We know that in today’s financial landscape, achieving immediate income whilst planning for sustained long-term growth can be a crucial consideration for some investors.

Using a dual strategy of investing for income and growth could provide both financial stability and wealth accumulation. But navigating this investment strategy requires thoughtful consideration of investment options; it’s about making informed choices that align with your financial goals.

Our insights may help guide both the seasoned investor and those just starting out. Uncover the strategies, considerations and opportunities that can enhance your investments.

Work towards financial well-being with BlackRock.

Marketing material.

Income and growth animated explainer intro

An income and growth strategy could deliver both regular rewards and capital growth to your investments. But navigating the nuances of dividends, compounding and market dynamics requires deep understanding and an educated approach to successfully steer your decision-making.

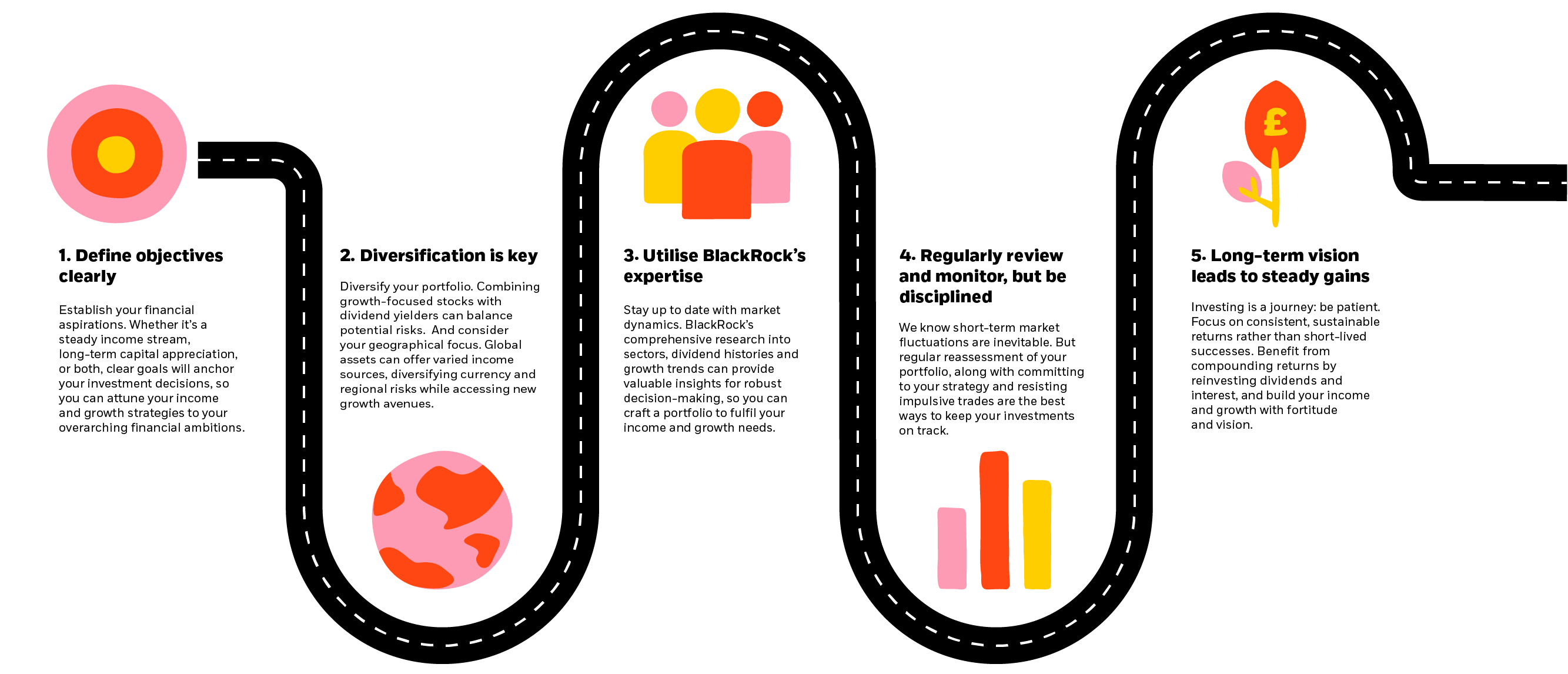

5 fundamentals of an income and growth strategy in investing

From clear goal setting to the power of diversification, leverage BlackRock’s expertise to navigate market dynamics.

We explore the core principles of effective investing, discover the essential steps to balance regular income and long-term growth in your investment journey and provide a clear roadmap for working towards financial well-being.

Diversification: Diversification and asset allocation may not fully protect you from market risk.

Currency risk: Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially.

Research capabilities: There is no guarantee that research capabilities will contribute to a positive investment outcome.

Frequently asked questions

Answers to some of the most commonly asked questions about income and growth investment strategies.

