Japan is back in business. The country’s economy and stock market seem to have ended three decades of battling deflation and economic stagnation.1 Japan equities are now again viewed as a potential location for long-term strategic asset placement.

Spotlight on Japan - 3 reasons why we're hopeful

Apr 29, 2024

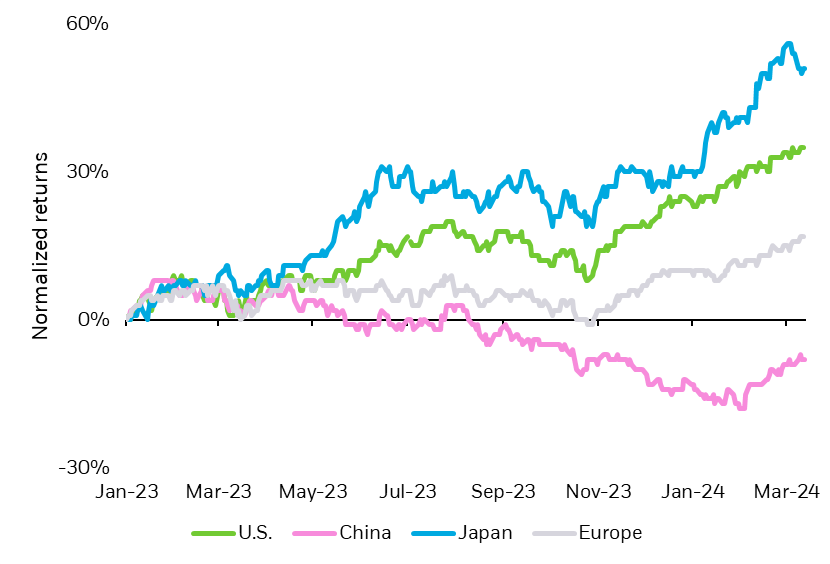

Figure 1: Japan is outperforming Europe, China, and even the U.S.

Source: BlackRock, Bloomberg. As of March 14, 2024. U.S. equities represented by MSCI U.S. Index. China equities represented by MSCI China Index. Japan equities represented by MSCI Japan Index. Europe equities represented by MSCI Europe Index. Data normalized as of January 1, 2023. The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Chart description: Line chart depicting normalized returns, as percentage, of U.S., China, Japan, and Europe equities, since January 2023.

Despite the 50% return for Japanese equities since Jan. 2023,2 we remain constructive on Japanese equities as we believe there is room to run.3 Why is that?

1. BOJ: HIGHER RATES REFLECT INFLATION SUCCESS

In late March, the Bank of Japan (BOJ) finally announced its exit from 8 years of negative rate policy (NIRP) in the country.4 This decision has been widely anticipated, and well-supported by evidence of meaningful structural shifts in the inflation outlook, such as the recent Shunto wage growth negotiations5. These negotiations play a key role in determining the direction of wage growth in Japan. We see this as a hard-won return to inflation, and a positive sign for sustainable economic growth in Japan.

2. CORPORATE REFORMS AND VALUATIONS

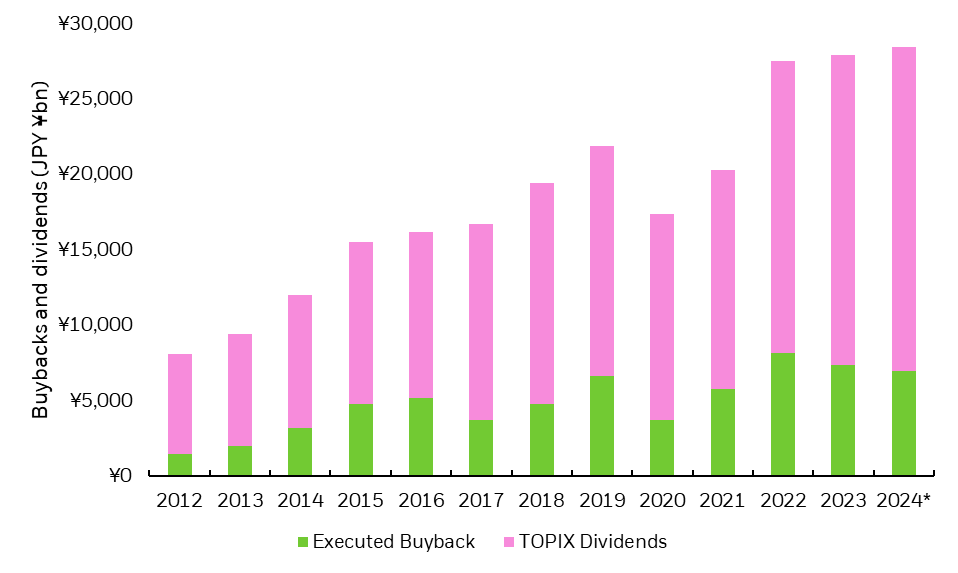

One of the key drivers of outperformance of Japanese equities has been stellar corporate profit growth. Earnings have been revised higher and expected 12-month earnings growth estimate stands at 7.9%.6 Despite the recent outperformance, Japanese equities are cheap relative to both their own history and U.S. equities.7 In addition, buybacks in 2023 came in at an all-time high of 28 trillion yen8.

Figure 2: Capital Returns from Buybacks and Dividends on the rise

Source: BlackRock Investment Institute with data from Nikkei NEEDS, Bloomberg, AlphaSense, Morgan Stanley Research as of February 29, 2024. Asterisk represents full-year 2024 forecasts.

Chart description: Bar chart depicting yearly returns from buybacks and dividends from Japanese stocks since 2012.

