The New Infrastructure Blueprint

A global opportunity

Taken together, these forces require an enormous amount of new infrastructure, from super batteries and hyperscale data centers to modern logistics hubs and upgraded airports.

We explore the major structural forces driving what’s poised to be a transformational moment in infrastructure investing. And we dive into the various ways capital can invest in the opportunities that we’re seeing today as well as the ones we’re expecting, and how investors can incorporate the asset class into their portfolios.

A changing world

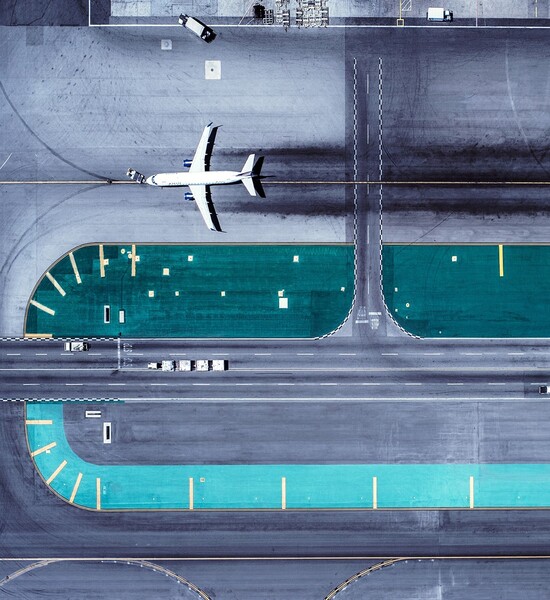

Infrastructure sits at the intersection of the trends transforming the world we live in. It’s the cell towers and fiber internet that power the digitization of business and everyday life. It’s the new land, air and sea transportation facilities that support global supply chains as they reconfigure.

More broadly, it’s the new and upgraded infrastructure across transportation, energy, communication and other services required by a growing and urbanizing world population.

Rising working-age populations make EMs like India key targets for infrastructure and energy investment.

Data use is surging and will keep rising, especially with the growth of artificial intelligence.

Urban expansion means enhanced infrastructure across multiple sectors. Among other things, cities require more electricity, expanded telecommunications networks and essential water and sanitation systems.

Source: The BlackRock Investment Institute

Source: McKinsey & Co: Expanding data center capacity to meet growing demand, October 2024.There is no guarantee that any forecasts made will come to pass.

Source: World Bank, “Urban Development Overview,” April 3, 2023

A new era for energy

An increasingly digital and urban population requires more electricity, while nations work to lower carbon emissions and strengthen their energy security.

The financing gap

Governments have traditionally built and maintained infrastructure, but with national debt tripling since the 1970s, it’s unlikely they can fund it alone. The situation requires a strategic pivot. And private investors are meeting this need, led by large pensions and sovereign wealth funds who are attracted by the stability, long duration and inflation-protected potential returns of infrastructure assets.

At the same time, for companies around the world infrastructure is just one of many demands on their resources – and is often not their core business consideration. A private investor can work with corporates, allowing firms to focus on their strategic priorities.

What it means for investors

The infrastructure moment is a growing opportunity for investors. It encompasses a wide range of investment options and sectors, and it can play a variety of roles within a portfolio.

A wide array of opportunities

Private investors have the chance to be at the center of a transformative period for essential infrastructure. The opportunities range from partnering with governments to build physical assets to joint ventures with infrastructure operators, as well as bespoke debt structures.

Diversification in a portfolio

Infrastructure has historically had a relatively low correlation to traditional asset classes due to its idiosyncratic characteristics – it typically doesn’t move in step with economic cycles and its service contracts are often inflation-linked.

Stable investment

As an asset class, infrastructure has traditionally been known for its stability. Many projects involve essential services that remain in demand regardless of economic conditions, and which generate steady, regular and predictable cash flows.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

The Bid “Rebuilding The US Physical Economy”

Episode Description:

A critical theme for 2025 and beyond rebuilding the US physical economy with the Infrastructure, Investment and Jobs Act, and other policy measures, there's a renewed focus on enhancing infrastructure, reshoring manufacturing and addressing the housing supply gap.

