INVESTING FOR AFTER-TAX RETURNS

BlackRock's Tax Center

Access the tools, solutions and insights to keep taxes at the forefront of your investment process. In today s market, where 95% of U.S. equity funds are experiencing negative price returns,1 learn how to take advantage of heightened volatility and uncover tax loss harvesting opportunities.

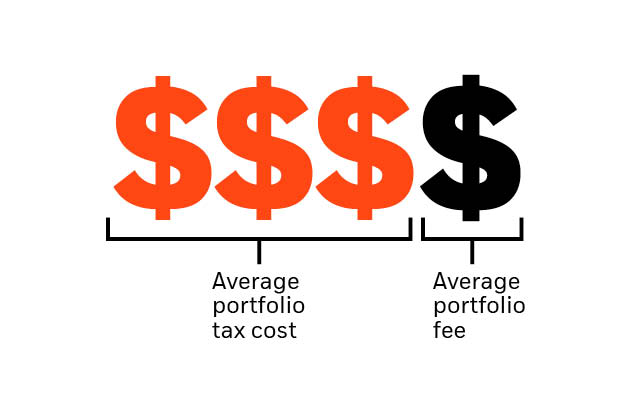

The average tax cost for advisor portfolios is 3x the average fee

Did you know its actually the taxes that are more detrimental to overall portfolio returns, not the fees? In fact, the average annual tax cost of 1.14% is 3x higher than the average portfolio fee of 0.38%.2 Take an after-tax return lens for taxable investors to help your clients keep more of what they earn.

You don’t have to spend hours collecting and analyzing the tax impact of capital gains on all your clients’ portfolios. Tax Evaluator aggregates and automates this process for you! With access to over 7,000 mutual funds and ETFs all in one place, you can create a detailed picture – in minutes. See which funds have reported estimated capital gains distributions before your clients incur the tax liability. You can also help your clients consider the benefits of tax loss harvesting by identifying funds with negative price returns. Additionally, compare fund characteristics and rankings to help clients make informed decisions about specific holdings. Use Tax Evaluator to track portfolios, identify potential tax savings, and help your clients keep more of what they earn. Run a tax analysis today at blackrock.com/tax.

Identify potential savings with Tax Evaluator

View capital gains estimates and identify potential tax loss harvesting opportunities to help minimize tax impacts for your clients.

Earn CE with our Tax Foundations course

Optimizing for after-tax returns can help investors keep more of what they earn. Learn why managing taxes matters and how to adapt your investment process.

BLACKROCK RESOURCES: AFTER-TAX STRATEGIES

Explore tax-smart portfolio strategies

BlackRock is a leader in indexing and tax-managed investing strategies to help you better serve your clients.3 We provide access across:

Active & index iShares ETFs

Select iShares funds indexed to S&P Dow Jones Indices.

ETFs have paid out significantly less distributions than mutual funds, even when actively managed. Over the last 5 years, 17% of active ETFs paid out a gain compared to 76% of active mutual funds.4

BlackRock SMAs

Offerings across fixed income, direct indexing, active equity, and option overlays that can provide greater flexibility and control through personalization, transparency and maximizing after-tax return potential.

BlackRock municipal platform

As one of the world’s largest municipal bond managers, investors can benefit from our trading scale and credit research across mutual funds, ETFs, and SMAs.

Tax-aware models

BlackRock’s Tax-Aware model portfolios are built with the same core investment views as our flagship Target Allocation model portfolios, but with a focus on maximizing after-tax return potential.