BlackRock on healthcare investment opportunities amid COVID-19

Speaking of health, we have never been so vigilant. We wash hands, exercise to boost immunity, and look out for vaccine to combat COVID-19. It is a time our healthcare systems come under pressure, driving both public and private sectors to realize the importance of investing in healthcare. In the first half of this year, healthcare companies have dominated the IPO market, raising as much as US$17 billion in equity offerings1. These underscore the vast opportunities investors can capture in healthcare.

Below are insights from Ben Bei, Product Strategist on the Global Emerging Markets Equities Team in BlackRock’s Active Equity Group.

Question: Why should we invest in healthcare equities?

Ben Bei: Healthcare is a sector with enormous opportunities, supported by long term demographic trends and fundamentals. In our view, healthcare is a “defensive growth” sector, characterized by its defensive and growth nature. It is defensive thanks to its low correlation with global macro conditions. Compared to other sectors, demand for healthcare is resilient and less impacted by economic swings. Historically, the sector has been the strongest performer in late cycle and recessionary periods, suggesting this may be an area investors should look into amid uncertainty over the broader macroeconomic outlook.

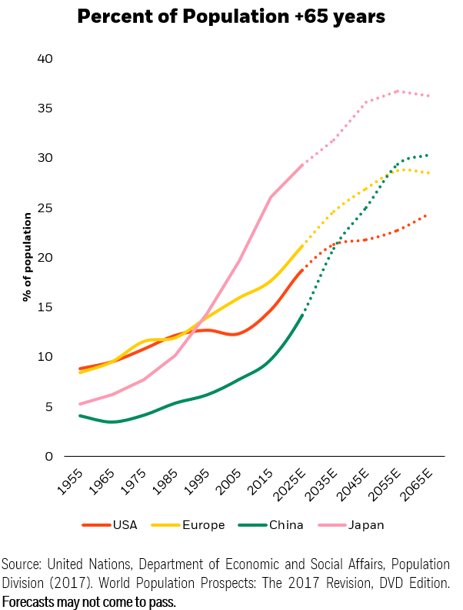

Meanwhile, healthcare is also bolstered by growth from demographic trends and innovation. Ageing populations in both developed and emerging markets, as well as increasing wealth and a rising middle class, translates into growing demand for healthcare. This sector is also a greenhouse of innovation: an array of R&D companies constantly delivers new products to fulfil unmet demand, which, we believe, act as a long-term driver for the sector’s growth.

Question: What are the sub-sectors within the healthcare space?

Ben Bei: Healthcare is a very broad sector comprised by four major sub-sectors: Pharmaceuticals, Biotechnology, Healthcare Providers & Services, as well as Medical Devices & Supplies. Among all, pharmaceuticals are likely the most familiar in our daily life. Biotechnology focuses on the creation of bio-related products for use in such areas as rare diseases, oncology and currently COVID-19 related drugs and potential vaccines. Healthcare Providers & Services is a broad subsector that includes health insurance providers, hospitals and facilities, as well as telemedicine companies. The final subsector, Medical Devices & Supplies, is an area of innovation, with latest examples as non-invasive surgery techniques and, even, robot assisted surgeries.

Question: What are the long-term opportunities that are most promising in the healthcare space?

Ben Bei: As long-term investor, we are most interested in areas with outstanding potential of technological advancement, which could fulfil previously unmet demand through new products or solutions. So far, we have identified four major promising areas. One of them is implant technologies. The attractiveness lies in their huge potential markets and the ability to replace the older standards of care. The second one is immuno-oncology companies, which are focused on enabling our immune system to target and fight cancer cells. These companies attempt to address many unmet medical needs in conjunction with strong research as well as development and innovation. The third long-term trend we identified is minimally invasive technologies, the use of which will significantly reduce the risk of surgeries and speed up recovery. Last but not least, antibody conjugate technology is worthy of attention. This is the next generation of chemotherapy drugs with the ability to target cancer cells while not affecting healthy cells.

Question: With the current COVID-19 situation, what are BlackRock’s views on the impact to the healthcare sector?

Ben Bei: Attention on the healthcare sector has surged in recent months due to COVID-19 and investors are watching companies within the sector more closely. Still, impact on different sub-sectors vary. There is increasing drug demand, as patients are more concerned about health. We also expect a growing demand for coronavirus-related products, such as ventilators and diagnostic test kits. At the same time, some sub-sectors are at the pivotal point of long term structural change. The online healthcare service industry, for instance, benefits from social distancing, while home care & community healthcare industries benefit from government policies concerning hospital capacity.

To be sure, some hospitals are negatively affected, while other services such as elective procedures and clinic trials are delayed due to COVID-19. Companies that provide devices for elective procedures are also under pressure. Despite that, we believe demand will return as the pandemic subsides.

Bottom Line

Like all other sectors, the healthcare space is not immune to geopolitical risks. Yet such risks are likely to be mild for this sector. In the medium term, we believe authorities are focusing their efforts on proper functioning of the healthcare system, and thus drug pricing policy is likely to remain stable despite the upcoming US presidential election. Meanwhile, any fiscal stimulus package in the US is likely to favor healthcare infrastructure.

In the midst of all these, healthcare is increasingly important with tremendous investment opportunities. It is time for investors to take a closer look at it.