BITCOIN INVESTING

Embrace the future of finance by guiding your clients on exposure to Bitcoin. Uncover the pros, cons, and strategies to help them build a savvy digital asset portfolio.

You're on the BlackRock site for advisors. Do you want to change your user type to advisor?

iSHARES THEMATIC ETFs

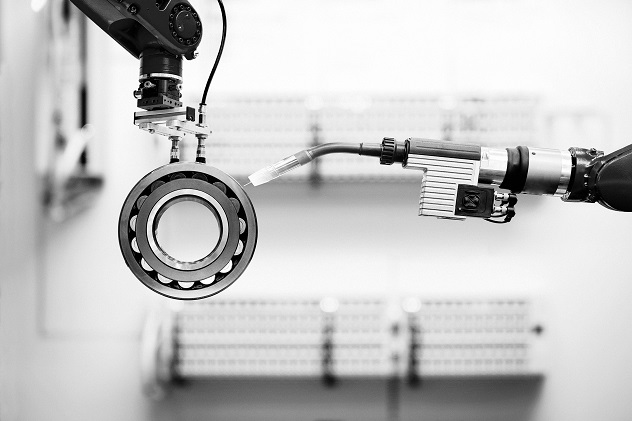

Thematic investing focuses on forward-looking themes, including technological advancements like robotics and semiconductors, as well as consumer-driven trends such as electric vehicles and home builders. iShares provides ETFs, along with timely insights and portfolio analysis tools, to help advisors gain exposure to themes that are top of mind for their clients.

iShares Future AI & Tech (ARTY)

Massive investment in AI infrastructure, along with increasingly powerful semiconductors and models, may be laying the groundwork for increased adoption. ARTY is indexed to Morningstar Indexes.

iShares U.S. Infrastructure ETF (IFRA)

The U.S. physical economy infrastructure is being rebuilt. Themes centered around rebuilding may benefit in the post-election environment. IFRA is indexed to ICE Indices.

Thematic, sub-sector, country, & real asset ETFs offer precise exposures to capture the impact of mega forces. BlackRock offers the widest range of ETFs to help investors position their portfolios for these seismic shifts – from custom thematic exposures to those built around traditional market classifications.

Thematic ETFs

Purpose-built to capture themes from bottom-up, often using a sector & geography-agnostic approach.

Sub-sector ETFs

Focus on a specific subset of companies within an industry. Allowing investors to make targeted bets on particular themes.

Region & Country ETFs

Target growth in specific geographies, driven by themes like geopolitics & demographics.

Real Asset ETFs

Access tangible assets that have intrinsic value. Including exposure to commodities, real estate, infrastructure, & natural resources.

Our 2024 Mid-Year thematic update focuses on two mega forces that are reaching critical inflection points -- the transformative advancements in artificial intelligence and the growing importance of geopolitics.

These mega forces are reshaping the global economy and, as a consequence, are impacting virtually all investors’ portfolios. So how should investors approach these mega forces for the rest of 2024 and beyond?

First, we believe the opportunity today in AI lies less in the digital world and more in the physical infrastructure supporting this technology. Artificial intelligence has transcended buzzword status and is getting rapidly integrated in businesses across the economy, from healthcare to financials and more. Yet as AI adoption takes off, its emergence is creating tremendous and immediate demand for hardware, for digital infrastructure and for power. Semiconductors, data centers, and even raw materials like copper are becoming the picks and shovels critical to AI’s growth with data centers alone requiring as much as $1 trillion of investment by 20301.

Second, geopolitics is reshaping supply chains and public policy, creating select opportunities. Bipartisan efforts in the US to support domestic production and critical industries like semiconductors and automobiles, are poised to drive a renaissance in U.S. manufacturing.

At the same time, select emerging markets like Mexico and India are even benefiting from growing trade and attractive labor pools. And finally, global competition in technology and AI highlights both the vulnerabilities and opportunities of the S&P 500’s largest sector2.

To learn more about these powerful mega forces and how to potentially capture these opportunities in your portfolio, please visit iShares.com/Insights.

Sources:

1: McKinsey & Company, “The semiconductor decade: A trillion-dollar industry,” 4/1/22. Forward looking estimates may not come to pass.

2: Sourced from Morningstar as of 6/12/24. The Information Technology sector holds the largest weight in the S&P 500 TR Index, accounting for 31% of the total.

Disclosures:

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Funds that concentrate investments in specific industries. sectors, markets or asset classes may underperform or be more volatile that other industries, sectors, markets or asset classes and the general securities market.

Technology companies may be subject to sever competition and product obsolescence.

International investing involves risk, including risk related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risk often are heightened for investments in emerging/developing markets and in concentrations of single countries.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Prepared by BlackRock investments. LLC, member FINRA.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0624U/S-3653818

Artificial intelligence can automate laborious tasks, analyze huge sets of data and help generate fresh ideas. Digital disruption goes beyond AI.

Themes centered around rebuilding and national security may benefit in the post-election environment, due to the intersection of policy tailwinds and structural changes.

Embrace the future of finance by guiding your clients on exposure to Bitcoin. Uncover the pros, cons, and strategies to help them build a savvy digital asset portfolio.

iShares U.S. Thematic Rotation Active ETF (THRO) provides dynamic and active thematic exposure in a single trade.