3. JAPAN EQUITIES ARE STILL UNDER-OWNED

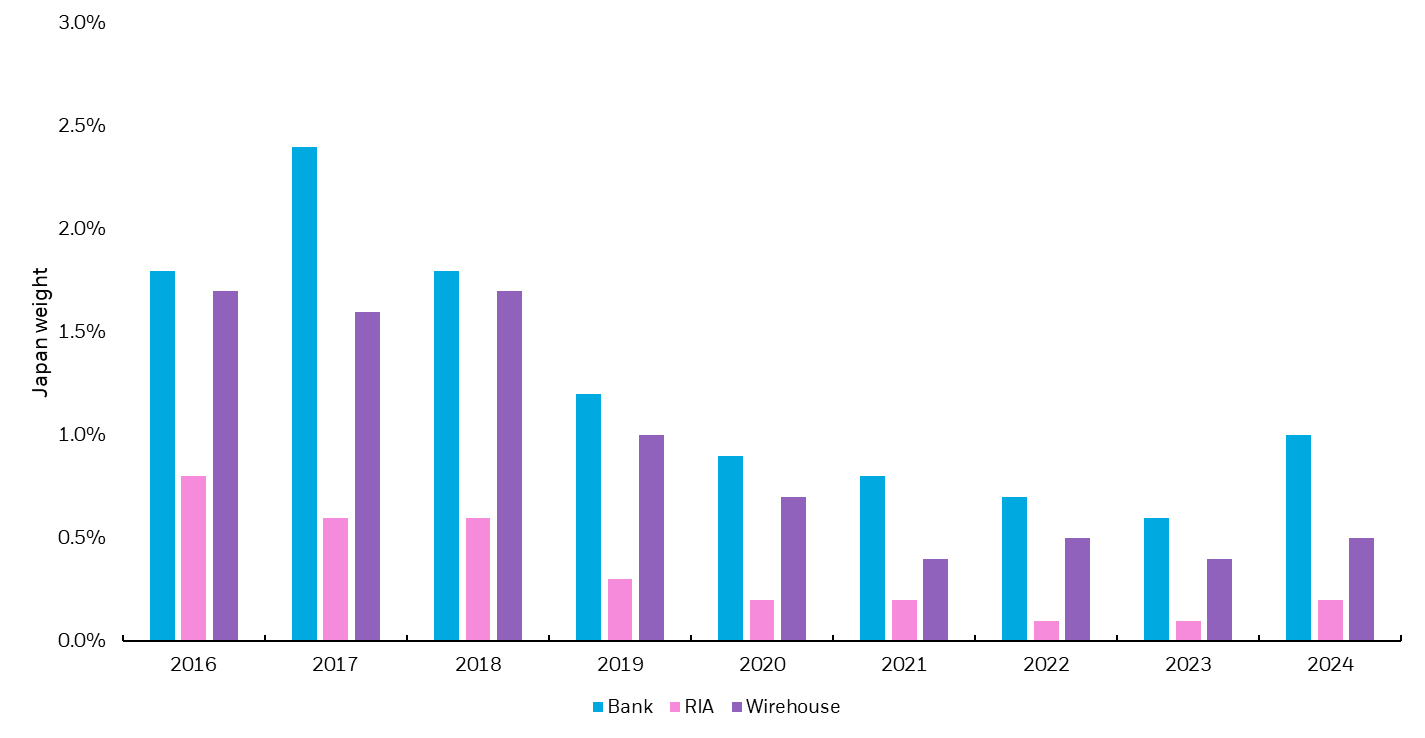

Japan focused ETFs logged their best year in over a decade with over $16.5 billion in net inflows globally in 2023.9 However, even with the return of foreign investors in 2023, years of persistent selling means that investors are still underweight. This has been particularly true with U.S. wealth clients, who had significantly reduced Japan equity exposures since 2018.

While the Japanese equity market has posted impressive returns in the past year, it has been a long-term underperformer relative to other equity markets and generally under-owned in most global portfolios, suggesting the run can continue. Within BlackRock’s Global Allocation (GA) Model Portfolios, an overweight to Japanese equities has been built up over the past few quarters, as the team rotated equity exposure away from Europe in favor of an overweight tilt toward Japan.

Figure 3: U.S. wealth clients have been underweight Japan since 2018

Source: Morningstar, as of December 31, 2023. The insights presented in this analysis uses monthly data sourced from the Broadridge GMI platform. The dataset looks at all US domiciled ETF’s in the US wealth space. The allocation % for a category looks at the AUM in the category as a percentage of total assets in each client channel.

Chart description: Bar chart showing U.S. wealth client weights to Japan since 2016.

U.S. investors have been allocating into Japan using both direct, targeted Japan focused funds and broad, regional international developed exposures. Beyond a market exposure to Japanese stocks, we also see alpha-generating opportunities across sectors, factors, and themes. A quality focused active approach creates opportunities for investors to capture upside across themes from electric vehicles, to reopening, to corporate transformation, to aging populations, to reshoring and factory automation, to decarbonization.

HEDGE OR NO HEDGE?

Finally, currency risk is one of the greatest challenges when it comes to investing in international equities. Appreciation in the yen could be a key consideration moving forward for investors who choose from hedged or unhedged exposures. Given the BOJ’s gradual policy change and the negative correlation between Japanese equities and its currency, investors could feel comfortable owning unhedged Japanese equities this year.

iSHARES FUNDS

Explore a range of iShares ETFs to meet your clients’ investing goals.

Subscribe for the latest market insights and trends

Get the latest on markets from BlackRock thought leaders including our models strategist, delivered weekly.

Please try again

RELATED RESOURCES

ACCESS EXCLUSIVE TOOLS AND CONTENT

Explore My Hub, your new personalized dashboard, for portfolio tools, market insights, and practice resources.