KEY TAKEAWAYS

- We are likely at the end of the Fed’s hiking cycle, but don’t anticipate rate cuts until the second half of 2024.

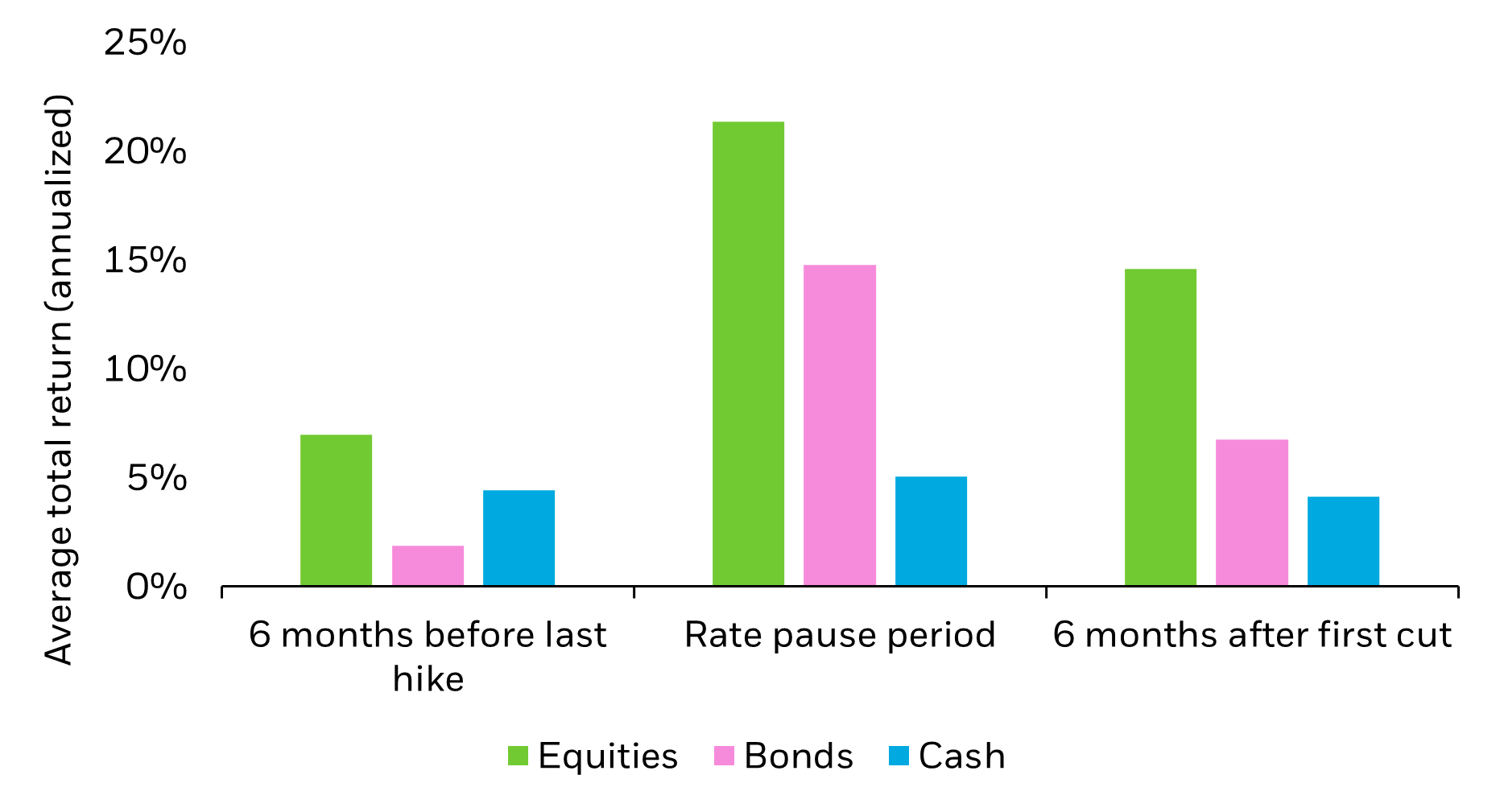

- Investors piled into cash in 2023. But staying there risks missing the returns in stocks and bonds often associated with the ‘pause period’ between the last Fed hike and the first cut.

- 2024 will be a year to pick your spots. In fixed income, we prefer pairing intermediate duration core holdings with differentiated income-seeking exposures. In equities, we favor adding downside protection in core exposures while taking targeted risk in loveable laggards.