Sustainable and transition investing

TEXT: The world is transitioning to a low-carbon economy.

TEXT: Technological innovation is spreading

Carolyn Weinberg: Wow, so this is the nerve center?

Dickon Pinner: Each one of those is one of these automated trucks?

Alvin Foo: Automated guided vehicles.

TEXT: Climate and transition policy initiatives are driving transformation.

Chris Kaminker: Recent shifts in U.S. policy have sparked a global clean energy race that is creating investment opportunities on both sides of the Atlantic.

TEXT: Companies are transforming and supply chains are evolving

Martin Lundstedt: This is the beauty.

Mark Wiedman: Fully electric!

Martin Lundstedt: Fully electric.

Mark Wiedman: I am driving a proper truck.

Martin Lundstedt: Yeah, yeah, absolutely.

TEXT: The shape of the global economy is changing.

TEXT: And new investment risks and opportunities are emerging.

Anne Valentine Andrews: The low-carbon transition is a once-in-a-lifetime opportunity for our clients and BlackRock has the breadth, expertise and whole portfolio solutions to meet our clients needs.

CONCLUSION

VO: The transition to a lower-carbon world is happening.

VO: And at BlackRock…

VO: We’re ready.

Clients are increasingly asking BlackRock how to mitigate risks to their portfolios, and capture investment opportunities associated with sustainability and the transition to a low-carbon economy. As a fiduciary, we invest on our clients’ behalf to help them meet their investment objectives.

BlackRock’s approach to sustainable investing and the transition to a low-carbon economy is rooted in our fiduciary duty to clients. We start by understanding our clients’ investment objectives and provide choice to meet their needs; we seek the best risk-adjusted returns within the scope of mandates they give us; and we underpin our work with research, data, and analytics.

What is sustainable investing?