These efforts are not just about construction and development. They're about revitalizing the US economy and creating sustainable economic growth. Joining Oscar is Jay Jacobs, US head of Thematic and Active ETFs at BlackRock. Jay will provide insights into the demographic trends influencing the housing market, the reshoring of manufacturing, and the bipartisan support for these developments

Sources: New York Governor. 'Governor Hochul Announces $54 Million in State Funding to Support the Second Avenue Subway Project.' 7/30/2024; Reuters. 'JFK Airport's massive overhaul takes winding route through debt markets.' 12/6/23; Department of Transportation. 'Hudson River Tunnel Project between New York and New Jersey.' July 2024; American Society of Civil Engineers. 'ASCE'S Infrastructure Report Card Gives U.S. 'C-' Grade, Says Investment Gap Trillion, Bold Action Needed. 3/3/2021; Report Card for America's Infrastructure. 'Overview of Bridges.' 2021; MRL Consulting. 'Semiconductor in everyday life: products from leading companies you use daily.' 7/31/24; Center for Strategic and International Studies, “Mapping the semiconductor supply chain: the critical role of the indo-pacific region,”5/30/2023; Semiconductor Industry Association. 'America Projected to Triple Semiconductor Manufacturing Capacity by 2032. The Largest Rate of Growth in the World.' 5/8/24;

Realtor.com, “U.S. housing supply gap grows in 2023; growth outpaces permits in fast-growing sunbelt metros,” 2/27/2024; Motley Fool Money. 'Millennial Home-Buying and Homeownership Statistics.' 9/10/24; CNN. “More than half of American renters who want to buy a home fear they’ll never afford one.' July 29, 2024; Merrill Lynch. 'Will the 'Great Wealth Transfer' transform the markets?' May 2024.

Written disclosures in each podcast platform and each episode description: This content is for informational purposes only and is not an offer or a solicitation. Reliance

upon information in this material is at the sole discretion of the listener. Reference to the names of each company mentioned in this communication is merely for

explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies.

In the UK and Non-European Economic Area countries, this is authorised and regulated by the Financial Conduct Authority. In the European Economic Area, this is authorised and regulated by the Netherlands Authority for the Financial Markets.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

<<THEME MUSIC>>

<<TRANSCRIPT>>

Oscar Pulido: Welcome to The Bid, where we break down what's happening in the markets and explore the forces changing the economy and finance. I'm Oscar Polito.

Today we're diving into a critical theme for 2025 and beyond rebuilding the US Physical Economy with the Infrastructure, investment, and Jobs Act, and other policy measures, there's a renewed focus on enhancing infrastructure, reshoring manufacturing and addressing the housing supply gap. These efforts are not just about construction and development. They're about revitalizing the US economy and creating sustainable economic growth.

Joining me is Jay Jacobs, US head of Thematic and Active ETFs at BlackRock. Jay will provide insights into the demographic trends influencing the housing market, the reshoring of manufacturing, and the bipartisan support for these developments.

Together we'll explore the impact of these initiatives on the US economy, the key areas of investment, and the role of private and public sectors in driving these changes.

Jay, thank you so much for joining us on The. Bid.

Jay Jacobs: It's a pleasure to be here, Oscar,

Oscar Pulido: And welcome back. It was just a short while ago that we had John talking about artificial intelligence, but today we're going to talk about the US economy. So, we'd love to hear, what your views are of the US economy, and you're using a term, the US physical economy in your conversations these days. What does that really mean?

Jay Jacobs: I actually think it's a really good juxtaposition with artificial intelligence because AI is really about the digital economy, we think about data, we think about processing that data, turning it into everything from poems to computer programs, to stories that you can create using artificial intelligence. But all of that's happening in the digital world.

At the other end of the spectrum is the physical economy, the actual shovels in the ground, building things in the US that are really important to our day-to-day lives. We think about the houses we live in; we think about the roads that we drive on, or the airports and the rails that we travel through. We think about the factories that are building things in the United States. All of this really encompasses the physical economy in the United States, which as much excitement as there is around artificial intelligence and digitalization, the physical economy is incredibly important to driving the US economy and our everyday lives.

Oscar Pulido: And when you're saying physical economy, I can't help but think of the word infrastructure. I think that's, maybe the word that describes also the physical economy. And I know that a couple years ago there was a bipartisan bill enacted The Infrastructure, Investment and Jobs act. So how has that impacted the infrastructure, investment and development in the US over the last few years since it was rolled out? Jay Jacobs: Well, it's been a major accelerant, and I think one of the things that that bill highlighted is that infrastructure is actually a very universally held need by the United States. It's not very partisan.

This is something that people across the aisle agree with. It's what people agree with at different levels of government. This is not just about the US Federal government; this is about state. This is about local, and it's also something that private companies feel very strongly about as well. And you've seen a lot of private investment in infrastructure. So, I think this bill, this landmark bill, the IIJA which earmarked about $1.2 trillion - the largest bill ever to be invested in US infrastructure - really serves as an accelerant for a broader theme around rebuilding the United States' infrastructure. What do we mean by that?

