Securitised Assets: a better breakeven?

Estimated reading time: 5 minutes

Securitised assets are a growing focus in recent conversations with our UK pension clients. The securitised market includes Asset Backed Securities (ABS) and Collateralised Loan Obligations (CLOs) backed by a variety of receivables and assets, including mortgages, credit cards, auto loans and leveraged loans.

The asset class ticks boxes for schemes for a variety of reasons. Many schemes are already holding a significant corporate bond allocation and are seeking to diversify risk, particularly at current low spread levels. The uplift in quality, liquidity and floating rate nature of most of the securities is also often appealing as schemes consider how to invest surplus assets or prepare for buy-out.

However, with spreads across a variety of credit assets at compressed levels, is now a good entry point and how do the fundamentals of the market stack up?

In this update we dive into recent market developments and why securitised assets have a key part to play in pension scheme asset allocations despite the current low spread environment.

Decomposing the market – Valuations, Fundamentals, Technicals

As the chart below shows, valuations in securitised assets are at the upper end of recent experience, with most sector spreads at close to their tights for the year.

AAA UK/European Securitised Assets versus Corporate Spreads

Source: Morgan Stanley, JP Morgan, Citibank. 27 September 2024. Securitised spreads are based on secondary market spreads and a premium may exist for primary issuance.

This comes despite a record level of issuance coming to the market over the course of 2024, with volumes now at their highest-level year to date since the Global Financial Crisis (GFC). So far, this supply has been met with robust demand, as spreads on offer in other parts of the credit markets are also low, while the all in yield has looked attractive thanks to high bank base rates and the pickup in spread that you typically get in this asset class.

2024 expected to be a record year for UK/European ABS issuance

Source: Blackrock, JP Morgan, 04 October 2024. Other: CDO, Leases.

Alongside this, as we recently wrote about for Investment Grade Corporate Bond markets, the fundamentals in the securitised market continue to look robust. Delinquencies (missed or partial payments due) have remained low and better-than-expected despite the large uptick in rates since 2022.

UK Buy to Let RMBS arrears (30+ and 90+ days)

Source: Moody’s. Data as at May 2024.

In summary, spreads are low despite high levels of supply as yield driven demand and better-than expected fundamentals continue to support the securitised market. Further support is coming from a structural shift in the demand for the asset class as more investors allocate to securitised, drawn in by high all in yields, floating rate exposure and diversification characteristics that securitised assets can offer.

Should you wait for a better entry opportunity for credit assets, including securitised?

Given the valuations backdrop, it is tempting to conclude that it is best to sit on the sidelines and await a better entry level. But history shows that this can be a costly strategy. Long periods of low and benign spreads can occur, for example through much of 2006 and 2007, and there is an opportunity cost to not being invested through lost yield in the interim.

A longer history of corporate bond spreads shows that credit markets can experience extended periods of lower spreads

Source: BlackRock. Data as at 30 September 2024. iBoxx Sterling Non Gilt index.

However, drawdowns can happen when economic conditions turn. While we are not predicting another event on the scale of the Global Financial Crisis (GFC), if you are going to hide out in an asset to earn some yield while waiting for a better entry point, it is sensible to choose something with limited sensitivity to spread moves and a high quality bias.

In the table below we compare the characteristics of an investment in a high-quality securitised portfolio vs. a typical investment grade corporate bond mandate managed on a buy and maintain basis. A breakeven period tells you how long it will take the additional yield earned on the instrument to cover transaction costs or a loss from a change in valuations. Reviewing the breakeven period for costs, these are recouped in a relatively short space of time, meaning returns earned beyond that point are a net benefit. Worries about exit and entry costs should not deter investors from deploying excess capital into credit strategies as the spread carry of being invested will quickly overcome these costs.

But comparing the impact of a 50bps credit spread increase on securitised vs. on a typical Buy and Maintain Corporate Bond mandate, the breakeven period on the securitised portfolio is far shorter at just over one year, reflecting the lower sensitivity to spreads. Following an increase in spreads, a review could be undertaken to consider shifting into longer dated corporate bond spreads to lock these in. But given the history of spreads persisting at lower levels for some time, this breakeven period appears attractive. Securitised could be a good place to wait out for higher spreads in case these don’t materialise for some time. In the interim you continue to earn additional yield and positive carry, but downside risks are more limited.

