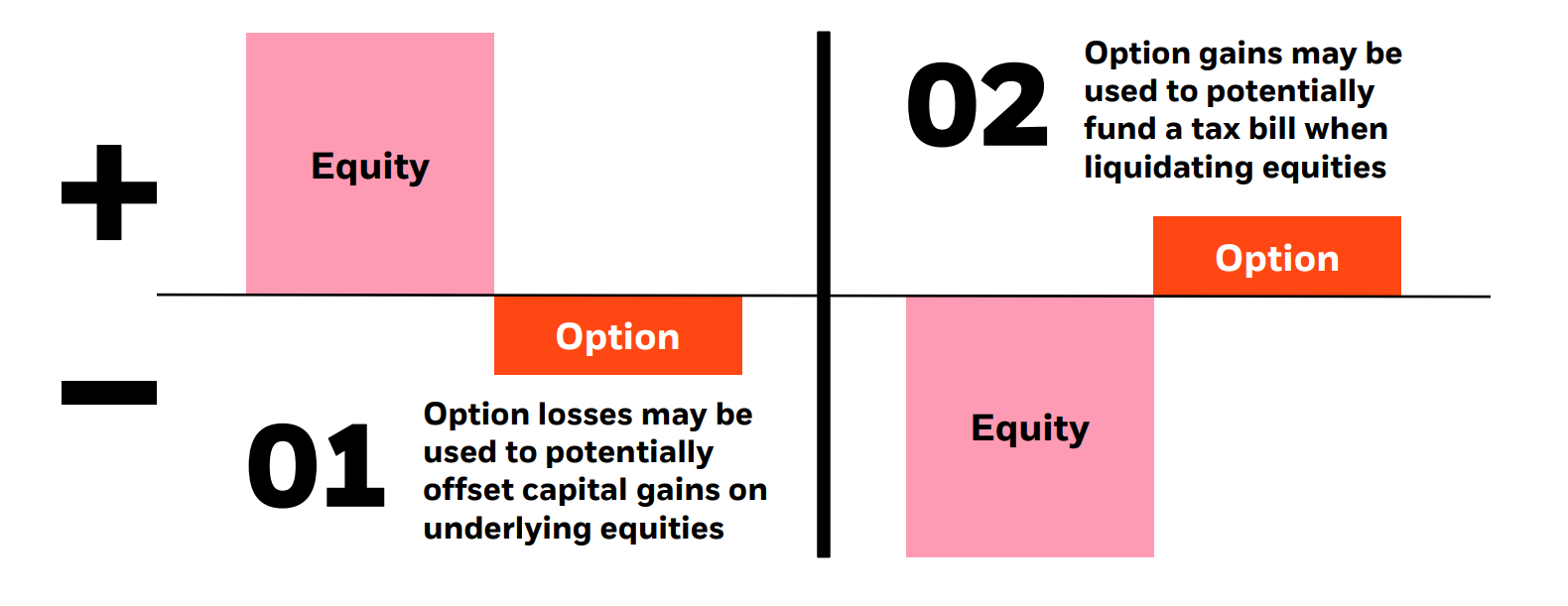

Parting ways with a concentrated position can be difficult for many clients. They have many motivations for wanting to keep their stock. The main reasons clients continue to maintain a concentrated position is their assumption that the risk isn’t high, their concern with taxes, and their emotional attachment to the stock. How do we get a client to move the dial? Understanding your client’s motivations is key to unlocking the opportunity to help them. With risk underestimation, it is important that they understand the true risk of a concentrated position. For tax concerns, it’s important that they also know there are ways to reduce risk with taxes in focus. For the clients emotionally attached or have high conviction on the company, it’s important to let them know that strategies don’t have to be “all or none”, and that risk management can be achieved without necessarily selling the stock.

Let’s focus on risk. The broader market, measured by the Russell 3000 index has grown over 3000% in the last few decades¹. Now we all know the benefits of being diversified*, but do your clients know the risks of being undiversified? Many clients think that individual stocks would have a similar trajectory to the broader market. The reality is many investors underestimate the risk of individual stocks which have had a wild and unpredictable ride. During the same timeframe, only about 1/3 of companies in the Russell 3000 outperformed the index while the rest underperformed. That means that 2/3 of the stocks took on more risk than the broader market and have not keep up with the index’s performance. Of all the stocks in the Russell 3000, more than 1/3 underperformed and also have lost money.3

Now, if your clients have built a concentrated stock position, they may be part of the lucky 1/3 that have outperformed the index. We have seen a tremendous amount of wealth built in the last decade from just a handful of names. Although these companies may be the darlings of the market today, they can also end up being the dogs tomorrow. Hitting it big with a stock can be like winning the lottery, but what are the chances it happens twice? It’s important for clients to recognize that their concentrated position is taking on company specific risks that can be hard to predict and account for. Are your client’s disciplined enough to know when to call it quits? Let’s take a look at three very different companies that were once winners, crashed, and never recovered.