Well, if you take a step back, the American Society of Civil Engineers gave the us a report card rating of a C minus in infrastructure, not a very good grade. That was a few years ago, and I think a lot of that spurred this realization that our roads aren't great, our highways aren't great, our bridges aren't great.

Oscar, I'm going to put you on the spot. Do you know how many bridges there are in the United States?

Oscar Pulido: Boy, you are putting me on the spot. I'm going to say 3000,

Jay Jacobs: 600,000. Do you know how many are structurally deficient?

Oscar Pulido: I'm going to say 75% of those,

Jay Jacobs: That's a little high, but about one in 13 bridges is structurally deficient, which any amount, which should be worrisome.

But it highlights that a lot of our infrastructure, which was built many decades ago, has just been under invested in and needs these trillions of dollars to be spent to bring it up to speed. The impact on the economy can be tremendous if we have less structurally deficient bridges. If we have more efficient airports, if we have more lanes and highways, people can spend less time and traffic, and goods can spend less time getting from point A to point B. And it can really serve as this grease in the American economy engine to move things faster and more efficiently around the country.

Oscar Pulido: I learned that I need to spend more time learning about the US infrastructure. You've taught me that. you also mentioned the C minus grade, that was given to the us, which is. I think technically below average is what that grade means. So, it's clear that there's more investment needed in infrastructure in the us You mentioned private companies, and we've heard from our partners at Global Infrastructure Partners or GIP discuss that private companies have a big role to play in the infrastructure development, the investment opportunity. So, what role do private investments play in accelerating these projects in the us?

Jay Jacobs: Well, it's another really important source of funding for building infrastructure in the United States. So, let's just take New York for example, and some of the projects that have been happening around Hudson Yards and around BlackRock's headquarters here. If you look at the seven train extension, which brings a lot of people to work every day, that was actually mostly funded by New York City. If you look at the Second Avenue subway extension, that is largely being funded by New York State as well as the Infrastructure Investments and Jobs Act. If you look at some of the airports in New York, LaGuardia and JFK, a lot of that funding is coming from private companies predominantly. So, if you just look at the infrastructure around this area, you're seeing city, you're seeing state, you're seeing federal, and you're seeing private money, all to really reinvigorate, infrastructure in the area. And frankly, over the last 15 years or so, I think infrastructure has been a lot better in New York and other cities are starting to experience that boom as well.

Actually, under us right now is the Hudson tunnel project, which is going to, double the amount of train tracks that basically connect New York to New Jersey. That's a $16 billion project, which is largely funded by the Infrastructure Investments and Jobs Act as well. So, we're really surrounded by a lot of these major infrastructure projects, but a lot of them are getting money from different sources to really create a mosaic of money to coming in to fund very expensive infrastructure

Oscar Pulido: And you highlighted a few projects in the New York City area, so in some cases, funded by government and in some cases funded by private companies. I have seen the barges on the Hudson River that, are part of what are developing those tunnels that you mentioned as well. So, when we think about in 2025, what are some of those additional areas that you think are going to see significant, investment and improvement maybe outside of New York City?

Jay Jacobs: We really think about it as two buckets. You have infrastructure operators. These are the existing infrastructure that operate today. You could think about airports, you could think about toll roads, you could think about seaports and train tracks the existing operators of that infrastructure.

Today, we'll tend to benefit from a few things. One, we're seeing some falling interest rates, which tends to be positive for kind of these cash flowing infrastructure projects. But also, they could benefit from additional dollars from the infrastructure investments and jobs act and private spending. Now, the other bucket that I think is really interesting is the infrastructure enablers.

This consists of construction engineering companies that are helping to build this infrastructure. It consists of materials, everything from copper and cement and steel that's being used to build this infrastructure as well. These companies tend to be big beneficiaries when there's more money being spent when you need to build and repair infrastructure.

Those materials and those construction companies have to come in and build it. So, we're really looking at kind of those two distinct buckets, the operators and the enablers as two areas that could benefit from this infrastructure boom.

Oscar Pulido: When you say enablers, I'm thinking back to that conversation you and I had about AI, which is that investing in AI as a theme isn't just companies that are making the chips, for example. There are other related sectors and companies that therefore benefit from the theme. And so, it sounds like the enablers are along that thread as well that there are sectors and industries outside of just purely infrastructure defined that are going to benefit from this broader build out.

