Ready or not.

The competing priorities when saving for retirement

BlackRock dug into the data to look at the complexities of saving for retirement across generations

Not looking too far ahead … yet

57% - Want to enjoy life today rather than stress too much about planning for the future.

9th out of 10 - Being on track for retirement is very low on Gen Z’s list of biggest concerns.

Under considerable pressure

70% - Feel unable to plan for the future, due to current financial pressures.

10th out of 10 - Being on track for retirement is bottom of Millennial’s list of biggest concerns.

The retirement industry’s lost generation?

61% - Are concerned they will outlive their savings.

3rd out of 10 - Being on track for retirement is one of Gen X’s biggest concerns.

Focused on the transition

70% - Feel able to plan for the future, due to fewer financial pressures.

1st out of 10 - Saving for retirement is Pre Retirees number one financial priority.

We focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years.

People feel more uncertain than ever about being on track

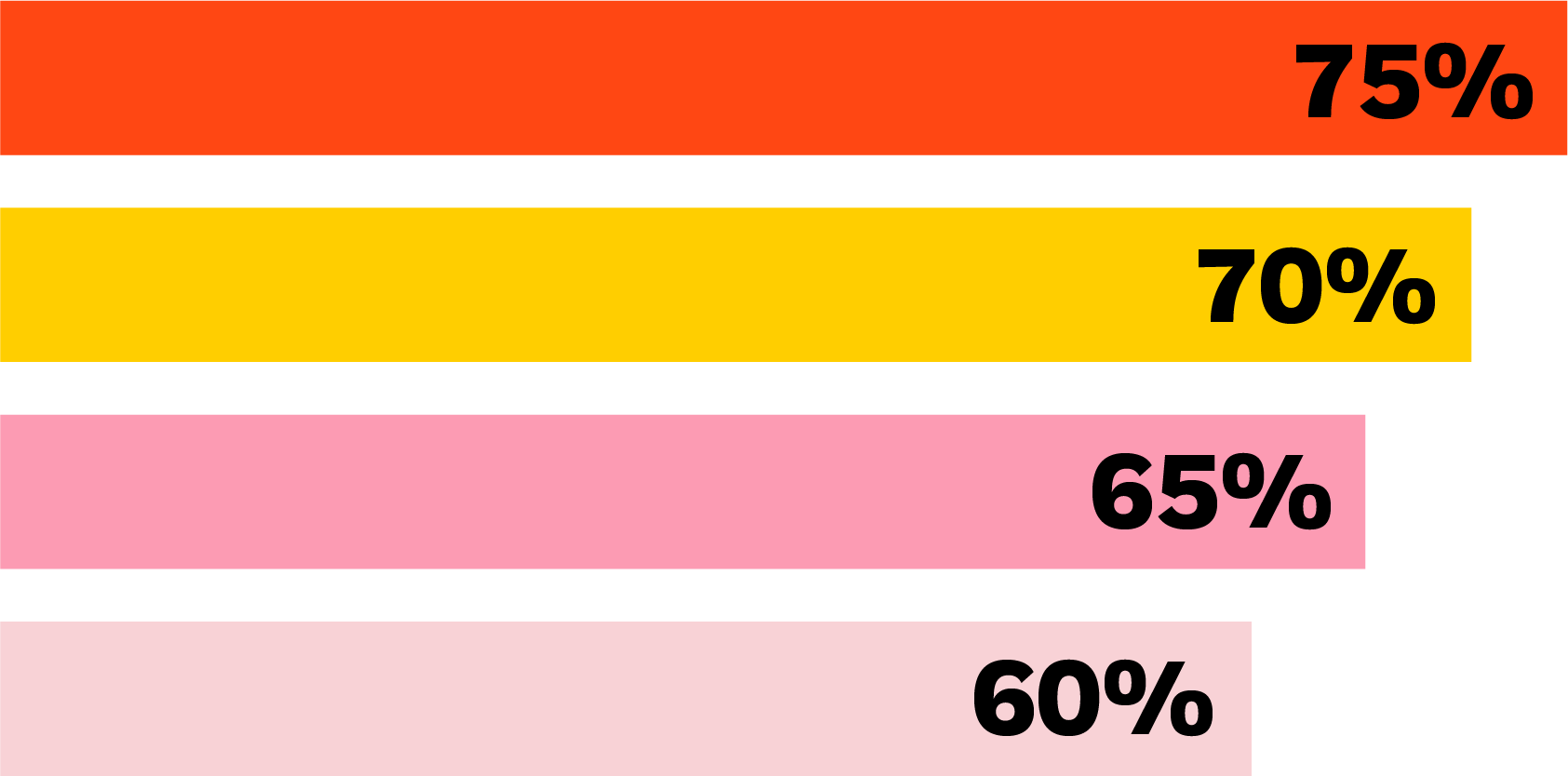

Q: Do you think you are on track to allow you to have a reasonable standard of living in retirement?

Pre Retirees feel most confident about their retirement, but Gen X are most concerned and feel underprepared.

Encouraging better savings behaviours

Q: How important is putting money into a pension, and for each question please tell us how much you agree or disagree?

Pensions are recognised as being the most important – and for many, the only mechanism available to them to try to secure a reasonable standard of living in retirement.

Emergency savings are key

Q: How interested would you be in [ The NEST Insight ‘Sidecar Savings’ Concept ] if that could be offered in your scheme?

Three-quarters of UK participants (76%) would value the flexibility of savings solutions such as the NEST Insight ‘Sidecar’. Gen Z and Millennials are most interested in the idea. Large proportions of both groups have fewer than three months’ ‘rainy day’ savings on which to fall back, and this solution is a ‘win-win’ in this context.

As a concept I really like it. It gives people that comfort that they can save, but the comfort of some liquidity. If they don't want to save into a pension, fine. They lose a tax relief. But we need to get the saving habit developed.

The later life retirement conundrum

Q: Can you tell me whether you agree or disagree with the following?

Participants agreed with the following statements

I would really value help calculating the income I will need in retirement

It’s difficult to know how my retirement pot will translate into monthly income

The thought of having to generate my retirement income worries me

I worry about outliving my retirement savings

Pre Retirees need guidance

Those nearing retirement would value simple information on how much they’ll have and what is best to do with it. More than that, they need solutions that facilitate the journey into decumulation.