A better breakeven? Shorter spread duration of securitised assets can offer relative protection in a drawdown

Source: BlackRock. Data as at 01 October 2024. Example portfolios. Entry and exit spreads are subject to change based on market conditions. Does not factor in the potential for defaults. Figures shown exclude the impact of fees and defaults. Illustrative only.

Choosing your spot in the Credit stack

Securitised transactions offer flexibility not typically seen in other markets in the sense that risk is tranched, with a range of ratings on offer allowing investors to choose where they want to be in the capital structure depending on their own risk and return objectives. In a standard structure, any losses are applied from the bottom of the capital structure up, whilst principal is applied from the top down, thus higher rated tranches are typically the most insulated from losses, but earn lower spreads as a result.

As spreads on credit assets have tightened over the past two years, a compression has taken place across the credit stack. The differential between the spread for a AAA asset and a that of a BBB in the example shown below has come in considerably.

Lower rated tranches have experienced spread compression relative to higher quality

Source: BlackRock. Data as at 27 September 2024

In part this is a function of technical factors as we described earlier. Demand for credit has been strong generally thanks to the all in yield levels on offer. In securitised markets supply of lower rated deals is highly constrained, with these making up a relatively small proportion of the market. This has helped to drive the outperformance of the bottom of the capital structure.

European ABS and CLO markets is heavily skewed towards higher quality issuance

Source: JP Morgan, 30 June 2024. Percentage of outstanding, by rating.

Building meaningful portfolios of lower rated public securitised assets that yield in excess of gilts + 2% can be challenging given this lack of supply and requires a powerful sourcing platform and strong relationships with issuers.

The recent spread compression, combined with a lack of differentiation in pricing between deals of varying quality, means that we favour up in quality right now – both in terms of the part of the capital structure, and the credits in which we invest. The strong fundamental picture along with the carry characteristics of the securitised market mean that there are still opportunities to be had at the bottom of the capital stack but credit selection is key. The lack of supply in this space should be acknowledged when considering ramp up speeds.

Looking outside of the UK and Europe, Australia is a market that offers both supply and attractive spreads along with strong issuer credit profiles. It has been a record year in terms of distributed issuance with over AUS$60 billion. This is predominately RMBS followed by Autos with some other consumer credit types. Clearly, from an economic point of view, there are key differences and there are structural features of the market that differ, but overall we think it is comparable to what we see in the UK and Europe and offers very good value.