Jay Jacobs: It's a tremendous callback. When we think about thematic investing, what we really want to do is look at the entire value chain of opportunities and sometimes there's a narrow view of what is an infrastructure company and then there's a broader view of what are the companies around it that benefit.

And that's exactly right. When we think about infrastructure, those enablers are the broader lens of who benefits from this theme of infrastructure.

Oscar Pulido: Speaking of themes, one of the other themes that we've explored with guests and talked about is nearshoring and reshoring, which is a reflection of changes in the supply chains, globally, particularly post the pandemic in 2020. So how is that trend in manufacturing expected to benefit the US economy? And are there any legislative measures in place that are supporting this?

Jay Jacobs: Exactly. If you think about infrastructure as literally paving the road for goods to move across the country more efficiently, then the next layer up is who's building those goods, and that's coming to the manufacturing, the factories in the United States that frankly hadn't experienced a lot of growth over the last few decades but are starting to see a bit of a resurgence.

In fact, the amount of construction spending on factories in the US has tripled in the last four years. There's a lot more money being spent to build factories here in the US. And you mentioned it, a lot of it is post pandemic. We realized during Covid that there was a lot of supply chain risk with globally integrated supply chains.

And if you can't get goods across the world into your country, it can really slow down economic growth, but also, you're seeing more geopolitical fragmentation where, in a lot of ways it's more politically popular to be building more things in the United States as well. So, both of those mega forces are really combining to power, renewed interest in manufacturing in the United States.

The way that we see this playing out is in certain bills. The Chips and Science Act, which passed a couple of years ago, that is designed to bring tens of billions of dollars into funding the build out of semiconductor fabs in the United States. Why is this important? On one hand, almost everything we buy today has a semiconductor in it. In fact, even if you buy a toaster, probably has a semiconductor in it. So, it's a really important ingredient into all the goods that we want to make in the United States. Then secondly, this is an industry that has some of the most, geopolitical integration of any supply chain out there. The average semiconductor crosses 70 borders before it ends up in your cell phone to use on your everyday basis.

So, if one of those borders is closed or if there's a weather event or if there's anything that could disrupt the movement of that good. It presents challenges to the economy. And so, it's been, very clearly made a strategic priority by the United States to say, we want to control more of the semiconductor supply chain.

We're going to pass a bill with tens of billions of dollars to support the build out of these factories, these fabs, to build those semiconductors. And now we've already seen over 80 projects be announced in the United States to build semiconductors here. So, I think it's a really good thread between there's a need. There's a policy and there's an impact of building semiconductors in the United States again,

Oscar Pulido: And that's a really powerful visual. I'm picturing the semiconductor traveling around the world. You said 70 borders and it's so critical to our everyday lives. You said pretty much in a lot of the goods that we consume. So important for it to cross less borders so that we can get it into the economy quicker. One of the topics, Jay, lately in the US is around housing supply and the lack of housing supply. So, talk to us a little bit about how is that gap being addressed, in the US what measures are being taken that you see from your perspective?

Jay Jacobs: If you look at, really the last 10 years or so, there was about 17 million families formed and only about 10 million houses built. So, it's a really simple supply and demand problem of. You have a lot of demand, not enough supply to keep up with it.

So, it's caused all kinds of issues in the housing market. We see housing prices are still extraordinarily high. You wouldn't expect that in such a high-interest rate environment. But that's the case because demand continues to push that dynamic forward. we saw in this election cycle that both parties were really talking about housing as a topic that has been elevated to the federal level.

Again, this is a topic that it transcends all levels of government. It transcends both the public and private sphere. When you have a supply and demand and balance and it's impacting individuals, there's a lot of different ways that you can address it. Both through federal funding, through regulation, through private investment, all of those things can come together to really help solve this issue, and I think we're starting to see movement in that space for this year and beyond.

Oscar Pulido: You mentioned 17 million households formed and 10 million new homes. And what was the time period again?

Jay Jacobs: This was from 2012 to 2023.

Oscar Pulido: Okay. So basically, a little bit over the past decade there, there's that gap between supply and demand. So, are there demographic trends that have been driving that gap? Do you think those are going to continue playing out in 2025?

Jay Jacobs: The biggest thing here is the rise of the millennial generation. This is the largest generation by number of people in the United States. but if you compare them to baby boomers, only about four in 10 millennials own a home, whereas at the age of 30, about five in 10 baby boomers owned a home.

So, there's a pretty big difference in terms of home ownership with millennials. A lot of this has to do with affordability. 86% of renters say they would like to buy a house if they could afford it, but they can't. So, you have this very large generation that would like to buy houses, but largely is unable to afford them.

