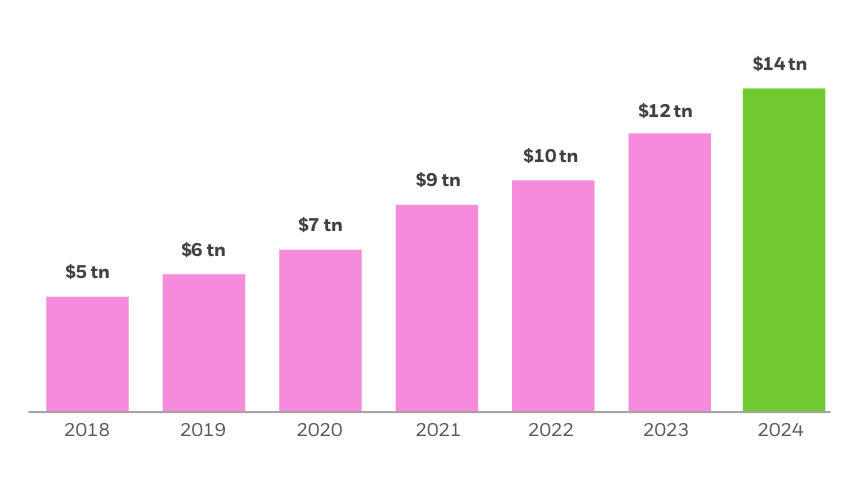

Global ETF assets are poised reach US$14 trillion by the end of 20241.

4 TRENDS DRIVING ETF GROWTH

Examine four ETF growth trends which are likely to carry global ETF assets to US$14 trillion by the end of 20241.

Exchange traded funds (ETFs) have come a long way since the first U.S. product launched in 19932. Since then, more and more investors are recognizing that ETFs are an important tool. What will drive the ongoing growth of ETFs? Take a look at the following trends, which are likely to carry global ETF assets to US$14 trillion by the end of 20241.

EXPECT GROWTH TO ACCELERATE.

Potential global ETF asset growth trajectory

Source: BlackRock, Global Business Intelligence, as of June 2021. In US dollars. For illustrative purpose only. There is no guarantee that any forecast made will come to pass.

WHAT’S DRIVING THIS GROWTH?

Four trends are likely to fuel future ETF growth, especially in the U.S. and Europe:

- ETF investors are active investors

- Investors everywhere are sensitive to cost

- A transformation in the business model for financial advice

- An evolution in the way bonds trade tends to favour ETFs for efficient market access

Let’s examine each trend in detail.

1. ETF investors are active investors.

Forget the “active versus passive” debate. All investment decisions are active ones. We believe that investors are poised to increase their use of ETF strategies as tools to potentially beat the market in the years ahead.

ETFs are increasingly used in portfolios to seek outcomes that differ from the broad market. As investors recognize that asset allocation tends to be more important than individual security selection, they are likely to step up their use of ETFs as building blocks in asset allocation and as vehicles to deliver factor-based3 investment strategies that seek to emphasize persistent drivers of returns.

A spectrum of Investment choices

Source: BlackRock, as of May 2018

2. Investors everywhere are sensitive to cost, and demand quality.

ETF growth is entwined with investors’ embrace of index investments as foundational strategies. Index investing is predicated partly on the notion, popularized in academia a generation ago, that costs associated with stock-picking can erode long-term returns4. It’s an easy concept to understand: the extra small fee that you are paying to a fund manager to pick stocks for you, adds up and will cost you after 5 years, 10 years and 20 years.

ETF adoption dovetails with that recognition by all types of investors. More self-directed retail investors and sophisticated institutions alike are turning to lower cost, diversified ETFs as core broad market exposures.

3. A transformation in the business model for financial advice

Investors are increasingly paying wealth managers a transparent fee based on assets, instead of an indirect fee via brokerage commissions and retrocessions.

The fee-based wealth advisory models are also starting to migrate to Europe. Implemented at the start of 2018, the Markets in Financial Instruments Directive II (MiFID II) shines a light on commissions and retrocessions charged by fund companies, private banks and independent financial advisors. Critically, advisors are now required to disclose all upfront and ongoing fees to clients, and its greatest immediate impact is transparency5.

In the years ahead, we expect to see new demand for lower-cost index products that will bring more adoption of ETFs into advisory. This backdrop could favor ETFs at the heart of portfolios.

4. An evolution in the way bonds trade favors ETFs for efficient market access.

The bond liquidity that many institutions once took for granted is declining6.

We believe there is tremendous growth potential in bond ETFs as institutions find it more difficult to access individual bonds. To facilitate large transactions, investors are increasingly likely to use bond ETFs alongside or instead of single securities.

Bond ETFs also allow efficient trading of bundles of securities that would otherwise be difficult and expensive to access individually. Trading individual emerging market bonds from more than 50 countries can be as much as 65 times more expensive than an ETF tracking an index7.

CONCLUSION

ETFs have come a long way since a first-of-its-kind product linked to the performance of large U.S. stocks hit the market in 1993. Over the past two and a half decades, it appears global investors have recognized the potential benefits of ETFs. This financial technology affords a rich diversity of investment exposures at low cost, along with transparency and liquidity.

On the shoulders of past growth, we think there is tremendous future potential, with global ETF assets poised to reach US$14 trillion by the end of 20241. Four trends have aligned, and together, represent a decades-in-the-making ETF movement that is just beginning.

ETF INSIGHTS

BOND ETFS AND THE PATH TO US$2 TRILLION

Bond ETFs have transformed how all investors access fixed income markets. But the movement is only beginning.