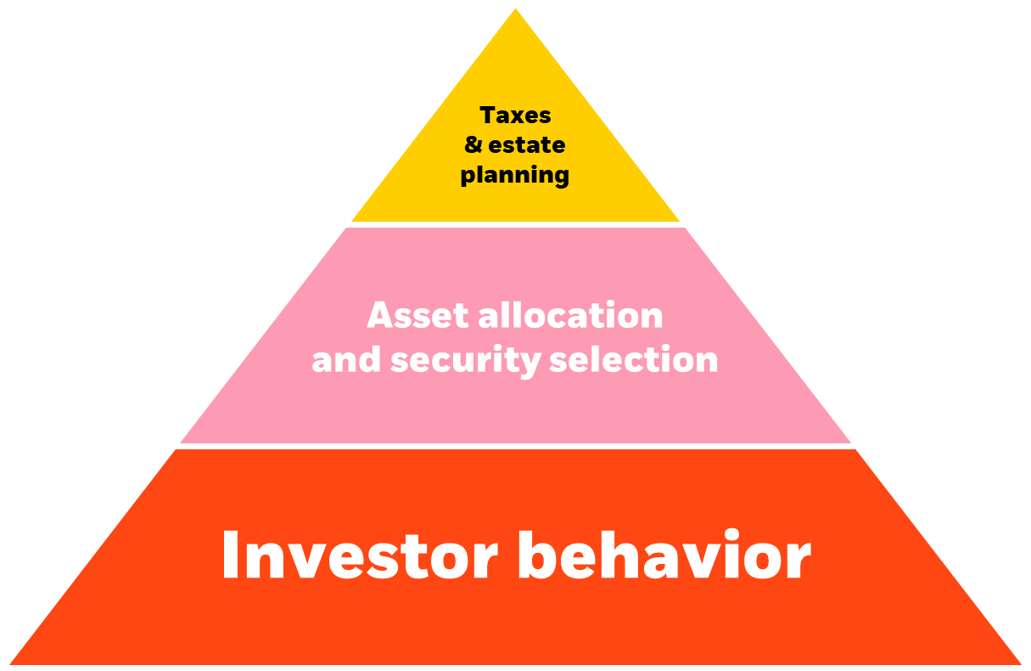

Behavioural Finance

What is behavioural finance?

Use our model portfolios to help clients stay the course

Market volatility can unnerve even the most experienced investors. Using BlackRock Model Portfolios gives you access to low-cost, diversified building blocks, which can help manage volatility and make it easier for investors to stay the course during market turmoil.