And as millennials continue to do more household formation, continue to see increasing wages as they progress through their careers, maybe even accumulate money through the passage of potentially $40 trillion from the baby boomer generation to millennials, you're going to see more and more demand for housing from this millennial generation.

Oscar Pulido: And, you touched on interest rates briefly, before, and the fact that, despite the fact that, interest rates have been high and they've started to come down a bit, but they've been high over the past couple years and, housing prices have remained high, which is counterintuitive, but it goes to show that there is just, so much demand for housing and not enough supply, and that's been driving that. So now that rates have started to come down in recent months. Does that help the housing market? Is that enough to start to relieve some of these pressures?

Jay Jacobs: There's kind of two fronts where it could help. On one front, on the home builders’ side, that a lot of these companies or even just individuals that build homes, have to get construction loans to be able to fund that building.

So, with lower interest rates, easier to get that funding less expensive. You should see that be additive to building more homes. On the other hand of the spectrum, on the demand side, lower interest rates can make it more affordable from a mortgage perspective. So, if we can see both supply increase from lower interest rates and demand increase, again, we think this should really propel both the public and private sphere to be able to respond to this growing housing shortage issue.

Oscar Pulido: When you talk about housing, we talked about infrastructure, again, the theme here being the physical economy in the US. What does this all mean for an investor in their portfolio? How should they be thinking about positioning for this theme?

Jay Jacobs: Again, I think this is a really good contrast to artificial intelligence, which is one of the other themes that we mentioned in our 2025 thematic outlook.

The view here is that not all themes are growth companies. Not all themes are technology companies. A lot of structural changes that we're seeing around the world impact what we would consider more value-oriented companies that come from value sectors, like materials like industrials, like utilities, companies even. So, you don't just have to think about technology as the way to play high growth. There's really some kind of interesting areas. Within the value end of the spectrum where you can still see structural tailwinds, propelling, long-term, returns going forward.

Oscar Pulido: And that's what you're describing is the broadening of the market. What we have talked a lot about the dominance of the Magnificent Seven, the tech sector and the outperformance and the concentration that it has in many indices. but quietly, over the past, several months there have been other sectors that have started to really participate in the gains of the stock market. And what you're suggesting is that maybe that's going to continue?

Jay Jacobs: That's exactly right. This is, obviously we've seen some tremendous innovation in technology, and we continue to expect that to be a major mega force going forward, but it's very narrow to just look at thematic structural growth opportunities through that technology lens.

This is why we think about mega forces through our five mega forces framework, which includes AI and digital disruption, but also looks at demographic divergence. And I think demo, as we were mentioning, demographics is a huge part of this physical economy trend. It's why we look at a megaforce like geopolitical fragmentation, which is impacting things like supply chains.

A transition to a lower carbon economy where we're seeing changing energy production as well as the future of finance and the changing role that asset managers and digital assets are playing in financing and in the capital markets. So, this is why we have a five mega forces framework. It's not just about technology. There are a lot of structural trends powering growth going forward.

Oscar Pulido: And it's consistent with what Jean Boivin, talked about when we had him on talking about the outlook for 2025. Is that. One of the recommendations, his team is talking about is thinking about the world through themes and not just through asset classes. And you've nicely laid that out. Jay, it's always great talking to you. I hope at some point when you come back, you'll tell us if the C minus report card has improved. I know it might take a little bit of time, but maybe the next time you're on, we'll see where we are. Jay, thank you for joining us on The Bid.

Jay Jacobs: Great to be here, Oscar.

Oscar Pulido: Thanks for listening to this episode of The Bid. If you've enjoyed this conversation, check out Jay's previous appearance on The Bid. How to invest in AI versus tech in a portfolio. And don't forget to subscribe to The Bid wherever you get your podcasts.

<<THEME MUSIC>>

Spoken disclosures at end of each episode:

This content is for informational purposes only and is not an offer or a solicitation. Reliance upon information in this material is at the sole discretion of the listener. In the UK and Non-European Economic Area countries, this is authorised and regulated by the Financial Conduct Authority. In the European Economic Area, this is authorised and regulated by the Netherlands Authority for the Financial Markets.

For full disclosures go to Blackrock.com/corporate/compliance/bid-disclosures

Rebuilding the U.S. physical economy

Jay Jacobs, U.S. Head of Thematic and Active ETFs at BlackRock joins host Oscar Pulido to explore the impact of infrastructure investment initiatives on the U.S. economy, the key areas of investment, and the role of private and public sectors in driving these changes.