Yahoo’s meteoric rise was cut short like many others tech companies during the “dotcom bubble”.

PG&E faced serious trouble when fires swept across California.

It’s important to recognize that protecting clients’ concentrated positions not only helps them, but it is also a significant opportunity to help you grow your business. Concentrated stocks represent a $3 trillion opportunity for advisors2. We know clients are looking for solutions on their outside assets; engaging them around these positions may help set up a win-win scenario. Managing risk can help eliminate the boom or bust nature of the concentrated position and unify your clients’ assets in line with their wealth management plan.

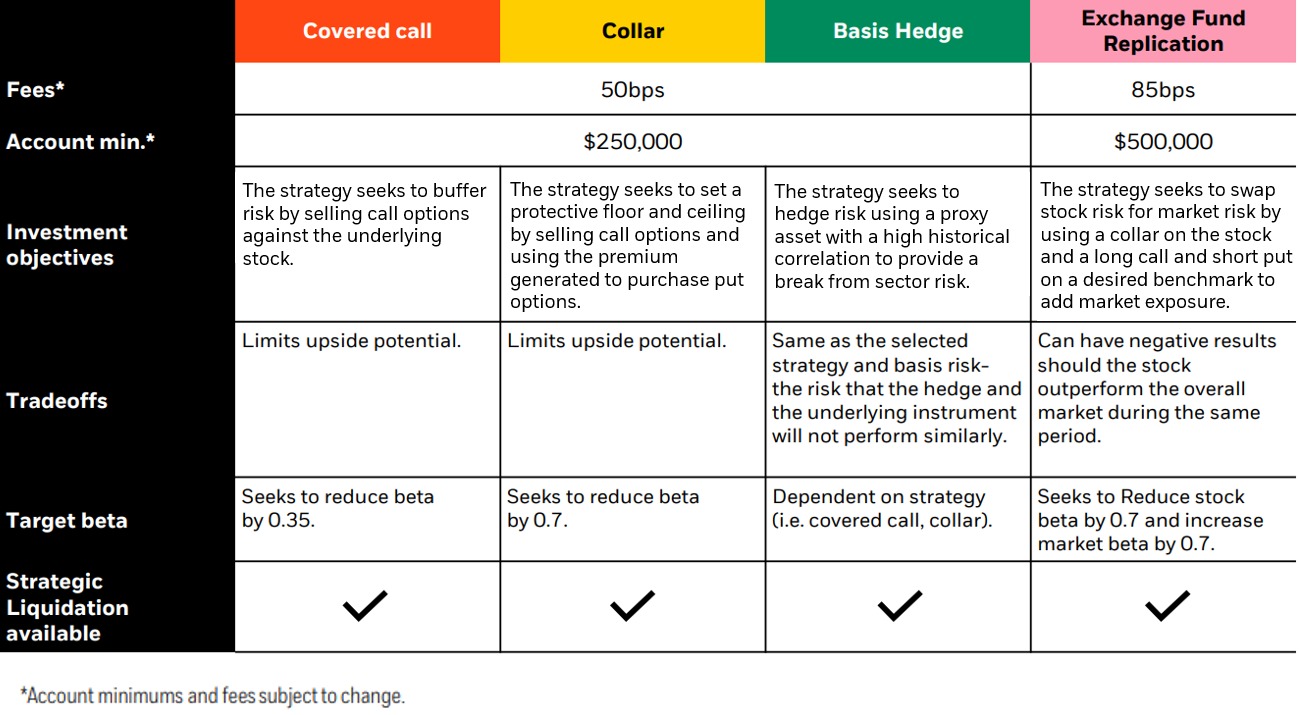

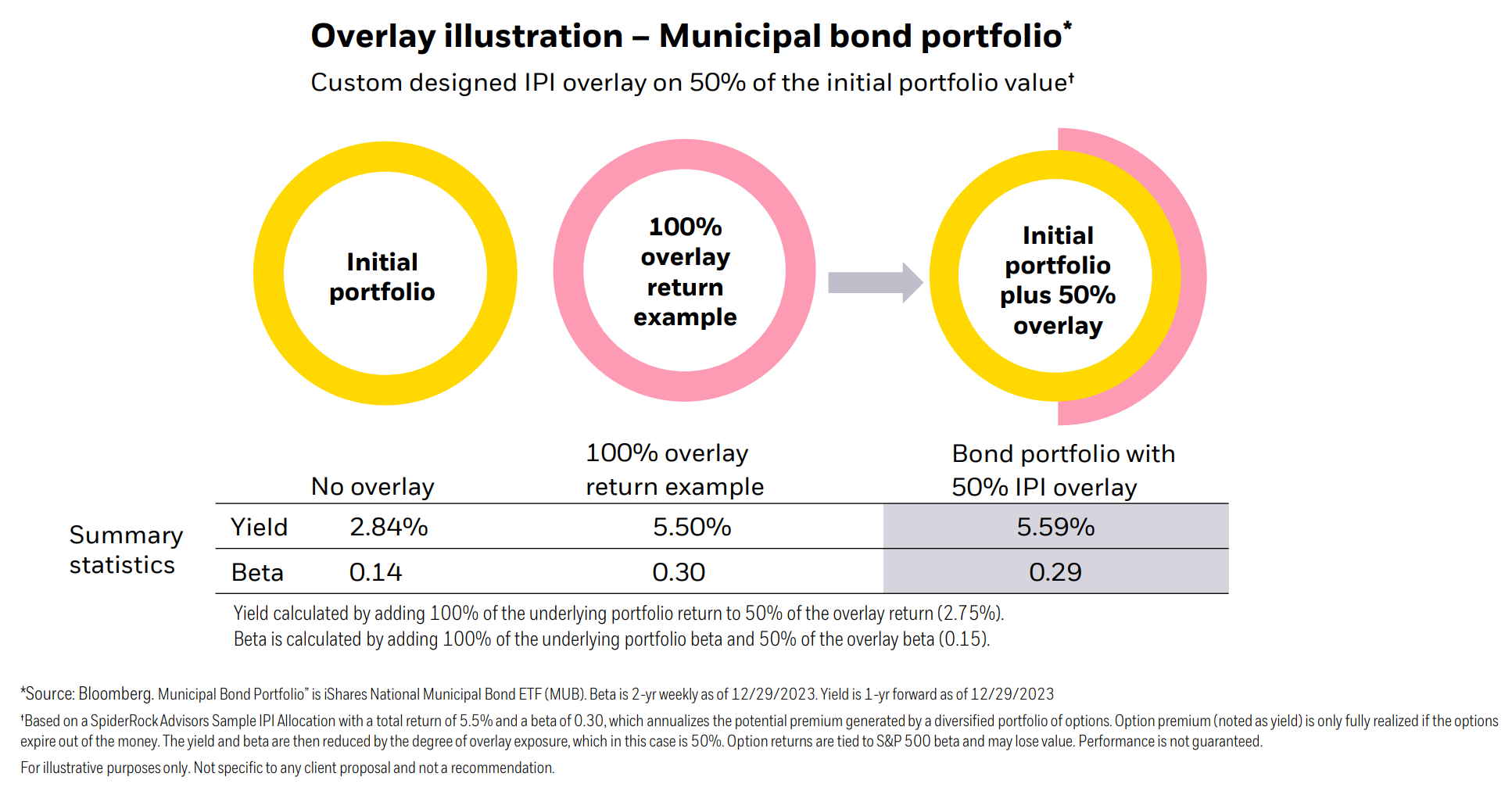

BlackRock understands that every client situation is different and diversifying away from a concentrated position is a multi-dimensional challenge. That is why we have expanded our resources and capabilities to offer access to a spectrum of solutions. Whether your client is looking to immediately diversify, wants to maintain their position, or is looking for something in between, we are ready to help. Our market leaders will partner with you to understand your clients’ goals and discuss our broad range of solutions and partnerships that include tax-loss harvesting, direct indexing, and option overlays. If you are ready to learn more, call your BlackRock representative.

*Diversification does not guarantee profits or protect against investment loss.

¹Source: Aperio, MSCI. Performance from January 1987 through February 2022.

2Source: BlackRock estimate.

3Data used from January 1987 through February 2022. The data includes all companies listed in the Russell 3000 ® Index, except for those with non-continuous return histories, approximately 10% of the data. End dates may correspond to bankruptcy, termination, delisting, acquisitions/mergers, or the end of the study period. The Russell 3000 index was used due to the size of scope of its holdings. The timeframe reflects the longest historical performance based on MSCI data at the time of analysis.

Investment fees may reduce investment returns. Past performance is not indicative of future results.