Skip to content

Welcome to the BlackRock site for wealth managers

Before you proceed, please take a moment to review and accept the following Terms and Conditions.

This site is designed for Professional Investors resident in South Africa. We define "Professional Investors" as those who have the appropriate expertise and knowledge e.g. asset managers, distributors and financial intermediaries. You should not use this site if you do not fall within this category.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Alternative investments are essential

New to alternative investing? Here are a few key terms and how we define them at BlackRock.

What is alternative investing?

Alternative investments are assets that don’t fall into traditional categories such as stocks, bonds, or cash. They provide a counterweight for portfolio diversification – and some hard assets may effectively hedge against inflation.

What are the types of alternative investments?

There is private market investing, in assets like private equity, private credit, infrastructure, and real estate, which are traded less frequently than public assets and may offer potential additional returns. And liquid alternatives - hedge funds and listed funds investing in underlying private markets assets.

What is private equity?

Private equity (PE) refers to investments in non-publicly listed private companies. Investors provide the capital to PE funds, which is then invested into these companies, to add value through strategies like geographic expansion, strategic acquisitions, cost optimisation or long-term strategic planning.

What is private credit?

Private credit (sometimes referred to as “direct lending” or “private lending”) is an alternative to bank lending for businesses that want to raise capital. Private credit is a debt that is not issued or traded on the public markets.

What are hedge funds

Hedge funds are the second type of alternative investments and represent a core pillar of our alternatives platform at BlackRock. They are pooled investment funds that are actively managed using complex trading techniques in an attempt to improve performance. These may include leverage, short selling, and derivatives.

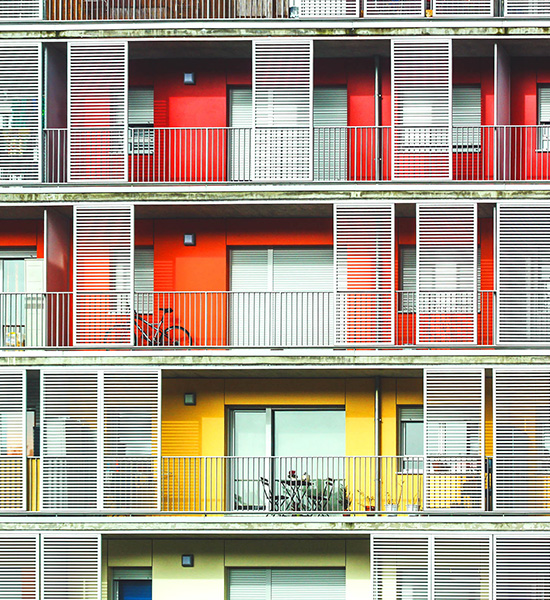

What are real estate & infrastructure?

Real estate (RE) & infrastructure are investments that provide direct ownership of nonfinancial assets, such as infrastructure traditionally controlled by the public sector or real estate. They can be accessed via private markets or listed equity markets.

BlackRock is tomorrow’s alternatives platform

As alternative investments have become increasingly critical, we continue to evolve and innovate our alternatives platform – leveraging our technology, our scale, and our fiduciary model to better serve our clients now and in the future.

$326

Our $326B alternatives platform seeks to deliver outperformance with true partnership1

Increase5000

A firmwide network of 5,000+ investment individuals2

Source

1Source: BlackRock, 30 June 2024.

2Source: Number of professionals include all employees except contingent workers and interns as of 31 March 2024.

3Source: BlackRock, 20 August 2024.

4Source: Figure refers to eFront platform While proprietary technology platforms may help manage risk, risk cannot be eliminated.