BlackRock Global Bond Income Fund

Don’t miss the boat with bonds

Key considerations

-

01

Yields at decade highs

Yields are at decade highs across the fixed income spectrum. Higher rates may set the stage for higher expected returns and a “yield cushion” that can potentially hedge against multiple scenarios.

-

02

Income returns win in the long term

The compounding effect of income during periods of uncertain price movements may be undervalued by markets, particularly for long-term investors.

-

03

Flexible investing

Market volatility is calling for a more flexible approach to investing, allowing for the dynamic capture of investment opportunities as they arise while also seeking to limit potential drawdowns.

Why BlackRock Global Bond Income Fund?

BlackRock Global Bond Income Fund seeks to deliver attractive income by dynamically allocating across a broad global multisector fixed income universe while reducing interest rate sensitivity and volatility.

Maximize income per unit of risk

The Fund seeks to generate competitive yield with lower volatility through a high quality, diversified portfolio.

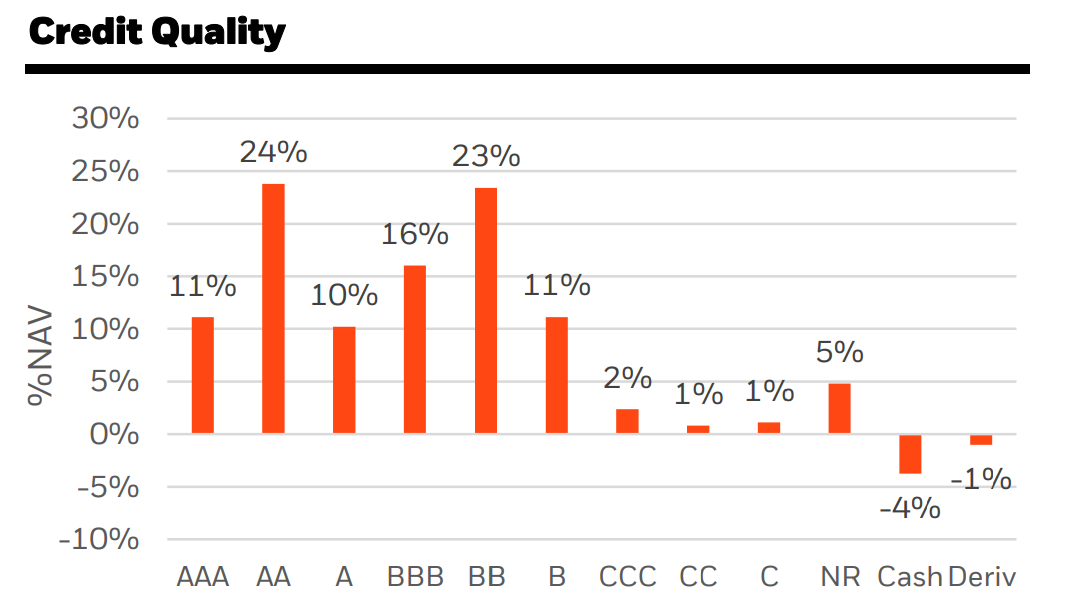

Primarily exposed to high quality, investment grade bonds

Source: Blackrock as of 30 April 2025.