Capturing robust growth opportunities in the technology sector

The new normalcy under COVID-19 has boosted our use of technology to new height in recent months. Governments are ramping up solutions to combat the virus, while businesses have made work-from-home a new norm. Our day-to-day life, from education to grocery shopping, has shifted to the virtual world. Online games have gained more traction, sending equities to skyrocket high. Cyber security has also become more imminent than ever.

So how can investors capture the tremendous growth in the technology sector? Here are thoughts from Ben Bei, Product Strategist on the Global Emerging Markets Equities Team in BlackRock’s Active Equity Group.

Question: Why do technology equities outperform?

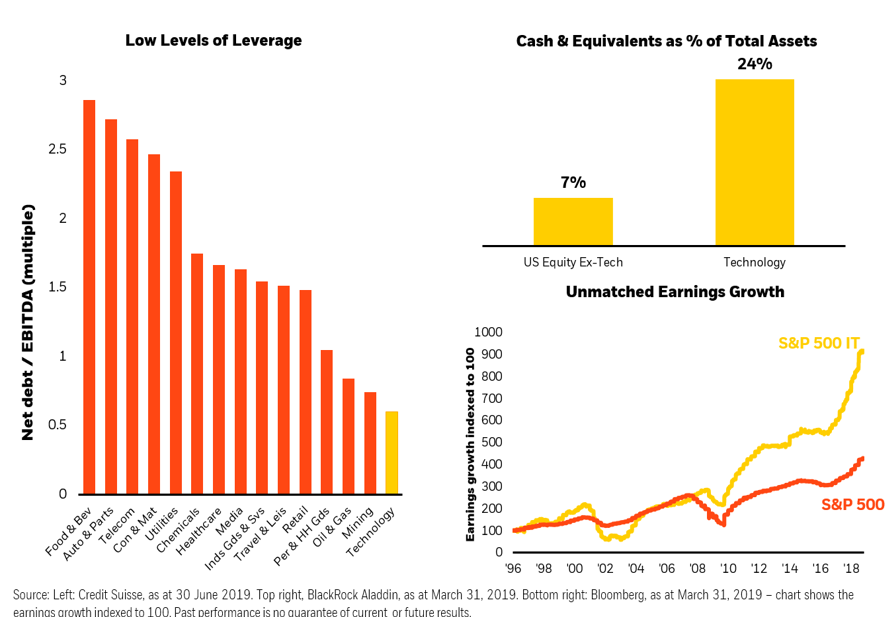

Ben Bei: The tech sector’s strong performance over the past years was supported by its solid fundamentals. We believe the sector is well positioned to deliver favourable returns to investors in the coming years. In terms of profitability, this sector’s earnings growth outpaces the overall equity market. At the same time, the strong balance sheets, highlighted by the robust cash generation capabilities, also support its equity performance. Many tech companies have abundant cash on their balance sheets. They also enjoy the least leverage ratio among all sectors. In short, strong earnings, positive free cash generation and low level of debt support the sector to perform well amid the changing macro environment.

Question: How do you identify investment opportunities in the technology space?

Ben Bei: The growth potential of the technology sector is embedded in a wide range of investment opportunities. Our philosophy goes beyond the traditional definition of information technology and explore the whole equity space to identify companies with a strong technology element . This gives us an extremely diverse range of corporates across this broader technology universe, with as many as 1,200 companies for consideration. Technology is manifested in six subsectors - Hardware, Semiconductors, Internet, Services, Software, and Games and Data Centres, based on our re-definition.

Question: What are the trending themes within this sector?

Ben Bei: We have identified five major long-term themes that may offer interesting investment opportunities. Three of them are especially noteworthy. First is Artificial Intelligence (AI) – instead of targeting a specific AI company, we tend to explore opportunities where companies are leveraging the best technology to drive their businesses and gain market share. Second is cloud computing, for the flexibility, efficiency and strategic value it offers to businesses. From a user perspective, the cost calculation of cloud services is often based on usage and needs. It is therefore more cost-effective than advance payment for equipment. Meanwhile, cloud service providers tend to offer value-added services such as disaster recovery services, which are promising income generators. Third, we see tremendous business opportunities in both electric and autonomous vehicles. Such industries contain various high-tech components in their broad value chain, providing investors a wide range of opportunities. In particular, the application of autonomous driving is much more than transportation, it can also be applied to delivery services, which in turn facilitates the vibrant growth of the e-commerce sector.

Question: What is the pandemic’s impact on the technology sector?

Ben Bei: While the pandemic has changed the way we live and work, technology has been at the centre of many of these changes. Working from home and social distancing have become the new norms, which have long-term impacts on certain trends we observe within the sector. There are two categories of technology reliance. The first is consumer-facing technology or consumer-staples-related technology, which includes areas like entertainment, electronic devices, telemedicine, virtual education and communication. Demand has increased substantially in these industries. The second is infrastructure technology, which lays the foundation for consumer-oriented technology to thrive. Take cloud computing for example, which has enabled millions of people to work from home during COVID-19. This migration to cloud services, accelerated by the pandemic, also generates opportunities for next generation encryption and cyber security. That has boosted consumer technology to advance to levels that match our needs. That said, certain industries are hurt by the virus outbreak. One example is digital payments, as many merchants and online travel agencies are having challenging times.

Technology is an ever evolving sector that is embedded in almost every industry in the world. It appears to be disruptive to all sectors but it also rejuvenates them to a more efficient and effective operational model. By looking beyond the traditional definition of technology, our team is well placed to capture opportunities that have and will benefit from emerging tech themes.

Technology is an exciting sector on a robust growing track. It is worth paying more attention to it now.