I98 / QK9

iShares MSCI India Climate Transition ETF

-

Fees as stated in the prospectus

Management Fee: 0.65%

• The Fund may invest in India Access Products ("IAPs") being derivative instruments linked to Indian Securities issued by third parties. An IAP represents only an obligation of the IAP Issuer to provide the economic performance of the underlying Indian Security, and is a financial derivative subject to counterparty risk associated with the IAP issuer. The Fund may suffer losses potentially equal to the full value of the IAPs issued by the IAP issuer if such IAP issuer fails to perform its obligations under the IAP.

• The Fund is subject to concentration risk as a result of investing into a single country.

• Generally, investments in emerging markets are subject to a greater risk of loss than investments in a developed market. This is due to, among other things, greater market volatility, lower trading volume, political and economic instability, lack of regulation, greater risk of market shutdown and more governmental limitations on foreign investment policy than typical found in developed markets.

• Prices on the SGX are based on secondary market trading factors and may deviate significantly from the net asset value of the Fund.

Overview

Performance

Performance

Chart

-

Returns

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | -5.87 | 2.31 | 8.79 | 4.50 | 6.60 |

| Benchmark (%) | -6.01 | 4.06 | 11.08 | 6.12 | 8.16 |

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | -8.91 | -6.51 | -11.53 | -16.31 | -5.87 | 7.08 | 52.35 | 55.37 | 230.35 |

| Benchmark (%) | -10.20 | -7.59 | -13.15 | -18.98 | -6.01 | 12.67 | 69.15 | 81.20 | 333.66 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | 12.33 | 22.74 | -9.96 | 16.12 | 6.57 |

| Benchmark (%) | 15.55 | 26.23 | -8.06 | 18.82 | 8.75 |

Represents performance figures for each year ended 31 December, unless otherwise stated.

Note: The Index changed from the MSCI India Index to the MSCI India ESG Enhanced Focus CTB Select Index on 30 November 2022. The performance of the iShares Fund prior 30 November 2022 was achieved under circumstances that no longer apply.

Performance is calculated on a single pricing basis (NAV to NAV) in USD and assumes dividend reinvestment. Change indicates the change since the previous business day. Refer to the Prospectus for more information on determination of Net Asset Value.

Past performance may not be repeated and is no guide for future performance or returns. Performance is calculated on a single pricing basis (NAV to NAV) in base currency, inclusive of all transaction fees and assumes dividend reinvestment. Index returns are for illustrative purposes only and do not represent actual iShares Funds or iShares Trusts performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Key Facts

Key Facts

Index returns are for illustrative purposes only and are not indicative of future results. Index returns do not reflect any management fees, transaction costs or expenses. Change indicates the change since the previous business day's closing index level. Source: MSCI Barra.

The Fund commenced trading in two different currency denominations (i.e. USD and SGD) on 15 June 2012. Please refer to the Pricing and Exchange tab for further information, such as fund identifiers, for each of the trading currency.

Portfolio Characteristics

Portfolio Characteristics

% Cash and Cash Equivalent may include dividends booked but not yet received.

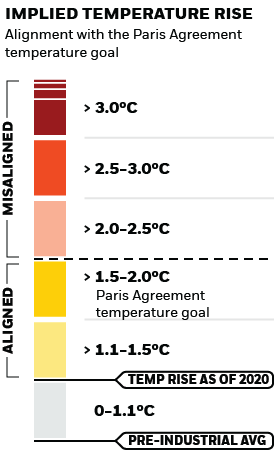

Sustainability Characteristics

Sustainability Characteristics

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

The metrics are not indicative of how or whether ESG factors will be integrated into a fund. Unless otherwise stated in fund documentation and included within a fund’s investment objective, the metrics do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe, and there is no indication that an ESG or Impact focused investment strategy or exclusionary screens will be adopted by a fund. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

Sustainability-related Disclosures

Sustainability-related Disclosures

This section provides sustainability-related information about the Fund, pursuant to Article 10 SFDR.

This section provides sustainability-related information about the Fund.

Ratings

Holdings

Holdings

| Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Shares | CUSIP | ISIN | SEDOL | Price | Location | Exchange | Currency | FX Rate | Market Currency |

|---|

Total allocation percentages shown in the All Holdings tables may not equal 100% due to rounding.

There is no IAP Issuers for this fund as of today. The Fund may use or invest in financial derivatives.

Participating Dealers

Participating Dealers

Pricing & Exchange

Pricing & Exchange

| Ticker | Exchange | Currency | Listing Date | Premium Discount | Premium Discount As Of | NAV | NAV Amount Change | NAV % Change | Price As Of | NAV As Of | Closing Price | Closing Price $ Change | Closing Price Change(%) | 20d Avg Volume | Exchange Volume | Bloomberg Ticker | Bloomberg IOPV | Bloomberg INAV | Bloomberg Shares Out. | SEDOL | ISIN | RIC | Trading Board Lot | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I98 | XSES | U.S. Dollar | 15-Jun-2006 | 0.02 | 25-Mar-2025 | 13.50 | -0.06 | -0.41 | 25-Mar-2025 | 25-Mar-2025 | 13.50 | 0.14 | 1.05 | - | 2,015.00 | 2,492.00 | INDIA SP | I98NAV | I98IV | I98SHO | B174ZJ5 | SG1T41930465 | INDI.SI | 1.00 |

| QK9 | XSES | Singapore Dollar | 15-Jun-2006 | - | - | - | - | - | 25-Mar-2025 | - | 18.05 | -0.16 | -0.88 | - | 9,137.00 | 7,570.00 | INDIAS SP | - | I98IV | I98SHO | B174ZJ5 | SG1T41930465 | INDI-D.SI | 1.00 |