Key takeaways:

- The Valentine’s Day eve CPI print came in hot and steamy and sparked the largest sell off in stocks of 2024. Has this print changed our views? Are we worried? Nah, not really

- We remain of the view that inflation will continue to ease, even if we see another month or two of superficially “hot” prints (which could surely bring with it increased market volatility)

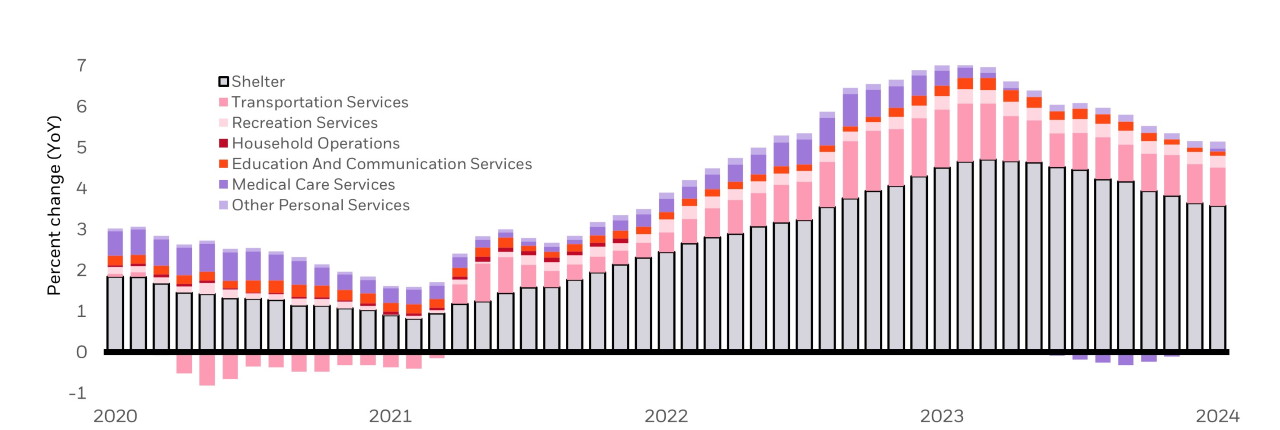

Shelter still propping up core CPI services (for now)

Shelter has been relatively sticky – but based on real-time rent prices, we expect future weakness to unlock lower CPI prints into the summer

Source: Bloomberg, U.S. Labor Department. Chart shows year-over-year percentage change to the Core Consumer Price Index Services subcomponents, as of 1/31/2024

The Valentine’s Day eve CPI print came in hot and steamy and sparked the largest sell off in stocks of 2024. Has this print changed our views? Are we worried? Nah, not really. We discussed how these sorts of events (inflation jitters, seesawing rate cut bets, etc.) could precipitate increased volatility the first half of the year. A more nuanced reading of the CPI data reveals the key instigators to be noisy ‘January-effect’ seasonal factors and a technical-driven divergence between owner equivalent rent (OER) and non owner rental rates. This divergence was caused by a change in how the government computes OER (which added weight to single family homes). All of which is to say, we remain of the view that inflation will continue to ease, even if we see another month or two of superficially “hot” prints (which could surely bring with it increased market volatility). By April/May, we expect the pieces will be coming into view for the Fed to start to wind down QT and the immaculate disinflation narrative to potentially reassert itself.”

Get model portfolio trade notices when they happen

Sign-up to receive trade update emails when our model portfolios rebalance so that you can review the latest allocations and commentary from our portfolio team.

Related resources

More articles loaded. Use Shift+Tab keys to browse.

Access exclusive tools and insights

Explore My Hub, your new personalized dashboard, for portfolio tools, market insights, and practice resources.