The Exchange-Traded Fund (ETF) industry has dramatically transformed in the past 30 years, progressively growing in both assets under management and in the variety of ETFs available to investors. From just a handful of U.S.-based funds in 1993 to over 13,000 globally currently, ETFs have evolved to provide transparent access to a broad range of asset classes, sectors, and geographies.2

The majority of ETFs seek to track an index — commonly known as index funds. But this is changing. With ETFs becoming a wrapper of choice — expanding from 15% of total fund assets in 2013 to 31% in 20233 — investors increasingly want the same low-cost, tax-efficient wrapper to pursue differentiated strategies such as alpha-seeking or to gain unique exposures. Enter active ETFs.

The active ETF universe is broad, with three distinct categories: alpha-seeking, outcomes, and exposures. While index ETFs seek to replicate the performance of an underlying index — such as the S&P 500 — active ETFs may seek to outperform a specific index or achieve a specific outcome, such as generating income.

Both active and index ETFs are professionally managed. But portfolio managers of active ETFs can incorporate proprietary research and react in real-time to evolving market conditions.

We believe the asset management industry is at an inflection point, where active ETFs are becoming an increasingly important part of investor toolkits, alongside mutual funds, closed-end funds, separately managed accounts, and index ETFs.

Consider the following:

- Active ETFs accounted for 76% of all U.S.-listed ETF launches in 2023, and 43% of global ETF launches.4

- Active ETFs comprised 21% of global ETF net asset inflows and organic asset growth in 2023, up from 17% the prior year.5

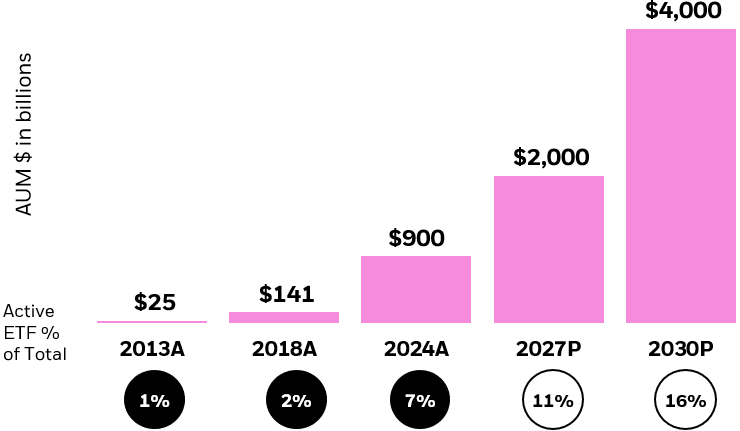

- BlackRock projects that global active ETF assets under management will surge to $4 trillion by 2030, a more than four-fold increase from $900 billion through June 2024.6