A-shares Advance on the Road to Reform

25 Feb 2015

What drove the rally in China A-shares in the last quarter of 2014?

HZ: While the surge in A-shares was not entirely unexpected, it was sharper and more dramatic than most people predicted. The popular view is that the performance came solely as a result of the earlier than expected interest rate cut. However, in my view, the run up in the A-shares was driven not just by expectations of monetary easing and cyclical improvements but was, much more importantly, a reflection of the structural improvements which have taken place over the last year.

We saw strong performance from a number of macro-sensitive large caps, notably in the financials sector. I believe this was driven by the proposed reforms, which are leading investors to understand that many of the long discussed tail risks are being diminished to some extent. The reduction of systemic tail risks allowed for valuations to expand meaningfully off a very low base.

What have been some of these concerns and what is changing?

HZ: Around 80% of the MSCI China index is made up of state-owned enterprises; 40% of the index is financial companies. Prices in these sectors have been depressed for some time. Companies with dual Shanghai and Hong Kong listed saw their A-shares trading at a deep discount to their H-share counterparts. This has been largely because of domestic investor concerns over a number of issues including leverage, credit growth, local government debt, and shadow banking and potential liquidity events.

Looking at the reforms proposed last year, many were specifically targeted at these areas. For example, the Ministry of Finance is undertaking a wide variety of fiscal and monetary reforms. They will be implementing a multi-year budgeting process going forward to allow local governments more visibility on cash flows and debt servicing capability. From 2016, issuance of corporate and municipal bonds will be the primary method for raising local government financing with some of the existing stock of loans without cashflow generation capability gradually being incorporated into the fiscal budget to ensure ability to repay. These may reduce the risk of dramatic local government bad debts that investors feared being absorbed by the banks. The China Banking Regulatory Commission has also passed new regulations aimed at suppressing some of the shadow banking expansion. As a result, banks’ contingent risks are lower and investor interest has flooded towards insurance products which, relatively speaking, now look more competitive. These initial steps on what we expect to be a long road of reform have helped reduce investor anxiety around the banking sector and revived fundamentals for the insurance sector.

What did near term catalysts, such as the interest rate cut, tell investors?

HZ: The interest rate cut acted as a catalyst for the rally, demonstrating that policymakers are willing to take serious steps to achieve sufficiently stable economic growth that can provide a solid foundation for the government to work on ensuring employment and social stability. Without such, it would be difficult to advance necessary reforms and focus on the larger structural concerns.

November’s launch of the Shanghai Hong Kong Stock Connect program acted as another catalyst. Initial volumes and take up was relatively light; however it was never really expected that foreign investors would flood into the A-share market and dominate a large percentage of the flows on establishment. Rather, domestic investors recognise that mutual market access opens the gates to a medium to longer term trend of increased foreign participation. A-share investors are aware that foreigners tend to be more fundamentally focused and valuation oriented, which bodes well for many of the cheap sectors which, as large index weights, could potentially see more buying interest from a new set of market participants.

What do these changes mean for equity investors, both in A-shares and H-shares?

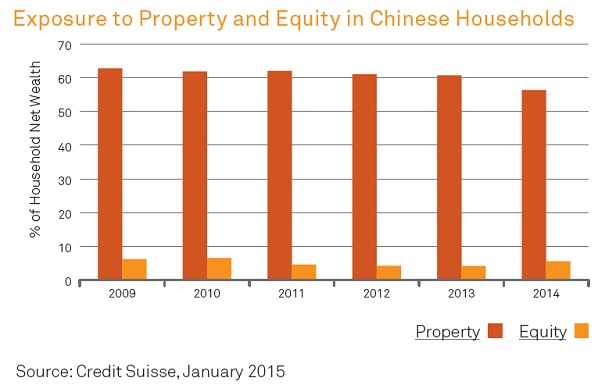

HZ: I believe we are starting to see domestic retail investors shift their asset allocation away from property and shadow banking and back toward equities and insurance products. This is very early days and has only been ongoing for two months but we are nowhere near the end of this trend given that a majority of Chinese household wealth is in property compared to just single digits in stocks. Even after the rally towards the end of last year, A-shares remain inexpensive and a powerful turn in retail sentiment can provide numerous opportunities for the market to trend up further in the medium term. That said, it is not going to be a solid line upwards and we will see volatility – the recent 8% one day fall in domestic Chinese equities is a good example of this. We will see further sector rotation and more selective buying. Nearer-term, we see an opportunity for H-shares to catch up to their domestic counterparts as well.

Which sectors do you currently favour and where are you more wary?

HZ: Right now, we’re looking at some of the state-owned enterprises which, until the latter part of 2014, had been very out of favour. SOE reform will provide a number of opportunities that we haven’t seen before, in terms of improving efficiencies and properly aligning management incentives. We’re also interested in companies which will benefit from the government’s push to reorient exports; moving from low-end manufacturing, such as textiles and toys, towards products which are higher up the value chain and have some level of intellectual property attached. These are areas we continue to follow and examine as potential investment targets.

While there may be some selective opportunities, at a broad level we are avoiding consumer staples. The sector has been a very consensus trade in the past years, and valuations remain high. As overall economic growth slows down, capacity continues to be added and competition heats up, I believe it will become increasingly challenging for companies in this sector to meet the current high earnings expectations. Reform, particularly anti-corruption measures, are negatively impacting even basic consumer staples, so for us, it is more of a wait and see situation.

What is your longer term outlook for China?

HZ: The economy is definitely slowing down – I don’t think that comes as a surprise to anyone. The 2015 GDP target is likely to be set at 7% and I would expect the final number to come in somewhere close to or slightly below that. What people are really looking at is, as I mentioned earlier, the ability of the government to start tackling the structural concerns. This obviously can’t all be done in a short period of time, but investors are keen to see that things are moving in the right direction, even if just at the margin. So long as the current leadership team remains firmly committed to reform and continues to build on a consistent track record of implementation, we should have a reasonable foundation for a more sustainable bull market.

There are, of course, still risks to this. If global demand collapses because of weakness in the developed world it would be likely policymakers would have to put reforms on pause and switch their focus to cyclically stabilising the economy. The property market remains another risk factor – the policymakers are making efforts to engineer a soft landing, but given the fragmented nature of this sector in terms of both demand (buyers) and supply (developers), top down control is more challenging than for some other areas of the economy.

Any final thoughts on the equity markets?

HZ: Much of the recent move in A-shares was driven by valuations going up and not by increased earnings expectations and we believe there is still room for these to be factored in. Falling energy prices, while a negative for the Chinese oil majors, will benefit the margins of a number of energy consumers. In Hong Kong, the H-shares have lagged their mainland listed peers and we believe that, in the absence of any major global correction, they could well outperform in 2015 given low valuations, light holding by overseas investors, and relatively better positioning than some other emerging markets. As I mentioned earlier, volatility remains on the horizon and investors should not expect another period of straight line gains, but with selective allocations there is plenty of opportunity still to be found in Chinese equities.

Issued in Hong Kong by BlackRock Asset Management North Asia Limited. This material has not been reviewed by the Securities and Futures Commission. Investment involves risks. Past performance is not a guide to future performance. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Any opinions contained herein, which reflect our judgment at this date, and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This material is for informational purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock fund and has not been prepared in connection with any such offer. Any research in this material has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. BlackRock® are registered trademarks of BlackRock, Inc. All other trademarks, servicemarks or registered trademarks are the property of their respective owners. ©2015 BlackRock Inc. All rights reserved.