Index Investing

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Why BlackRock for index investing?

For UK institutional investors, the indexing landscape has evolved considerably over the past decades. Extracting every unit of return for a given amount of risk is crucial, and barbelling of asset allocation across index and more complex alphas such as private markets is a trend that continues to deepen.

|

Index mutual funds: |

Professionally managed funds which pool the money from many investors and invest it in a portfolio of assets constructed to track the performance of a particular market index, such as the FTSE 100 or the iBoxx GBP Non-Gilt Index. |

|

Separate accounts: |

Investment vehicle that offers the same investment opportunities as a mutual fund, but instead gives the investor direct ownership of the securities in their account, with the potential to customise elements of the managed strategy. |

|

Exchange traded funds (ETFs): |

An ETF is an investment fund that invests in a basket of stocks, bonds, or other assets. ETFs are traded on a stock exchange, just like stocks. Investors are drawn to ETFs because of their low price, tax efficiency and ease of trading. ETFs are often compared to index mutual funds given their similarities, yet ETFs have the potential to offer:

|

Historically, index mutual funds and market cap weighted indices have been the mainstay for index investing amongst pension schemes, insurance companies and other institutional investors. However, over time indexing has evolved, with the ETF market growing significantly, particularly over the past decade, from under US $1tn in 2009 to over US $10tn today.1 Institutional investors are now increasingly turning to ETFs as an investment tool to help with a series of investment portfolio challenges.

Indexing has also evolved from an exposure standpoint, with single countries, sustainable investing options, factors, ESG, sectors and currency hedged share classes now widely available.

1 BlackRock Global Business Intelligence, 28th September 2023

How ETFs aid portfolio outcomes in a regime requiring flexibility

Fixed income

Adoption of fixed income ETFs has accelerated in recent years, with AUM in global fixed income ETFs growing from $867B to $2T over the past five years.2 We forecast global fixed income ETF AUM will reach $6T by 2030, equivalent to 3% of the fixed income market.3

There is no guarantee that any forecasts made will come to pass.

Macro-driven market volatility and challenging liquidity in underlying corporate bond markets has seen trading in fixed income ETFs surge in recent years. Industry-wide fixed income UCITS ETF traded volumes have doubled since 2018.3

BlackRock is a leading provider of indexed fixed income investments,4 with iShares offering 140+ products across ETFs and index mutual funds in EMEA (as of November 2023). An extensive range of fixed income ESG ETFs also help investors meet ESG integration requirements. In an increasing number of institutional portfolios, fixed income ETFs are used for both tactical and strategic asset allocation, as well as in liquid beta sleeves.

Risk: There can be no guarantee that the investment strategy can be successful, and the value of investments may go down as well as up.

2 BlackRock Global Business Intelligence, 24th October 2023. All data in USD ($).3 BlackRock as at 31st August 2023.4 Morningstar, as at January 2023.

The transition towards a sustainable future

Sustainable investing is no longer a niche area. Assets in dedicated sustainable investing strategies have grown at a rapid pace in recent years. This demand looks poised to accelerate — driven by societal and demographic changes, increased regulation and government focus, and greater investment conviction.

At BlackRock, we are committed to supporting you on that journey, navigating and driving the transition to a low-carbon economy in line with your specific needs and objectives.

Our sustainable investing platform, provides choice to meet investor needs through our Sustainable & Transition Investing Investment platforms. We offer a diverse range of investment products, consisting of 80+ ETFs and index mutual funds (as of 30 November 2023). This extensive selection enables clients to invest according to their specific sustainable investment goals and objectives. Additionally, our sustainable investing platform ensures a consistent approach to investing across asset classes. This approach is based on environmental, social, and governance (ESG) criteria and promotes responsible investment practices.

Risk: This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This is for illustrative and informational purposes and is subject to change. It has not been approved by any regulatory authority or securities regulator.