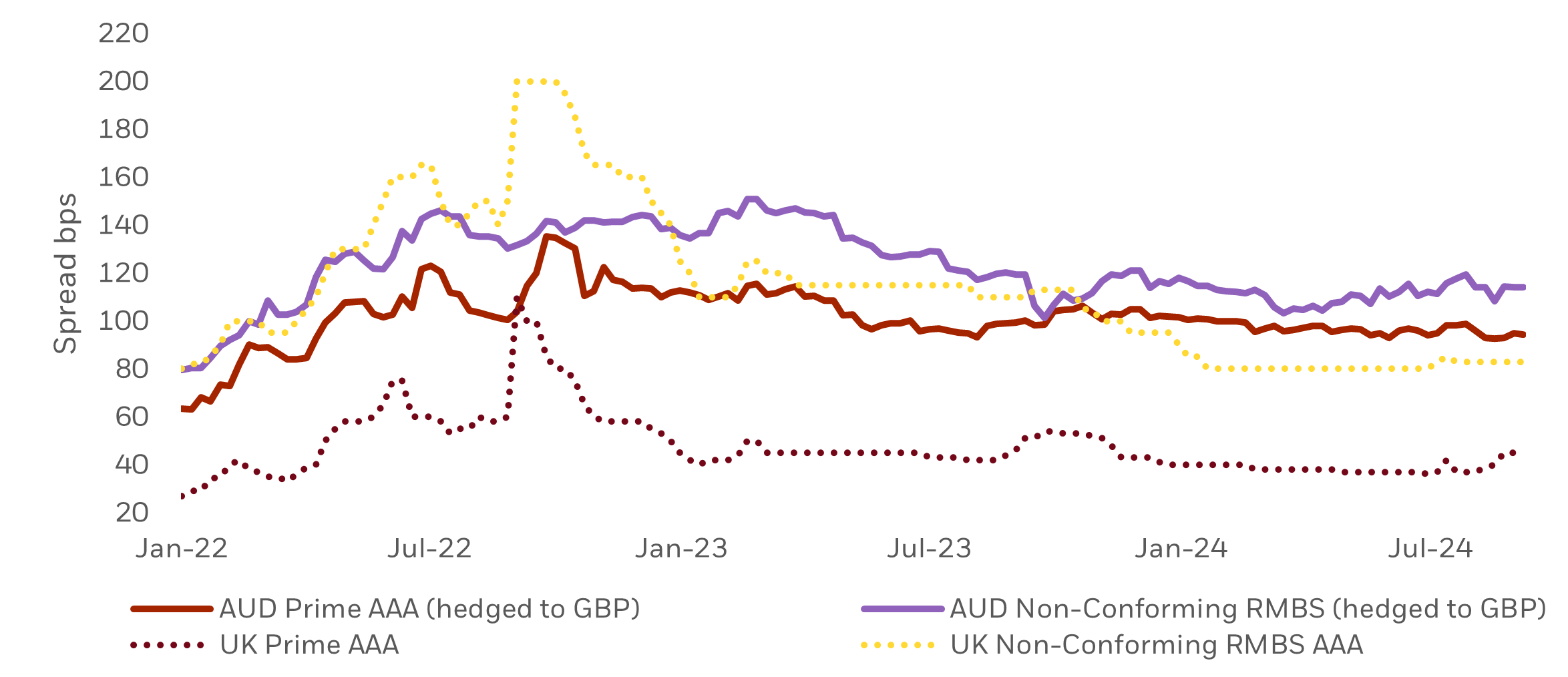

Australian securitised assets can offer a pickup to their UK equivalents

Source: JP Morgan. 4 October 2024.

Securitised as a surplus investment and in the collateral waterfall

Another differentiated attribute of securitised assets relative to traditional corporate bond allocations are that the majority are floating rate. With more schemes finding themselves in surplus but often lacking certainty on how that surplus will ultimately be deployed, this can be an appealing attribute. If the surplus is not used to enhance DB member benefits but instead used to fund DC allocations or even returned to the sponsor, there is no natural need to hedge the surplus in line with the duration of the liabilities. In fact, allocations to corporate bonds may introduce unwanted duration exposure.

As we wrote about in our paper, Keep the Plan, schemes that plan to run on may wish to explore re-risking into growth assets or greater use of illiquid assets if they wish to grow a surplus and have a longer term investment horizon prior to any eventual buy-out. Given the continued uncertainty around regulatory reform and rules on surplus extraction, high quality securitised assets may represent an attractive interim step while further clarity is awaited, and schemes work through their planning alongside their sponsors.

Securitised assets can also form another rung in the collateral waterfall. This is particularly effective when combined with a corporate bond allocation as part of an asset allocation framework, as in the event of additional collateral being required the asset allocation weights naturally steer a rebalancing out of the better performing collateral waterfall asset.

Key takeaways for pension schemes considering securitised assets

- Securitised spreads are low like much of the credit market, but the market fundamentals and levels of demand remain robust.

- There is an opportunity cost to not making further allocation to credit at all and waiting for a better entry point.

- The breakeven point on how quickly you will earn back any downside risk on securitised assets is attractive given the relatively modest spread duration and the risk that credit spreads remain low for some time.

- A higher quality bias appears sensible given the spread compression observed and supply dynamics, but a range of risk and return objectives can be achieved and higher return portfolios constructed with strong sourcing capabilities and some patience.

- Securitised assets are an interesting potential solution for interim surplus investment while long term plans are formalised and regulatory clarity is sought but can also form part of a collateral waterfall.

The opinions expressed are as of October 2024 and are subject to change at any time due to changes in market or economic conditions. The above descriptions are meant to be illustrative. There is no guarantee that any forecasts made will come to pass.

Risks

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2024 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, and iSHARES are trademarks of BlackRock, Inc. or its affiliates All other trademarks are those of their respective owners.