Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Any opinions or forecasts represent an assessment of the market environment at a specific time and is not a guarantee of future results. This information should not be relied upon by the reader as research, investment advice or a recommendation.

Earnings deliver

This year has been turbulent for markets, with persistent news about tariffs, geopolitics, inflation and bond yields keeping investors on their toes. Yet global markets rose to record highs as earnings delivered – a reminder that it is company earnings that matter most to equity markets over the long term.1

- Earnings pulled markets higher in Q2 amid volatility

- Banks and aerospace & defence may still have room to run

- AI power demand is driving investment opportunities

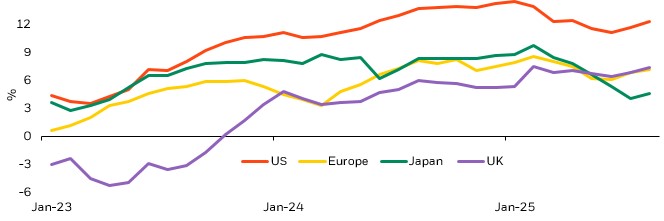

Earnings in both the U.S. and Europe beat expectations, building on the earnings momentum seen over the past 10 quarters (see the chart below). In the U.S., earnings grew 11% and sales were up 6%. In Europe, earnings grew by 5%, while sales fell 0.9% as companies cited a stronger euro as a drag.2

The Q2 earnings season showed that AI investment is powering earnings across the market – and we seek to unearth those opportunities.

Momentum continued for many of the sectors we have highlighted over the past couple of years. In Europe, more than 80% of companies in the financial sector beat expectations. We’re still backing the banks even after the European Central Bank cut rates for an eighth time in June – valuations remain below the long-term average and plans for capital return to shareholders look healthy.3 We also see selective opportunities in the insurance industry due to the appeal of regular income which we see as largely immune to the impact of tariffs.

Companies in the aerospace and defence sectors also powered on in the second quarter.4 We see further earnings upgrades for the civil aerospace companies that specialise in engine maintenance due to a long-term shortage of new planes, and defence companies should continue to prosper amid increased NATO spending.

Another theme we’re excited by – backed up by the Q2 earnings numbers – is AI-driven power demand and the broad selection of companies that may benefit.

Earnings have risen globally

12 month earnings growth estimates for global markets

Source: BlackRock Investment Institute, August 25, 2025. MSCI indices used for each region.

What’s powering earnings?

The AI race has been a powerful source of earnings support – and it’s not just the U.S. tech and chip companies that are benefitting. The large U.S. tech companies known as “hyperscalers” are forecast to spend around US$375 billion on AI capabilities in 2025, according to our analysis of company reports and earnings transcripts. Much of this flows into providers of the AI infrastructure such as data centres, accelerated computing and the cloud. But these processes require tremendous amounts of new power. The International Energy Agency predicts that global energy demand is going to grow by 4% a year until 2027 - equivalent to the total consumption of Japan every year – and much of this is going to be driven by data centres.

This power demand will require investment in all forms of energy, in our view, including clean energy and the massive upgrades and expansions of electrical grids. We believe these areas of the market are under-appreciated and under-priced beneficiaries of the AI race, and the Q2 earnings season supported this view.

Producing the power

Sustainable energy stocks gave double the returns of the broader market in the first half of the year as investors began to realise that a surge in global power demand could lead to pragmatic U.S. energy policy.5 Vestas – the largest listed wind-turbine manufacturer –said in its Q2 earnings report that its order backlog reached a record €67.3 billion at the end of June 2025.6

Despite this recent performance, sustainable energy companies are still trading at a substantial discount to historical levels based on 2Y forward P/E ratios – the “sustainability discount” which we think is an opportunity.7

Delivering the power

Many utility companies have raised long-term earnings expectations due to data centre power demand, and some are signing contracts directly with data-centre owners. As big-tech investment flows towards utility companies, so utility companies increase their own investment in energy infrastructure – which in many cases has led to earnings upgrades.

Three examples from the Q2 season: In the U.S., Entergy announced its third earnings growth upgrade in the last four quarters, and American Electric Power announced a US$16 billion capex increase due to data centre demand in Texas, Ohio and Indiana. And UK-based National Grid announced a record capital investment of £4.6 billion in the first half and is planning £35 billion of investment between 2026 to 2031 to connect large sources of demand such as data centres with new sources of power such as wind and solar.

Upgrading the grid

To cope with this extra power use – and to ensure electricity can get from where it’s generated to where it’s used – a huge investment in global power grids is needed. We see several investment opportunities in the beneficiaries of this grid capex, from energy technology providers to cable makers. Some highlights from the Q2 earnings season: Nexans and Prysmian – both cable makers – upgraded their earnings guidance, and Siemens Energy showed continued strength in gas and grid margins.

The AI race is transforming the investment landscape. We believe that a selective approach combined with a rigorous research process can lead to those opportunities that may – for now – have been overlooked by the rest of the market.

Specific companies throughout this article are mentioned for informational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products.

1 Source: Bloomberg. MSCI World hit record high on September 9, 2025.

2 Source for all earnings numbers: Barclays, August 20, 2025

3 Bloomberg, August 28, 2025

4 Bloomberg, August 28, 2025

5 Bloomberg, July 4, 2025

6 Specific companies throughout this article are mentioned for informational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products. Any opinions or forecasts represent an assessment of the market environment at a specific time and is not a guarantee of future results. This information should not be relied upon by the reader as research, investment advice or a recommendation.

7 Bloomberg, July 4, 2025