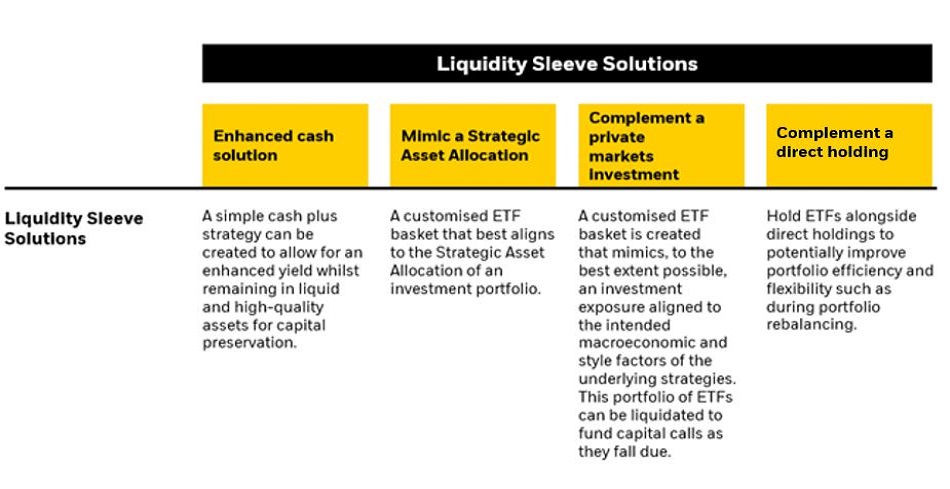

Liquidity sleeve solutions

ETF liquidity sleeves are a combination of ETFs, designed to enable investors to set aside a portion of their portfolio to be liquidated quickly if the need arises, aiming to solve the issue of excess cash without compromising on other investment objectives, returns, or liquidity. This allows investors to build deliberate asset allocations while retaining the ability to quickly access to cash when needed.

The liquidity and lower transaction costs of ETFs support liquidity management. A customised ETF basket can be created, that can range from a simple cash plus exposure, all the way to mimicking an exposure best aligned to the macro and style factors of the underlying alternatives strategy. The portfolio of ETFs can then be liquidated to facilitate multiple cash or portfolio allocation requirements as they fall due.

Reach out to our Portfolio Analysis & Consulting team for further details.

Tactical asset allocation

With higher market volatility expected in the new macro regime, investors need to be nimbler in their tactical asset allocation and have the toolkit to be flexible in the implementation of their investment views. ETFs offer a simple and cost-effective way for investors to implement tactical asset allocation strategies, allowing them to adjust their portfolios quickly and efficiently based on their short-term market outlook.

Precise market access

ETFs offer a more granular range of exposures than our index mutual funds which typically offer broader sector exposures, offering institutional investors the opportunity to use this granularity to target specific sectors, countries and factors.

How ETFs are broadening investment avenues for institutional investors

In this paper, we examine the ETF market from the perspective of asset owners and discuss common uses of ETFs with a special focus on fixed income. Read here

ETFs Role in Pension Risk Transfers (For Insurers)

As pension schemes approach their endgame, one of the options often considered is buying out the liabilities with an insurer via a Pensions Risk Transfer (PRT) transaction. This paper explores, from the insurer’s perspective, the important and useful role that ETFs can play in facilitating the transfer of risk (via a PRT). Read here

ETFs Role in Pension Risk Transfers (For Pension Schemes)

This paper explores the important and useful role that ETFs can play in facilitating this transfer of risk from the pension scheme to an insurer, from the former’s perspective. Read here

Incorporating sustainability insights

Explore our sustainability equity offering within the UK-domiciled index mutual funds of our ACS range. Read brochure

A sponsored feature with ETF Stream: BlackRock’s clean energy ETF hits three-year low

This year has been defined by stratospheric returns among tech-focused ETFs, however, Europe’s thematic darling the BlackRock clean energy ETF continues to fall from the lofty heights of years gone by.

Please be aware by clicking on this link you are leaving BlackRock and entering a third party’s website. As such, BlackRock is not liable for its content. Read article