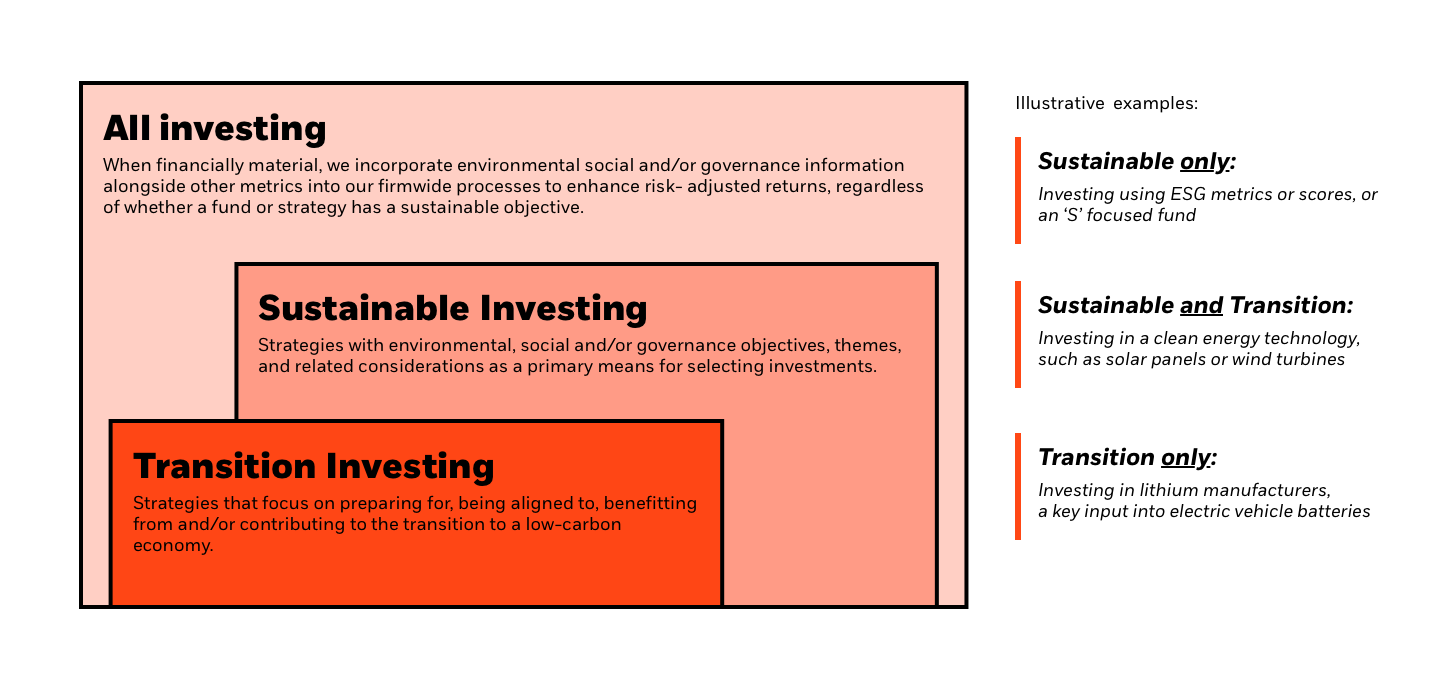

Sustainable investing refers to strategies which leverage environmental, social and/or governance (ESG) objectives, themes, and related considerations as a primary means for selecting investments.

Sustainable investing products

The four categories of the BlackRock sustainable investing platform—Screened, Uplift, Thematic and Impact—adopt different strategies to help investors to meet their investment objectives.

To explore the sustainability characteristics of specific funds, visit the product pages of BlackRock.com and iShares.com.

What is transition investing?

The transition to a low-carbon economy is among a handful of major structural shifts having the potential to rewire economies, sectors and businesses.

Today, not all sustainable strategies are transition, and not all transition strategies are sustainable. By understanding the relationship between these types of investing strategies, investors can identify the products and solutions that meet their objectives.

BlackRock defines transition investing as investing with a focus on preparing for, being aligned to, benefitting from and/or contributing to the transition to a low-carbon economy.

Source: BlackRock, September 2023. For illustrative purposes only. This graphic represents the relationship between sustainable investing and transition investing based on current AUM and may not be drawn to scale. For more information, please refer to our Firmwide ESG Integration Statement.

How is the transition creating investment opportunities?

Structural shifts associated with the low-carbon transition – technological innovation, consumer and investor preferences for lower-carbon products, and shifts in government policies – are reshaping production and consumption and spurring capital investment.

Three forces are driving this economic transformation: 1

This is creating investment opportunities. For example, average annual spend in the energy system through 2050 is estimated to reach US$4 trillion per year, up from US$2.2 trillion over the last decade. 2,3

Transition investing products

- Energy transition partnerships

PSA Singapore Tuas Port

PSA Singapore Tuas Port

Research

We have been at the forefront of helping investors understand the impact of climate and sustainability risk on portfolios. Our team of in-house specialists, including sector specialists and climate scientists, are uncovering insights to power investments.

What is ESG information?

ESG stands for environmental, social, and governance and refers to specific considerations that can be used as part of investment decision-making.

Example ESG information could include:

What is ESG integration?

BlackRock defines ESG integration to be the practice of incorporating financially material ESG data or information into our firmwide processes with the objective of enhancing risk-adjusted returns of our clients’ portfolios. This applies regardless of whether a fund or strategy has a sustainable or ESG-specific objective.

BlackRock has a framework for ESG integration that permits a diversity of approaches across different investment teams, strategies and particular client mandates.

For more detail, refer to BlackRock’s ESG Integration Statement.

Discover the latest sustainable and transition investing insights

Materials contribute to the global emissions problem, but they are also a critical part of the solution.

A material revolution in the energy landscape

We see opportunities as investors pay more attention to climate resilience as an investment theme.

Meet the BlackRock Sustainable and Transition Solutions APAC team

The Sustainable and Transition Solutions team leads BlackRock’s sustainability and transition strategy, drives cross-functional change, supports client and external engagement, powers product innovation, and embeds expertise across the firm.

APAC leadership

What is investment stewardship?

Investment Stewardship is part of how BlackRock fulfils its fiduciary responsibility to our clients to advance their long-term economic interests. We do this through engaging with the companies our clients are invested in, voting proxies for those clients who have given us authority, and encouraging sound corporate governance and business practices as an informed, engaged investor.

In our experience, companies that effectively manage material risks and opportunities in their business models, including those related to sustainability, are better positioned to deliver durable, long-term financial performance. High standards of corporate governance, and strong boardroom and executive leadership, enable companies to be resilient and adaptable through macroeconomic and societal challenges that can impact their financial performance over time.