Strategies to manage your clients' concentrated stock

Whether a client has inherited a stock position, earned stock as part of their compensation, or simply purchased a stock that has rocketed in value over time, they can end up with an unexpected problem – holding too much of one stock in their portfolio.

The good, the bad, and the ugly

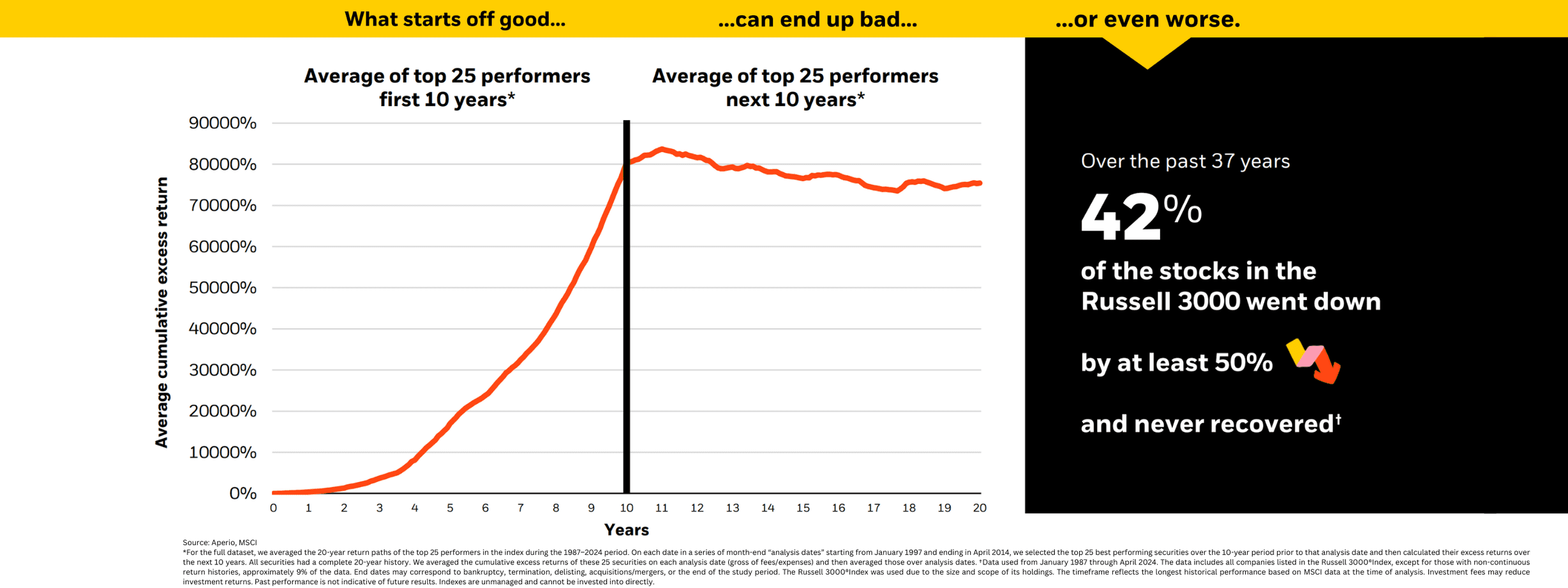

While a select few stocks have had meteoric success, it can be difficult to sustain over long periods. Even in the best-case scenarios, many start to fade after their first successful 10 years. The worst-case scenario? A catastrophic loss. Regardless of your outlook on a stock, owning too much can expose your clients to unnecessary risk.

How to approach client with concentrated stock positions

Many clients feel like they have a binary choice, to hold or sell the concentrated position. However, liquidating is not the only alternative, and to determine the right solution, an advisor must take into account a few key factors.

Concentrated stock strategies

For many clients, selling all of their concentrated stock is a non-starter, leaving them stuck with a large position. BlackRock offers strategies that can help you manage the risk and taxes of concentrated stock positions and diversify over time with direct indexing, option overlays, or a combination of both.

Headline-1,Messaging Crosslink-1,Paragraph-2,Accordion-1,Paragraph-3,Navigation List-1

Headline-2,Messaging Crosslink-2,Paragraph-4,Accordion-2,Paragraph-5,Navigation List-2

Headline-3,Messaging Crosslink-3,Paragraph-6,Accordion-3,Paragraph-7,Navigation List-3

How it works:

Direct indexing is an investment strategy that consists of a diversified portfolio of individual stocks that seeks to track the returns of an index with systematic tax-loss harvesting.

Fund direct indexing from cash

How it works for concentrated stock:

You can start with cash or sell a portion of a concentrated position to fund a direct indexing portfolio with the goal of systematically harvesting losses in order to offset gains from the sale of the concentrated position.

Client scenario:

A recent retiree owns a small cap stock that has low liquidity and a low-cost basis. They are now in a lower income tax bracket, allowing them to be more flexible with their capital gains budget. They are worried about the risk of their concentrated stock and want to sell a portion of it to diversify into the broader market.

Profiling questions and what to listen for:

-

Client response: “I’d sell the position and put it into stocks.”

-

Client response: “It’s small, I am not too worried about it”

-

Client response: “There are none, it’s done well for me and I’m comfortable parting ways with these shares.”

How BlackRock can help:

If the position is small relative to your clients’ total wealth, and they are willing to sell, the portfolio could invest in a direct-indexing strategy and be funded with an upfront sale of the position, and harvest potential losses which may offset gains from further stock sales.

Learn how we manage concentrated stock

BlackRock offers many solutions to help advisors protect their clients from the wide range of market risks and investment-specific, idiosyncratic risks that impact stocks.

To hear about possible solutions, watch this video from Eve Cout, Managing Director at BlackRock.

Ready to take the next step?

Want to speak to a specialist? Contact us by calling 1-800-ASK-BLK or send us an email at GroupOptionStrategists@blackrock.com

If you are a financial advisor, create an account or log in to Advisor Center to explore BlackRock’s solutions.