-

The choice between investing for growth or income depends on your financial goals, risk tolerance and investment timeline. If you are aiming for long-term wealth accumulation and are willing to tolerate some risk, a growth-oriented approach may be suitable. Conversely, if you require regular payouts and a more stable income stream, an income-focused strategy may be preferable. Adopting a diversified approach and balancing growth and income objectives to meet specific objectives is always sensible, as is aligning your investment strategy with your individual financial circumstances and goals. You could also visit our Growth Opportunities Hub which contains articles, expert perspectives and more to help determine which investment route may feel best suited to you.

-

The decision to invest in growth hinges on factors that include investment goals, risk tolerance and market conditions. Growth stocks suit those seeking capital appreciation with a high tolerance for risk and a long-term horizon. Value stocks, ideal when the market is undervalued, offer income potential and a more conservative approach. A balanced, diversified portfolio may blend both strategies for optimal results.

-

The key distinction between the two lies in their primary purpose and how they generate returns. Income bonds are designed to provide regular interest payments to investors, offering a consistent income stream, suitable for those seeking predictable cash flow. In contrast, growth bonds prioritise capital appreciation, aiming to increase the bond’s value over time.

-

Income investing can be a good strategy, depending on your specific financial goals and risk tolerance. Income investments can provide a steady cash flow, which may be appealing to those looking for regular payouts. However, it's essential to carefully assess the risk-return profile and align income investments with overall portfolio objectives. Diversification, thorough research, and staying informed about market conditions are crucial elements for successful income investing.

-

While growth-oriented strategies aim for capital appreciation, they come with higher volatility and risk. Growth stocks often trade at premium valuations indicating a business is perceived as more valuable compared to others in the market, and their performance can be sensitive to market fluctuations. In periods of economic downturns, growth stocks may experience more significant declines. Additionally, identifying the next high-growth opportunities requires careful research and may involve a degree of uncertainty.

Income and Growth Investment Trusts

Discover the BlackRock Income and Growth Investment Trusts series – a selection of our investment trusts for growth and income, designed to navigate the dynamic world of investment opportunities.

Risk Warnings

Investors should refer to the prospectus or offering documentation for the funds full list of risks.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Fund-specific risks

BlackRock Energy and Resources Income Trust plc

Counterparty Risk, Currency Risk, Emerging Markets, Gearing Risk, Investments in Mining Securities

BlackRock Income and Growth Investment Trust plc

Counterparty Risk, Gearing Risk, Liquidity Risk

BlackRock Latin American Investment Trust plc

Counterparty Risk, Currency Risk, Emerging Markets, Gearing Risk

BlackRock Sustainable American Income Trust plc

Capital Growth / Income Variation, Currency Risk, Derivatives Risk, Derivative Risk (Derivatives, Options, Covered calls) , Gearing Risk, Investment Trust Disclaimers

BlackRock World Mining Trust plc

Counterparty Risk, Currency Risk, Emerging Markets, Gearing Risk, Gold / Mining Funds.

Description of Fund Risks

Capital Growth / Income Variation

Investors in the Fund should understand that capital growth is not a priority and values may fluctuate and the level of income may vary from time to time and is not guaranteed.

Counterparty Risk

The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss.

Currency Risk

The Fund invests in other currencies. Changes in exchange rates will therefore affect the value of the investment.

Derivative Risk (Derivatives, Options, Covered calls)

The Fund uses derivatives as part of its investment strategy. Compared to a fund which only invests in traditional instruments such as stocks and bonds, derivatives are potentially subject to a higher level of risk.

Derivatives Risk

Derivatives may be highly sensitive to changes in the value of the asset on which they are based and can increase the size of losses and gains, resulting in greater fluctuations in the value of the Fund. The impact to the Fund can be greater where derivatives are used in an extensive or complex way.

Emerging Markets

Emerging markets are generally more sensitive to economic and political conditions than developed markets. Other factors include greater 'Liquidity Risk', restrictions on investment or transfer of assets and failed/delayed delivery of securities or payments to the Fund.

Gearing Risk

Investment strategies, such as borrowing, used by the Trust can result in even larger losses suffered when the value of the underlying investments fall.

Gold / Mining Funds

Mining shares typically experience above average volatility when compared to other investments. Trends which occur within the general equity market may not be mirrored within mining securities.

Investment Trust Disclaimers

Net Asset Value (NAV) performance is not the same as share price performance, and shareholders may realise returns that are lower or higher than NAV performance.

Investments in Mining Securities

Investments in mining securities are subject to sector-specific risks which include environmental concerns, government policy, supply concerns and taxation. The variation in returns from mining securities is typically above average compared to other equity securities.

Liquidity Risk

The Fund's investments may have low liquidity which often causes the value of these investments to be less predictable. In extreme cases, the Fund may not be able to realise the investment at the latest market price or at a price considered fair.